Over 424.8 billion online! Douyin up 59%? Proya over 8 billion? TOP 60 national makeup brands over 5 billion | 2024 China Beauty Trend Report

Category:

Keyword

language analysis information

Weight

Stock surplus

9997

隐藏域元素占位

- 详情概述

-

- Commodity name: Over 424.8 billion online! Douyin up 59%? Proya over 8 billion? TOP 60 national makeup brands over 5 billion | 2024 China Beauty Trend Report

Overview

Total Word Count:7265words

Reading Time:12-15minutes

1.2023Total retail sales of cosmetics reached4166yuanyear-on-year growth of5.85%。

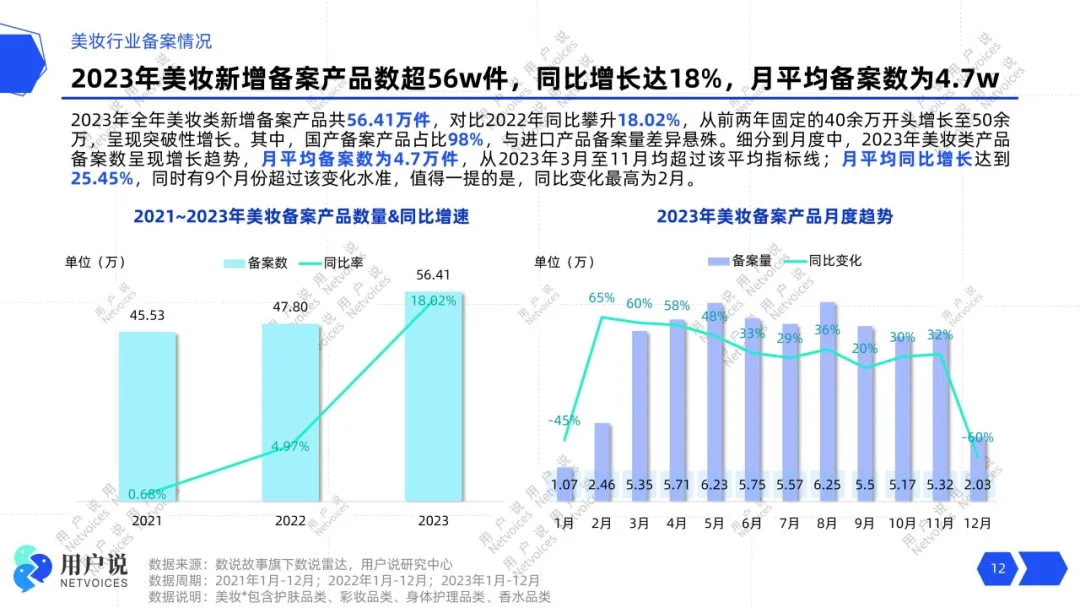

2.Number of skincare product registrations reached56witemswith a year-on-year growth rate of18.02%This marks three consecutive years of growth.

