Douyin's white-label products are creating a craze! Dr. Wen generated 400 million GMV in six months, and Ye Haiyang's founder matrix is mastering traffic | 2024 Douyin White-Label Insight Report

Category:

Keyword

language analysis information

Weight

Stock surplus

隐藏域元素占位

- 详情概述

-

- Commodity name: Douyin's white-label products are creating a craze! Dr. Wen generated 400 million GMV in six months, and Ye Haiyang's founder matrix is mastering traffic | 2024 Douyin White-Label Insight Report

Overview

Word Count: 6875 words

Reading Time: 10 minutes

1. Channel merchants awakening, insight into consumption points, precise population positioning, KOL and celebrity promotion, and national platform policy incentives,The characteristics of the rise of private label brands are different from traditional brands.。

2. Douyin supports various traffic distribution methods,Live streaming + video combined to boost salesConsumption becomes the largest incubation platform for beauty private label brandsThe largest incubation platform

3. Xiamen Beauty GangDriving the development of private label brands, the industry became famous in one battle

4. On the Douyin platformFounder's IP imageBecame the key to Ye Haiyang/DC EXPORT's success

5. Future private label explosive products need to usher inA new integration and upgradeIn order to meet market demand and policy requirements

Distant things will be shattered, while the people in front of them are still unaware.

Once upon a time, the commodity economy experienced explosive growth. In order to seize the attention and trust of consumers, the concept of "Brand" was born. With the popularization of the trademark registration system, modern brands with unique names and logos and exclusivity have become the cornerstone of modern commercial society.In mature economies such as the West and Japan, consumers have gone through a process of admiring brand premiums and then demystifying them, eventually reaching a balance between quality and Price.China is facing the huge wave of brand cooling. Behind the anchors shouting "factory direct sales" and "×× substitutes" are the e-commerce Price wars of Douyin, Pinduoduo, 1688, Taobao, and Tmall.

In today's Chinese consumer market, a profound structural transformation is quietly taking place. The rapid decline of traditional consumption hotspots andThe rise of new consumption methods oriented towards experience, emotional value, and personal experienceIn this reshaping of the underlying logic of the consumer field, the concept of "necessary consumption" has been redefined, consumer confidence has shown a differentiated trend, and the concepts of consumption among different groups of people all point to a core:Restraining extra needs, but not giving up the persistent pursuit of a better life.

Against this backdrop, a hidden and huge presence in the cosmetics industry—private label brands—has rapidly risen to become an undeniable force in the Chinese consumer market and has become the hottest concept in China's current consumption.The rise of private label brands today is not only a transfer of transaction trust, but also the reality that the vast consumer market needs private label productsand the pursuit of brands are two sides of the same coin that have coexisted for a long time after China became the "world's factory." The resurgence of private label brands is not a simple story of "consumption downgrade"; it involves far more than just private label brands themselves. It touches upon the essence of "Brand": What is the core value of a Brand? To what extent can one buy things without considering the Brand, and simply make a decision based on the recommendation of a certain anchor or group leader? Can building a Brand still bring profits to enterprises? These questions may be glimpsed from the development path of private label brands.

Full Report92Page

Original Price¥1999

(Contact customer service at the end of the article to receive coupons)

Private label brands counterattack to become mainstream, reshaping the e-commerce landscape?

Igniting an unprecedented consumer boom

Before understanding the current situation of "private label brands prevailing" in China's cosmetics market, we must first clarify a question,What exactly are "private label brands"? In the narrow sense, the definition of "private label brands" is clear; they are the private label brands of large retailers. However, the boundaries of "private label brands" in the broad sense are much more blurred. Brands directly operated by upstream manufacturers or downstream channel merchants in the commercial chain can be considered "private label brands." "Private label brands" in the narrow and broad senses are completely different in commercial practice but are placed under the same concept, perhaps because they both havetwocommon points:Pursuing cost-effectiveness; focusing on meeting the general needs of users, in contrast to traditional "Brands".

The rise of the private label brand phenomenon has become an undeniable trend, laying a solid foundation for the continued growth of consumption in the sinking market. Its success not only highlights the rise of channel Brands but also profoundly reshapes the relationship pattern between suppliers, prompting channel merchants to actively create their own Brands, thus forming a new market competitive landscape. In the sales field of beauty private label brands, the largest content e-commerce platform, Douyin, plays a crucial role.

Why can Douyin become a private label brand incubation platform?