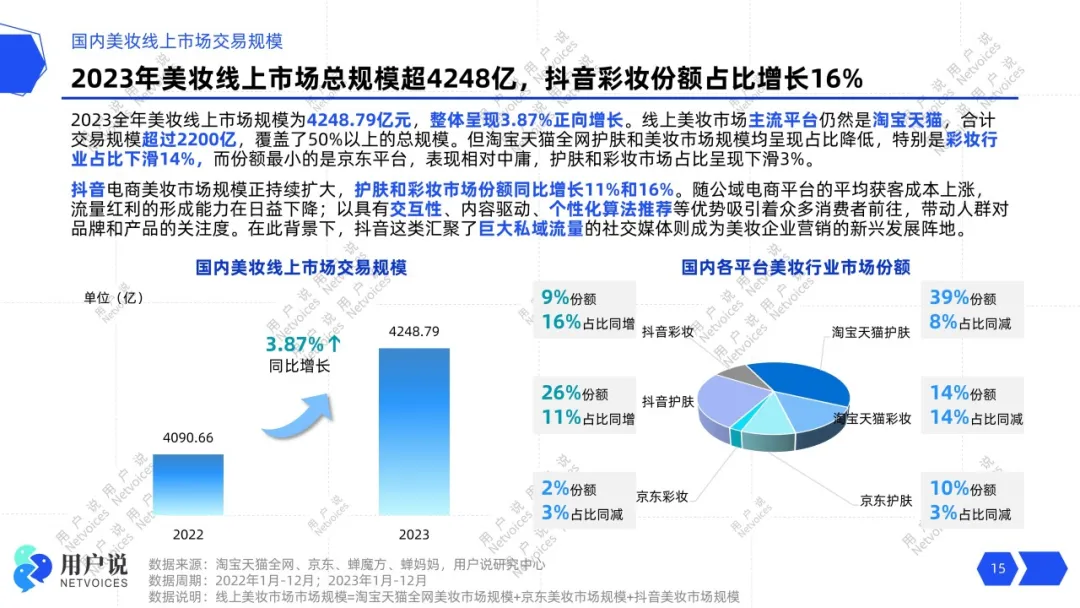

3.Total transaction value of beauty products on Taobao Tmall, Douyin, and JD.com reached4248.79yuanDouyin increased by59.49%while Taobao Tmall and JD.com both declined.

4.The scale of the skincare market across the three platforms3170yuanshowing a slight increase of2.62%; the scale of the makeup market1078yuanincreased by7.79%。

5.Based on data from the three platforms, the top ten domestic brands are:Proya, Winona, Hanshu, Natural Hall, Flower Knows, Kfmei, Carslan, Guyu,HBNand Osim。

6.She economyandsilver hair economyshow potential, with user demand emphasizingmilduser experience.

2023The year , like a spring breeze dispelling the gloom of the epidemic, marked the official entry of the cosmetics industry into a year of transformation, with continuous positive news.4Month7Day, China and the French Republic issued a joint statement, specifically mentioning cosmetics in the clauses on promoting economic exchanges. At the same time, China adheres to the correct direction of economic globalization and is committed to promoting the liberalization of trade and investment, as well as multilateral cooperation. Against this backdrop of multiple favorable factors,the cosmetics industry has rebounded. According to data from the National Bureau of Statistics,2023the total retail sales of cosmetics nationwide in the year reached4166yuanyear-on-year growth of5.85%。

2023In the year, the beauty industry actively advanced, with continuous positive news in policies and regulations. In the new2024year, with the vigorous development of various online channels, driven by regulatory policy promotion, increased consumer spending power and the pursuit of beauty, the popularity of the beauty industry is expected to reach new heights.

User Said has launched《2024China's Cosmetics Industry Development Trend Report》tracking2023a full year's sales and user dataproviding a comprehensive analysis of the latest trends in China's cosmetics industry from multiple dimensions, including the current state and changes in the consumer market, the popularity of social media platforms, user needs trends, and channel marketing investment. By deeply understanding the changing trends in the industry, it provides guidance for companies and brands to capture potential opportunities andseize the initiative。

Full Report180pages

Original price¥4999, free for corporate members

(Contact customer service at the end of the article to receive a coupon)

Online beauty market scale424.9 billion

Douyin's explosive growth60%

2023In the year, the number of newly registered beauty productsexceeded56ten thousandwith a monthly average of4.7ten thousand, indicating that the beauty market is booming at a rapid pace. Since2021year to date, the number of beauty product registrations hasmaintained a three-year consecutive growth trendwhile2023the year-on-year growth rate reached a staggering18.02%. This data shows that the beauty market is not only expanding in scale, but its growth momentum is also strengthening, providing consumers with a wider range of choices.

It is foreseeable that the development space of the beauty industry will further expand, attracting more and more brands and innovators to participate. This not only injects new vitality into the market, but also brings consumers more surprising products.This continuous growth trendhas provided a solid foundation for the entire beauty industry, laying a sustainable foundation for future innovation and development.

2023In the year, the total transaction volume of skincare and makeup categories on Taobao Tmall, Douyin, and JD.com reached4248.79yuana year-on-year2022increase of3.87%. In the online beauty market, Taobao Tmall remains the mainstream platform, with a beauty transaction volume of2270.22yuanbuta year-on-year decline of11%。

Second in scale is the Douyin platform, relying on59.49%high growth rate to emerge in the market and achieveover1400100 millionscale. JD.com's performance is relatively mediocre, with a scale of only505.85yuan,anda year-on-year decrease of15.43%。

From a macro perspective, looking at the overall beauty market, skincare accounts for75%of the market share, with an annual scale reaching3170yuanshowing a slight increase of2.62%。The scale of makeup1078yuan,shows a more rapid growth trend, with a growth rate of7.79%。