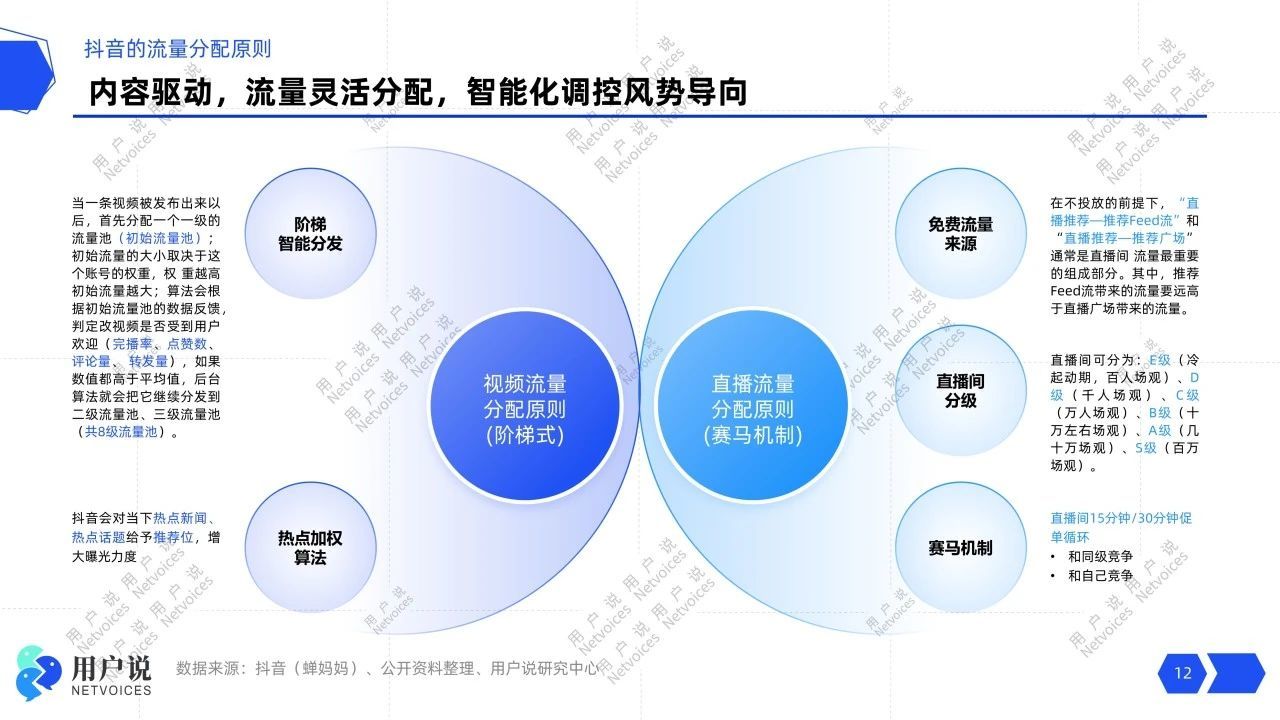

When talking about private label brands, Douyin is inevitable. In June 2020, when Douyin e-commerce was established, the three-legged stand of "Taobao, Tmall, and Pinduoduo" in Chinese e-commerce had almost matured. As a representative of ultimate efficiency, Douyin e-commerce itself has carved out a new continent in this almost gapless market, becoming an undeniable presence and a fiercely contested area for every beauty private label brand. The underlying reason lies inDouyin's new algorithm has defined a new set of operating rules for the e-commerce world.

Taobao and Tmall's traffic allocation mechanism includes stores and products, while Pinduoduo will weaken the presence of merchants, using "low Price" as the core indicator for traffic allocation. However,Douyin e-commerce is completely different from the former two; products and stores must give way to the "content" itself. Brands and KOLs work together to create content, and a large number of young users (nearly 800 million) engage in content-based interest consumption, with the cutting-edge interest algorithm recommendation acting as a bridge. This system will maximize the personalized recommendation of products, accurately pushing them to target users, and easily reaching consumers of different levels in first-tier and below cities. At the same time, it is accompanied by various traffic distribution methods, as well asLive streaming + videoJoint order consumption, Douyin canMaximize the compression of the time it takes for beauty makeup private labels to go from "unpopular" to "overnight success."

A group of lightly equipped beauty private labels have therefore found the best soil for survival.As private labels rush towards Douyin, Douyin is also actively embracing them.In order to continuously support new GMV, Douyin e-commerce has opened up more traffic entrances for private labels. In August 2023,“Douyin e-commerce new merchant support plan”launched, inMerchant entry, commission-free support, business guidance, traffic incentives, insurance subsidiesetc., launched ten measures to support new merchants in quickly starting their business on the platform. Under this plan, private labels have also ushered in explosive sales growth and have quickly emerged. In the first quarter of 2024 rankings, less than half a year oldWen BoshiwithOver 400 million GMV results squeezed into the top tensurpassing Lancome and Helena, once again writing Douyin's "private label miracle"

Live broadcast beauty, private label new blue ocean

In the past year (July 2023 to June 2024),The beauty category Douyin GMV exceeded 190 billion, a year-on-year increase of 49.32%. If the logic of Brand selection is to first investigate market demand, find an unmet pain point, and then produce high-quality and cost-effective products, thenPrivate labels start entirely from the content presentation of the selling point. In this, private labels are more aggressive in every step of Douyin's algorithm, and even more so in their choice of methods, showing an extreme sales drive. According to user data statistics,Live streaming is still the top sales channel for the Douyin beauty marketaccounting for as much as 77.57%, with live sales of beauty and personal care products accounting for 77% and 66% respectively.

Currently, Douyin live traffic mainly uses a horse racing mechanism. Only live broadcast rooms that receive more natural traffic under natural flow recommendations can gain more traffic in the live broadcast square. Therefore,The ultimate traffic battle is an unavoidable battle for many beauty private labels. Under this model,The product card model has quietly grown(increased by 150% year-on-year), and is slowly eroding the video/live share, and merchants are expected to achieve a fully managed mechanism here. At the same time,The importance of Brand self-operated accounts is also constantly risingand gradually eroding the share of merchant self-operated accounts and KOL cooperation accounts, becoming a new focus for bringing goods. In the sub-categories of the beauty and personal care market, private labels show the same trend as beauty Brands. Facial care for beauty private labels still accounts for the majority of the beauty category, facial and lip makeup has seen a rapid year-on-year growth rate, whileBody essential oils and aromatherapy are expected to become the next outlet for beauty private labels。

Breaking out from "Douyin"

Xiamen Gang's overnight success

Since this year, the topic of“Xiamen Gang”has become increasingly discussed. A number of Xiamen beauty Brands, including Sanziztang, VC, Gongfu, Wen Boshi, Creator, and BUV, have swept Douyin in the past two years, with GMV exceeding 100 million in a short period of time.The speed at which Xiamen "creates stars" on Douyin is hard to ignore. Just two months ago, the BUV Brand was still unknown. During the 618 period, it quietly appeared on the "Douyin e-commerce mid-year promotion mass/national beauty and skin care Brand list" from Douyin, ranking 15th. Wen Boshi, the most eye-catching Brand among many Brands, has been dominating the Douyin beauty and skin care - facial care - mask track product list TOP1 since December 2023.

These new beauty Brands born in Xiamen, relying on Douyin's traffic mechanism andSelling points such as "high cost performance + efficacy"often create tens of billions of GMV, creating one beauty "myth" after another. So, how did the Xiamen beauty gang come about? Why did it originate in Xiamen? And how did it break through the siege in the current competitive environment? What is the future of the currently successful "Xiamen Gang", long-term achievements or a flash in the pan?

Why was the "beauty gang" born in Xiamen?

FirstXiamen has unparalleled geographical advantages,Backed by Guangdong, a major province in the beauty industry chainThis means that the Xiamen beauty gang can easily obtain products with extremely low cost but reliable quality, providing strong support for quickly responding to market changes, reducing costs, and improving efficiency. With Guangdong's mature cosmetics production and supply chain system, Xiamen can quickly produce products that meet market demand.

Government support and preferential policies have also created favorable conditions for the rise of the Xiamen beauty gang: The newly released "Several Measures of Xiamen City to Promote the High-Quality Development of Live E-commerce (2024-2026)" clearly states that by 2026, more than 20 live e-commerce bases will be built in Xiamen; more than 50 live e-commerce service institutions will be cultivated and introduced; and the annual average growth rate of live e-commerce sales will strive to reach 10%, exceeding 45 billion yuan. These policy supports provide a solid backing for the development of the Xiamen beauty gang.

The assistance of the Douyin platform is equally indispensableThrough effective operation on the Douyin platform, Xiamen Meizhuangbang successfully attracted a large number of followers and achieved rapid dissemination through the platform's algorithm recommendation mechanism. It is worth mentioning that Zhang Yiming, the founder of ByteDance, Wang Xing, the founder of Meituan, and Fang Sanwen, the founder of Xueqiu, and other Chinese internet tycoons are all from Fujian. The actual controlling company of ByteDance is also in Xiamen, which provides Xiamen Meizhuangbang with unique advantages in its development on the Douyin platform. In addition, the Douyin Xiamen base is expected to be put into operation in 2025, which undoubtedly injects new vitality into Xiamen's e-commerce landscape.

Why did the "Xiamen Gang" choose cosmetics?

The biggest cost for a single Brand on Douyin is the traffic cost.According to industry insiders, many Brands' traffic fees reaching 60% is already high, but private label Brands can generally reach 70%, or even 80%. EspeciallyIn the incubation stage of cosmetic private label Brands, spending money on traffic is an essential key step.。Taking the previously popular Jixianzhi as an example, in 2022, one of its product links alone placed tens of thousands of traffic advertisements, "burning 500 million in 3 months".