Taobao Tmall's market share in the skincare and makeup categories in the beauty market is showing a downward trend, especially in the makeup market. Taobao Tmall is constrained by the rising customer acquisition cost of public domain e-commerce platforms,the weakening of traffic dividends is becoming increasingly apparent。

Douyin, with itsstrong interactivity, content-driven approach, and personalized algorithm recommendationsleads the trend. Especially products like makeup, which have immediately visible effects, can quickly penetrate and occupy consumer minds through short videos, driving attention to brands and products. Against this backdrop, social platforms like Douyin, which have gathered a large amount of private domain traffic, are graduallybecoming a new battlefield for beauty brand marketing,its market scale is continuously expanding, and the proportion of skincare and makeup markets has increased year-on-year by11%and16%。

01

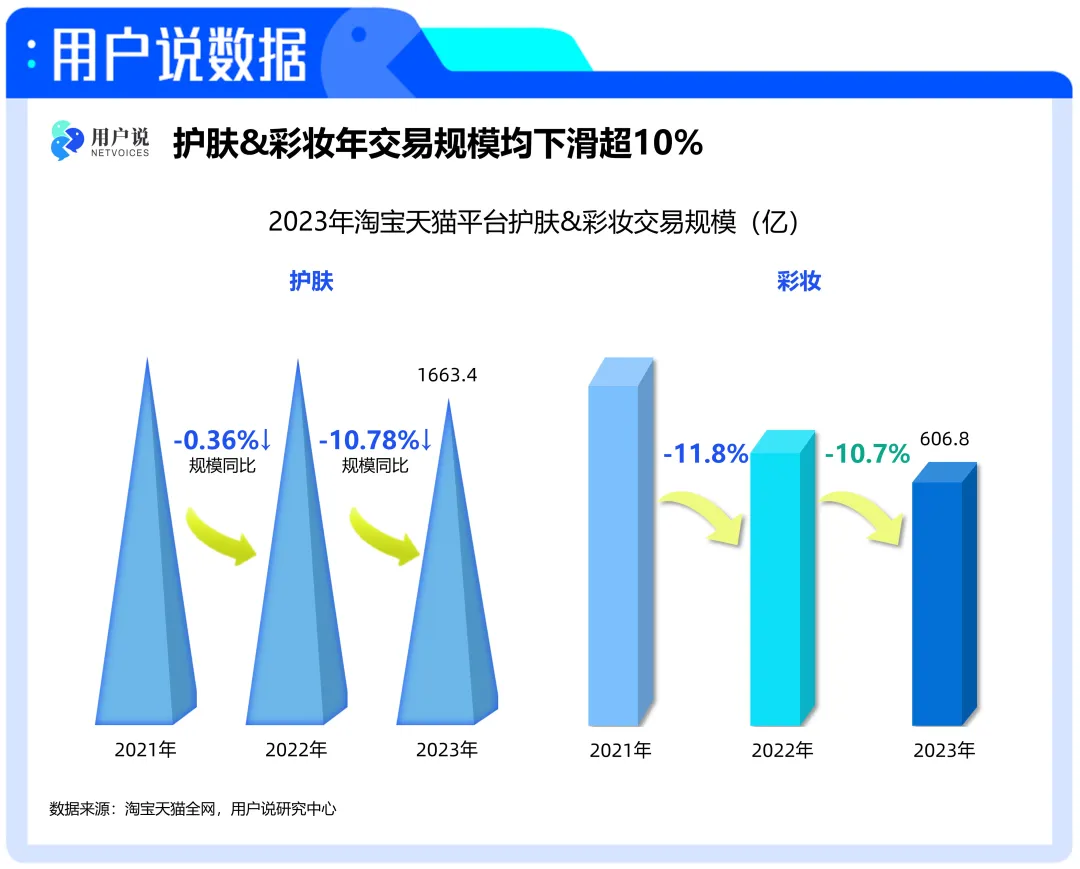

Taobao Tmall: Skincare&Makeup decline exceeding10%

Focusing on the Taobao Tmall platform, beauty and skincare/Body/Essential oil category total transaction volume1663.4yuan,year-on-year decrease of10.78%,since2021year, it has declined for two consecutive years, with the scale falling from1800100 million to1600100 million yuan.

Last year, the platform's consumption boom shifted to pre-festival warm-up and pre-sale activities, while2023year, during several major shopping festivals, although the skincare market still showed a decline, it showed obvious signs of recovery. Especially during618and Double11these two shopping festivals, the downward trend during the promotion period was relatively slow, and even in11month, it bucked the trend and increased year-on-year by14%,reaching the peak of the year272.6100 million yuan. However, the overall downward trend of the skincare market remains unchanged, “Ineffective warm-up”and“Post-festival cooling-off”phenomenon is obvious,7month,9month,10month,12month both declined20%above.