However, in contrast, the cosmetic private label market is characterized by small investment, fast operating cycle, high return on investment, and low risk.The industry's profit margin is above 70% or even 80%.The high profit margin of products is sufficient to support huge traffic advertising costs, creating the Xiamen Meizhuangbang. Under this series of advantages, Xiamen companies quickly flocked to the cosmetics track. Xiamen cosmetics are also accumulating strength to become a new pole of China's cosmetics industry.

So why have so many "Douyin Brands" emerged from Xiamen in such a short period of time?

Private Label Brand Explosive "Formula"

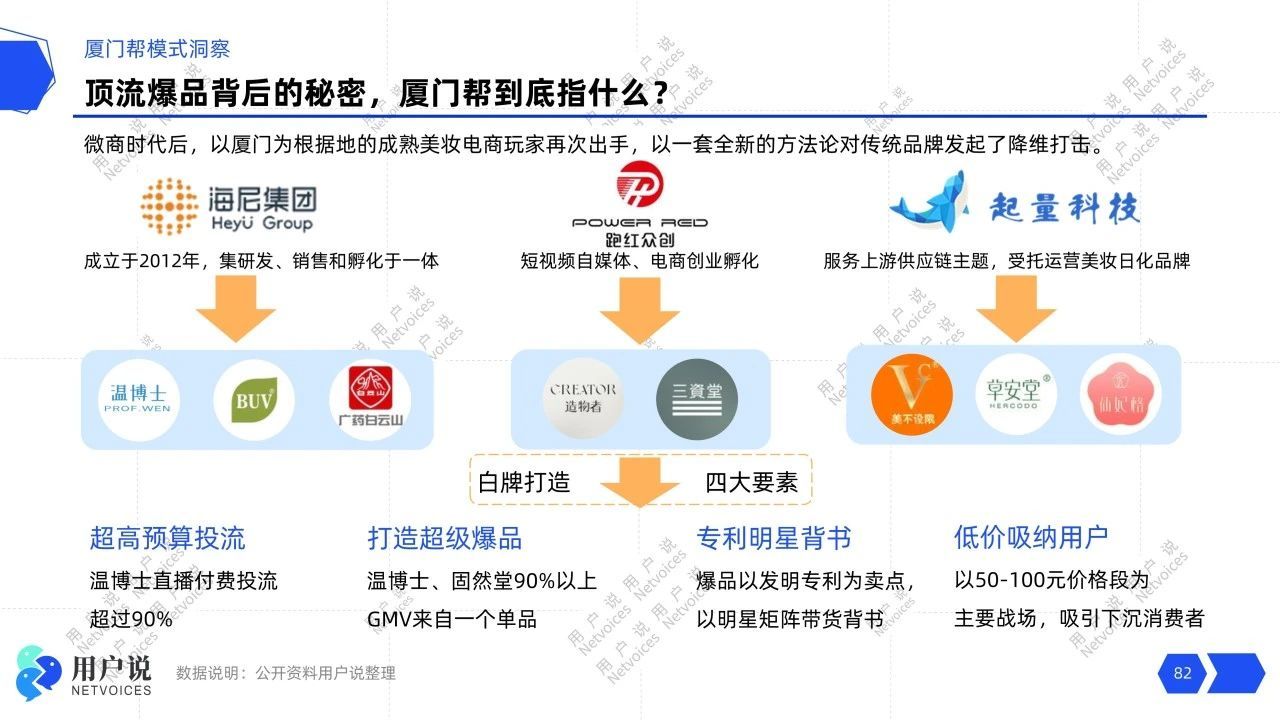

The operators behind the above-mentioned popular Brands are the main companies in the "Xiamen Gang" -Hainei Group, Qiliang Technology, Paohong Group, Chunpu Technologyetc., are all leading retail e-commerce companies in Fujian.

Public information shows that Hainei Group was founded in 2012, shifting from the Taobao platform to Douyin, focusing on Brand operation. Currently, its own Brands include KAZOO, Wen Boshi, BUV, etc., and the brands it operates include Miqi and Baiyunshan. Qiliang Technology was founded in 2019 and has developed rapidly. It has now built a complete short video and live e-commerce system, with Brands including VC, Xianfeige, and Caoantang. Paohong Group was also founded in 2019 and transformed into live streaming in 2020. Its current main Brands include: Zaowuzhe and Sanzitang.

It is understood that they have "mastered" Douyin's traffic methods. The rise of their Brands on Douyin can be roughly summarized as: opening a large number of platform accounts, adopting a strategy of concentrated SKUs and tower-style traffic investment, this processHighly values return on investment (ROI). Some Brands will also cooperate with celebrity endorsements to attract a large amount of attention and purchasing power, while using mid-to-low-end Prices to attract sinking populations, quickly gaining a foothold in the market. Using a "high-profile" approach, a large amount of traffic is exchanged for sales through high costs.

Founder IP Rising?

Reshaping Brand charm, detonating new market trends?

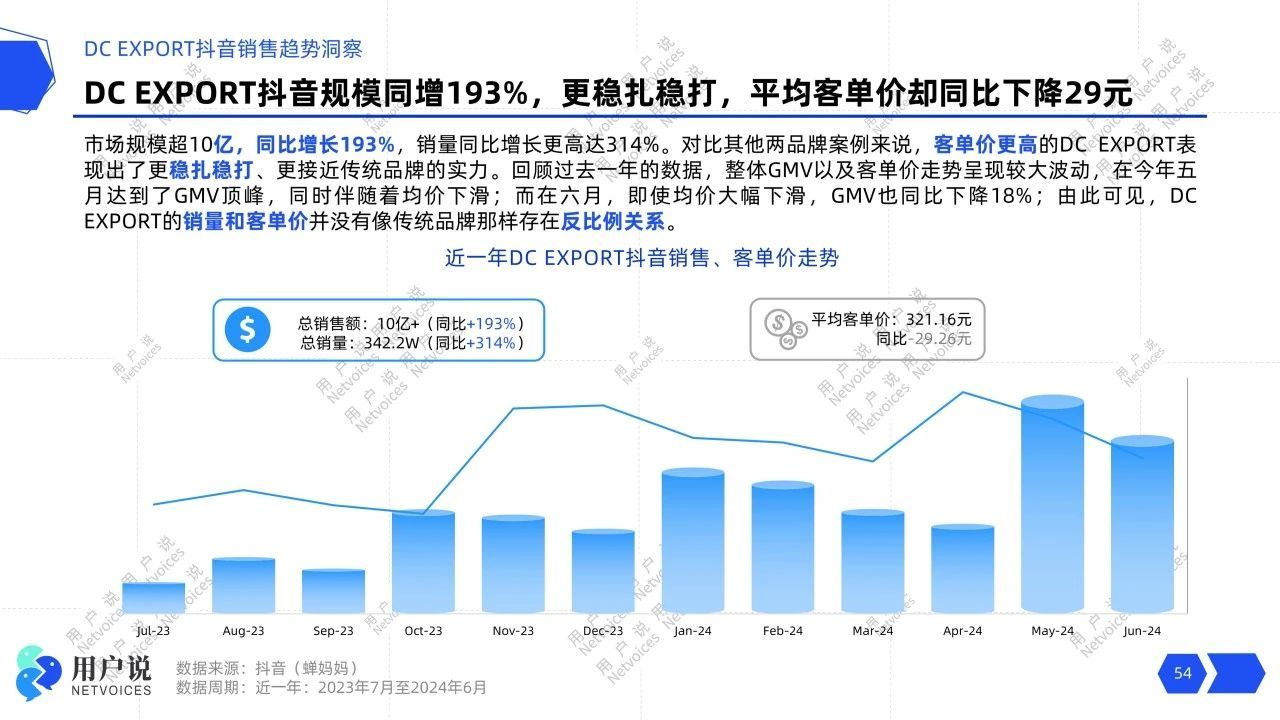

In addition to relying on Douyin for material placement, in terms of seeking breakthroughs and growth points for cosmetic Brands, Founder IP is no longer a new topic. Previously, Brands such as Mao Geping and Caitang broke through the Founder IP track, and later, Brands such as Youshiyan and Bishengzhiyan are eager to try.The era behind the scenes is gone, and Founders entering the public eye has become a trend.Successful cases of Founder IP in the market undoubtedly contribute to the expansion of the entire track, and Founder IP has become a new engine for Brand advancement, with more Brands and Founders eager to get a share of the traffic market. This is also true for cosmetic private label Brands,Ye Haiyang and her personal private label Brand DC EXPORT are experts in this approach.

With her rich life experience and daily sharing of interesting life, Ye Haiyang has gained a large number of fans on short video platforms, becoming a KOL with considerable influence among cosmetic Brand founders. Ye Haiyang has naturally become the main source of traffic for DC EXPORT. In the past year, DC EXPORT has mainly been dominated by Brand-centric campaigns, with sales peaking in May 2024 and continuing its excellent performance in June. On the contrary, its performance was slightly weaker than in the above months during traditional marketing nodes such as Double Eleven, Double Twelve, and Women's Day. Obviously,Under the influence of "her power", Ye Haiyang's IP persona has created a strong sense of user identification, and female founders continue to receive attention.。

So how did Ye Haiyang go fromBuilding a personatoExpanding account matrixtoStrengthening Brand image to achieve grass-planting goalsto form a closed loop?