In addition to skincare, makeup/Perfume/The scale of beauty tools category has also declined for two consecutive years, but the rate of decline has slowed down, with the scale falling to606.8100 million yuan, a year-on-year decrease of10.7%,monthly sales also declined year-on-year.

02

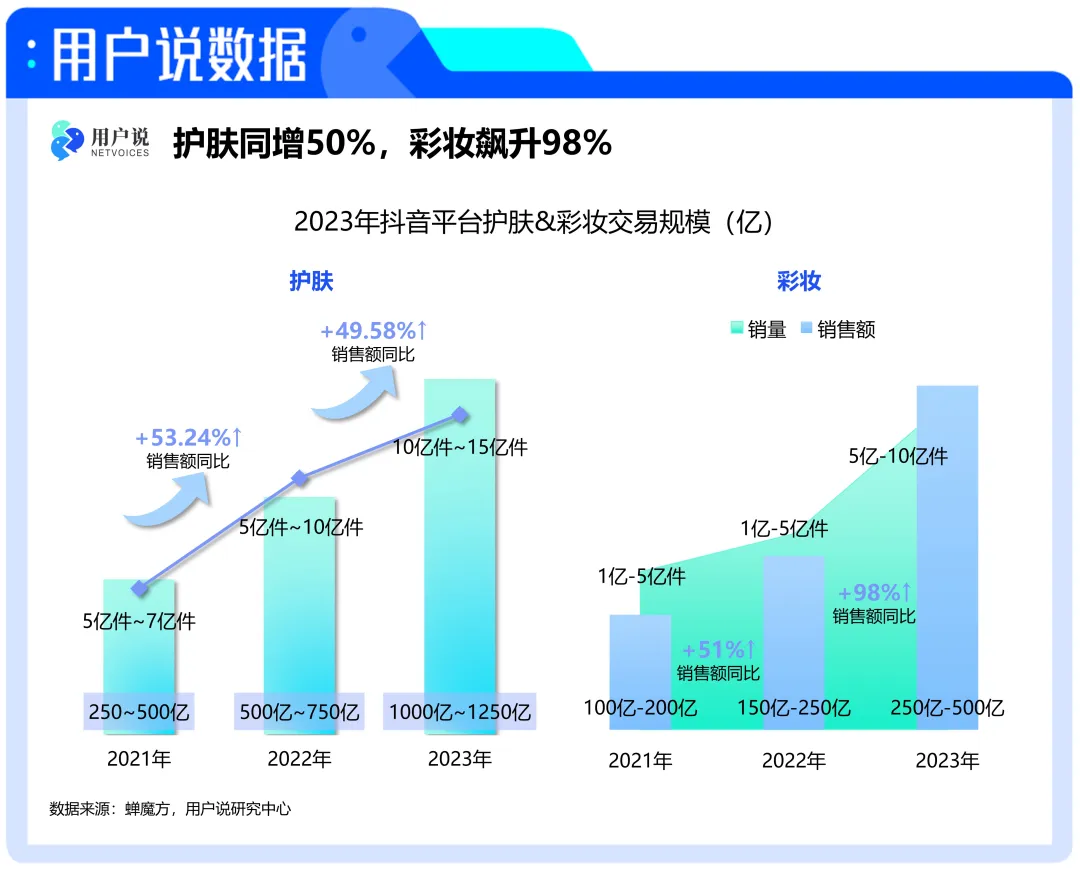

Douyin: Two consecutive years of growth exceeding50%

Unlike Taobao Tmall and JD.com, whose market share is declining, Douyin is increasingly becoming an important position in the beauty market. With its remarkable high growth rate, it is gradually seizing the leading platform.2023Year Douyin beautyGMVover1250100 millionscale, anda year-on-year increase of over two consecutive years50%。

Skincare category sales accounted for74.66%,scaleover1000100 million,year-on-year growth reached49.58%。In comparison, the growth rate of makeup sales is even faster, with a year-on-year increase of98%,scaleover250100 million。Douyin's makeup sales in several months of the second half of the year increased by more than1times year-on-year, among which11month had the fastest growth rate, reaching125%,providing a strong boost to the high growth rate of Douyin's makeup category throughout the year.