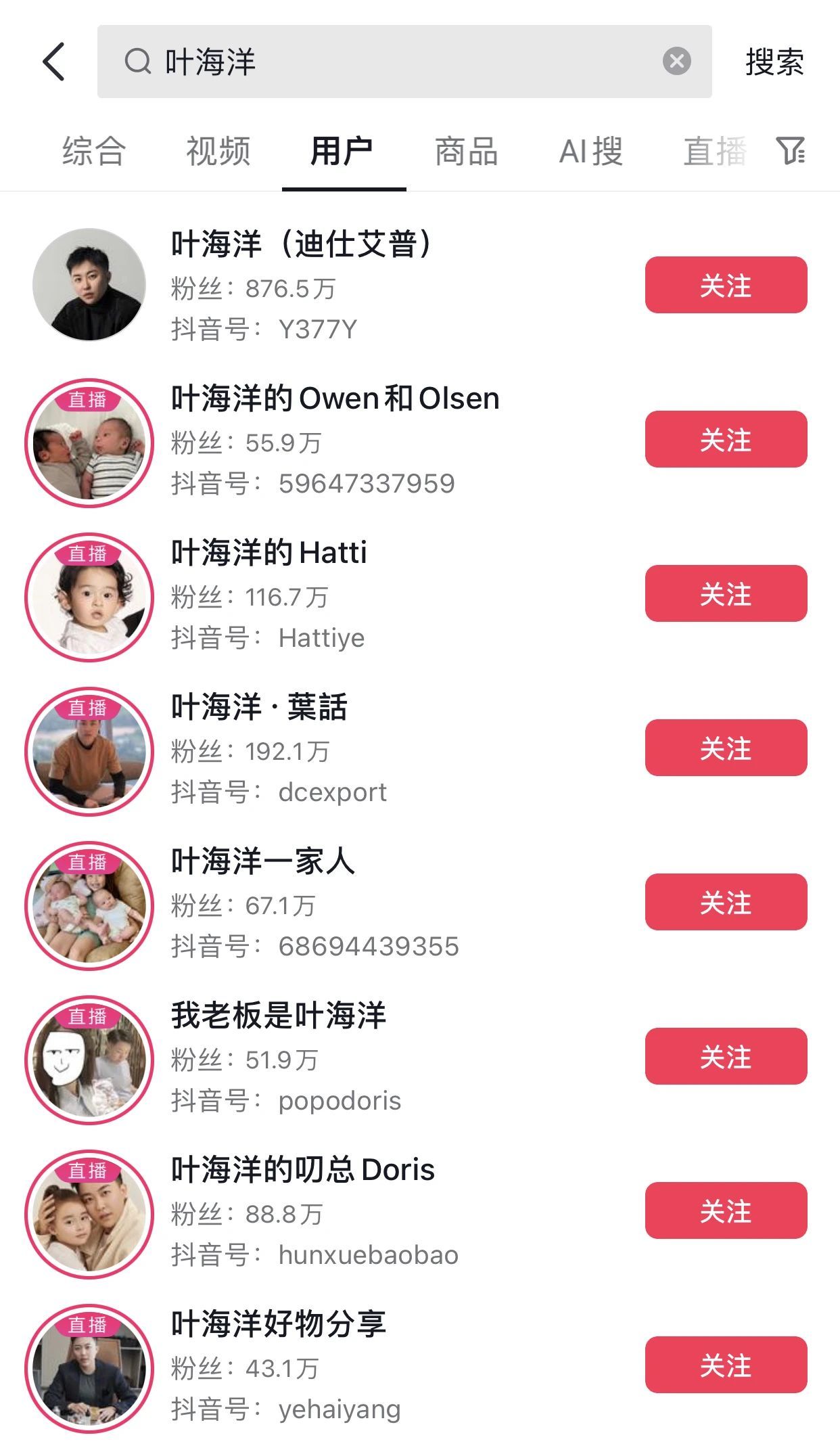

First,Create an "independent woman", "strong female lead" persona.Ye Haiyang, who gained attention for giving birth to a child in the US using donor sperm, created a personal label through a series of content such as having a child without a partner, sharing parenting, and entrepreneurial experience, and with continuous content output, she gained very high attention on social media platforms. Secondly,Professional operation of account matrix.Currently, Ye Haiyang's related account matrix is spread across the entire network, with layouts on Douyin, Kuaishou, Xiaohongshu, video accounts, Weibo, etc., with 7.889 million followers on Douyin.