In2023year, Douyin mainly had10marketing activities. From the perspective of traffic, duringDouyin New Year FestivalandDouyin38Queen's Festivalperiod, the number of related stores, related videos, and related live broadcasts in the skincare category increased significantly, especially the number of related videos in the Queen's Festival month reached the peak of the year. While in11month Double11Good Things Festival, the number of related stores reached the peak of the year2.1810,000。12month Double12Good Things Happy Season, the number of related live broadcasts also reached the peak of the year80.6510,000,daily average related live broadcasts about2.7Ten thousand fields.

03

JD.com: Decline15%,almost fell below500100 million

2022year, JD.com's beauty market size is close to600billion, year-on-year growth5.19%,but in2023year, it changed from growth to decline, and the scale almost fell below500billion mark.

Focusing on the skincare market,2023year JD.com skincare market sales were407.81yuan,accounting for80.49%,but the sales decline reached15.45%。The sales decline was even more significant, with a decrease of18.56%,a total of2.94billion pieces of skincare products.

2023There were9months in the year with year-on-year decline in sales,The decline in the second half of the year was particularly obvious,which is undoubtedly an unfavorable signal for the development of JD.com's skincare market. The second half of the year includes many major promotional nodes, and consumer spending is high. How to break through and regain profits has become an important issue to consider.

The sales of the makeup market were98.04yuan,down year-on-year by15.34%,at the same time, sales reached0.8billion pieces,year-on-year decrease of 14.84%。There were eight months of sales decline, only2month to5month maintained growth. Among them8month's decline was the most serious, almost halved compared to2022year.

Perfume promoted to the first place in the makeup category

Emotional value becomes an important driving force

01

Skincare sets remain in the first place

2023year, in the Taobao Tmall beauty and skincare industry, the annual turnover of facial care sets reached367.3yuan,ranking first in the category list. The year-on-year growth rate of body care sets was astonishing, reaching199%,among facial essence categories, essential oils also achieved43%year-on-year growth rate exceeded the leading liquid essence category.

Facial care sets, liquid essence, cream, sheet masks, facial cleanserThese top five categories also occupied the over 100 billion market of the total skincare category, accounting for65.12%,the market category concentration rate is relatively high.

JD.com platform skincare salesTop1Category isSkincare sets,with19.38%market share ranked first, sales reached79yuan,but decreased year-on-year by18%。Following are lotions/face cream and facial essence categories, with sales of66.3yuanand60.4yuan。Although lotions/face cream category increased year-on-year by4%,but there is still a gap of more than10billion with skincare sets, and the market category structure is stable. JD.com skincare sub-categoriesTop5are all facial skincare categories, with a combined market share of over half, reaching69.56%。