It is worth mentioning that in addition to Ye Haiyang's personal main account, her eldest daughter Doris and second daughter Hatti each have their own separate accounts. Even her twin sons, who were officially announced not long ago, have their own social media accounts. In addition, there are separate accounts sharing the daily life of Ye Haiyang and her four children, as well as accounts sharing parenting.

Finally,Strengthen Brand image, achieve grass-planting goalsHaving children is just one storyline under Ye Haiyang's personal IP. In her personal essay account @Ye Haiyang · Ye Hua, she shares her entrepreneurial story, the brand story of Dishi Aipu, and provides detailed explanations of each product. Through continuous reinforcement of her brand image and targeted cultivation of her audience, Ye Haiyang, leveraging her founder IP identity, has created a matrix of accounts, each carrying“brand spokesperson + product showcase + live streaming sales”functionality, thus achieving the conversion from traffic to sales.

Clearly, on short video platforms,building a genuine persona significantly promotes brand endorsement and trust building. Her 'spokesperson' identity can also inject a large amount of high-quality and precise fan traffic into products at a relatively low cost. However, it is undeniable that over-reliance on founder traffic marketing can lead to consumers focusing too much on the founder, weakening the direct influence of the product and brand. The high degree of binding between the brand and the founder also reduces the product's risk-resistance in public opinion and public relations. 'Starting with the founder, staying loyal to the brand and product,' rather than over-relying on founder traffic, is a point that抖音 white-label beauty products should pay close attention to.

The Future is Now

Where are white-label beauty products headed?

Unlike beauty brands that focus on efficacy and strive to create a 'research and development myth',white-label brands target the entire consumer market, and their only path to victory is value for moneyor the superficial appearance of value for money. In the white-label market, 'low price' is indispensable, and creating 'high-quality' white-label products has become the key to this battle.

For high-tier cities, white-label products are a result of downgraded consumption. However, numerous products that did not previously exist in county-level or rural areas are emerging and entering the sinking market, which represents a clear upgrade in consumption.Winning in the white-label beauty market does not lie in storytelling or artificially creating demand, but in gaining consumer trust.Whether it's white-label or branded products, in the market pursuing ultimate value for money, they need to understand and meet consumer needs to avoid dependence on channels and platforms, thus falling into a vicious cycle. The future of white-label products is here, but where should they go? How can white-label beauty products achieve self-breakthrough under the conditions of ultimate value for money?

Hit Product Development to Capture Minds

To enhance the competitiveness of white-label beauty products, their ingredients and formulas need continuous upgrading and innovation. White-label beauty brands can improve product quality by introducing more high-end ingredients; they are already beginning to use some high-end ingredients, such as grape seed, bee peptides, and resveratrol. However, many potentially effective ingredients remain underutilized, such as seaweed extract, centella asiatica, peptides, and boseain, which could become the core of new hit products. Furthermore, formulating unique self-developed ingredients is also an effective way to enhance product appeal, such as the polypeptide small molecule ingredient matrix in Estée Lauder's Little Brown Bottle.

In addition to upgrading ingredients and formulas, packaging design is also crucial. When packaging design resonates emotionally with consumers, it not only allows consumers to build a deeper connection with the brand on an emotional level, but it can also lead consumers to choose the product because of this emotional experience.Excellent packaging design primarily helps brands enhance recognition, stimulate consumer interest, and promote word-of-mouthand helps to create a differentiated brand image, ultimately helping white-label beauty brands break free from the image of OEM and low-end products.

Marketing Upgrade

Marketing essentially drives paid interest; attracting fans across multiple types and broad coverage can optimize marketing paths, expand customer base and promote transaction conversions. To better attract and retain fans,white-label beauty brands will adopt a fan marketing strategy using multiple types of accounts and support secondary creation (SC). This means the brand will create multiple 'sub-account' types of accounts to provide diverse information and services, such as product introduction accounts, officially partnered doctor accounts, usage tutorial accounts, marketing promotion accounts, and consumer feedback accounts, thereby building a brand account matrix that is closer to real life and targets a wider audience. In addition, the design of the live broadcast room will pay more attention to 'professionalism' and 'high-end,' to strengthen the brand image and authority. This includes the layout of the live broadcast room, the decorative style, and the iterative update of the product display page, aiming to create a rigorous and professional atmosphere to enhance consumers' trust in the brand and its products.

At the same time,brands will also attach importance to the construction and use of private domain trafficby regularly releasing opportunities for new product trials and encouraging users to promote each other through small promotional activities to enhance customer relationships. This method can not only achieve precise marketing but also understand users' skin needs and preferences through research, thus more effectively promoting some high-priced and high-end products. In this way, brands can not only provide valuable content but also deepen consumers' understanding and liking of the brand, further promoting sales and brand loyalty.

White-Label Comeback vs. Brand Hegemony

Market Battle: Who Will Ignite the New Consumer Boom?

The market is never idle; people are thinking about new opportunities from different dimensions. In the documentary "Entering Japan for Thirty Years," the first episode, themed "The Vitality of Consumption in the Lost Years," describes how, with the bursting of the bubble economy in the 1990s, Japanese household spending peaked and a long period of consumption downgrading began. However, in this market environment, some new categories, new business formats, and new models still emerged. The beverage, convenience store, and pet industries were able to develop rapidly during this stage, which also became the vitality of consumption during Japan's Lost Decade.Looking back at China's beauty industry, in the era of new and old alternation, new opportunities, new strategies, and new benchmarks will inevitably emerge.

The rise of white labels does not mean the decline of brands. Brands simply need to change their previous approach of using heavy marketing to increase their volume, and establish a new communication mechanism with consumers. From the customer's point of view,brand marketing has entered an era of customer capitalismBrands remain the most important competitive moat, but new standards for success have emerged: Does the brand deserve customer trust? Does it convey values with conviction? Does it cultivate customer interest? Does it help customers build relationships? Does it help customers build meaning? If a brand's offerings still remain at the stage of use value, it will face stronger challenges from private label brands.

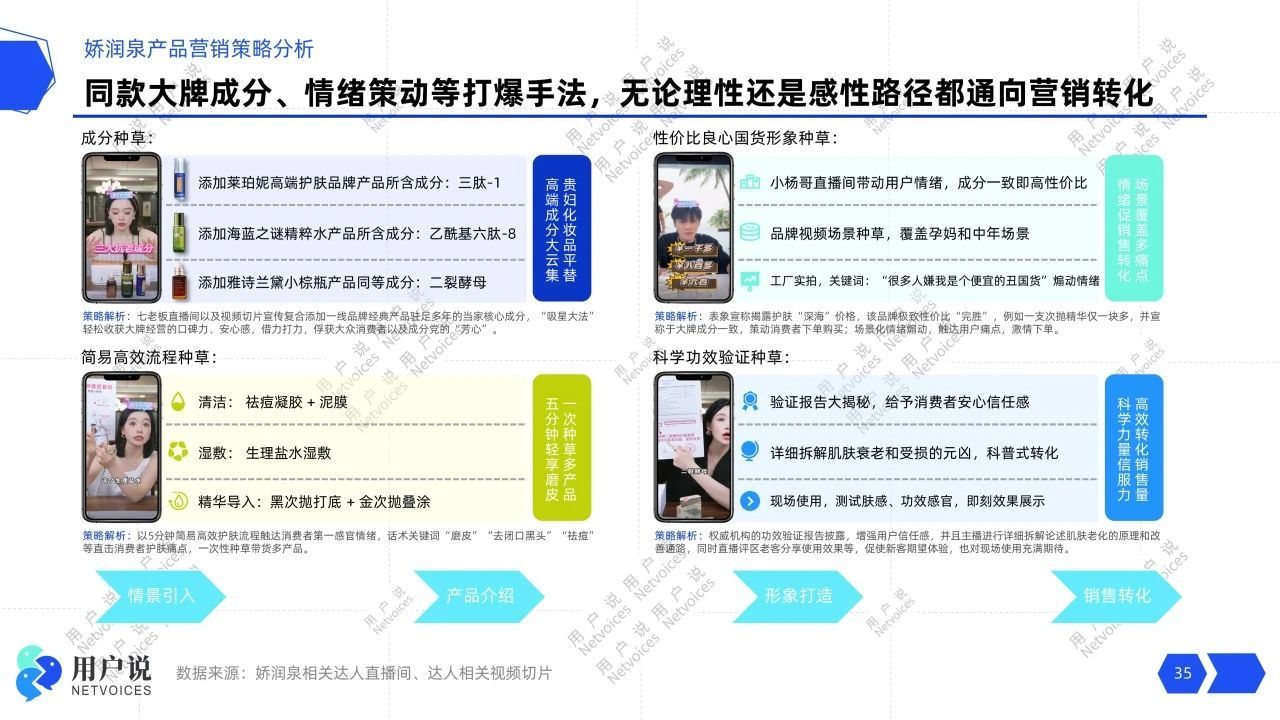

This report will provide an in-depth analysis of Douyin's gameplay logic and private label explosive growth strategies, helping to unlock new market trends. In addition, this report focuses on the analysis of representative private label brands:Jiao Run Quan、Wen Boshi、DC EXPORT、Gu Ran TangThis will help unlock diverse explosive growth strategies for private label brands,helping your Brand to stand out in fierce market competition。