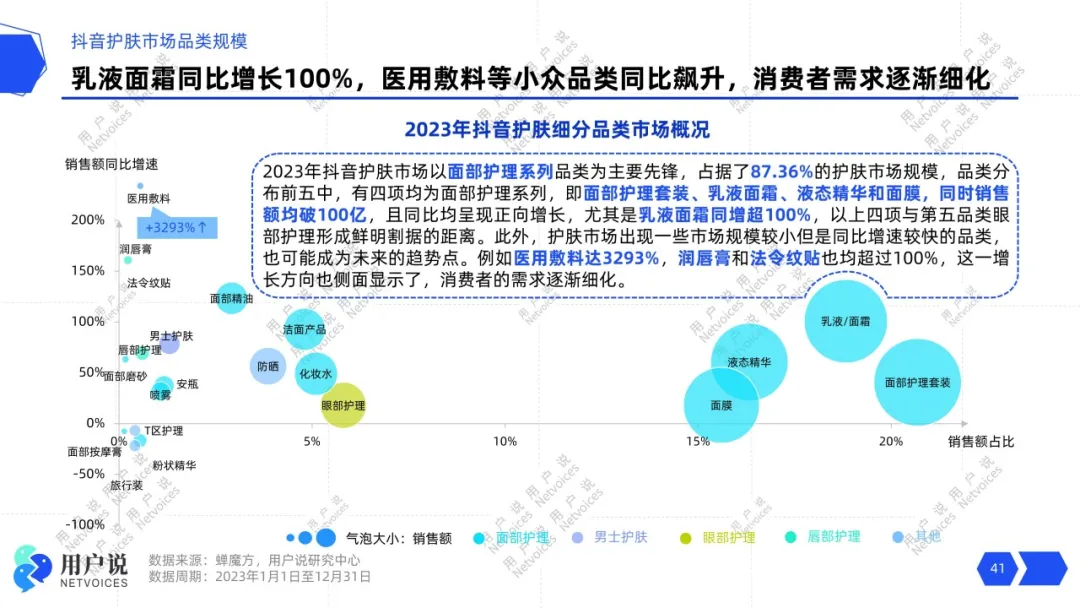

Douyin skincare market withfacial care categoryas the main vanguard, accounting for87.36%of the skincare market size. Among the top five skincare categories, four are facial care categories, namelyfacial care sets, lotions and creams, liquid essence and masks,the sales of the four categories are allover 100 billion,and all increased year-on-year, lotions and creams even increased year-on-year byexceeded100%。

In addition, some categories with smaller market size but rapid year-on-year growth rate have emerged in the skincare market, such asgrowth rate of3293%medical dressings,over year-on-year100%oflip balmandnasolabial fold stickersetc. The diversified growth direction not only shows the vitality of the market, but also highlights the increasingly refined skincare needs of consumers.

02

Douyin's three major makeup categories of face, lip and eye all increased

Among Taobao Tmall's makeup sub-categories, perfume was the second largest makeup category last year, but this year it ranked first with78yuanyear-on-yearGMVranked first, but due to the overall market trend,year-on-year decline19%。Following is foundation/In the category of pastes, sales reached67100 million,year-on-year decline14%.LipstickGMVcompared to last yeardecreased24%,but still entered for three consecutive yearsGMV Top 3,and its position in the cosmetics industry is stable.Last yearTop1beauty tools experienced a significant drop, falling to fourth place, with sales reaching only51100 million。

Overall, the top ten categories of cosmetics account for a total of72.97%,the categories mainly concentrated infacial makeupandlip makeup,and only isolation andBBcream showed positive year-on-year growth8%and6%,rising against the trend.

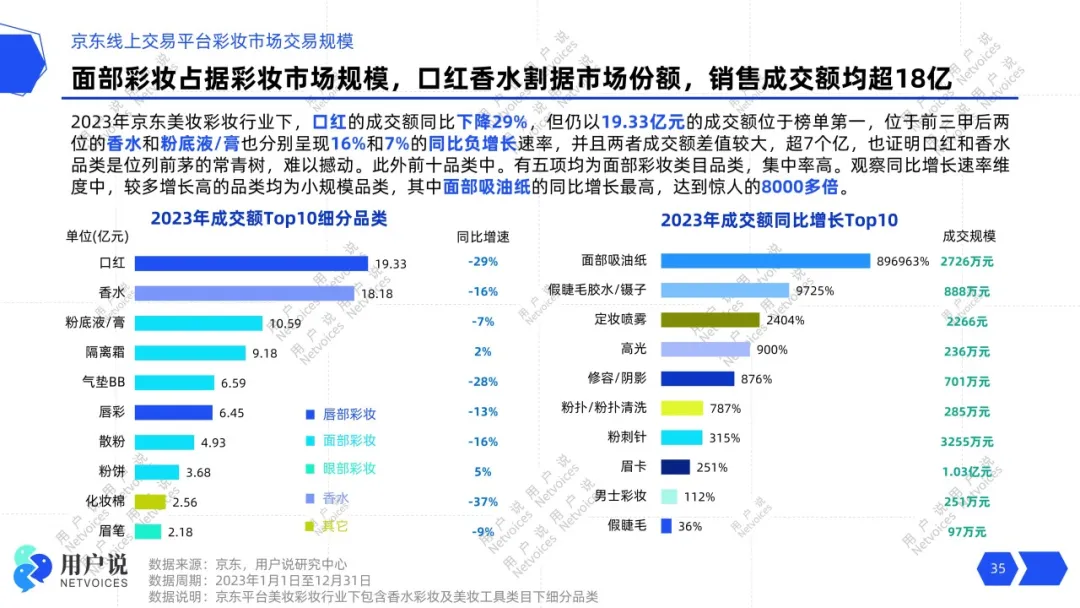

In JD.com's cosmetics sub-categories, the turnover of lipstick year-on-yeardecreased29%,but still ranked first with19.33yuanturnover.Among the top three, perfume and foundation/paste also showed a decline at a rate of16%and7%,and the gap in turnover between the two exceeds7100 million.

Douyin cosmetics/The overall market size of perfume is mainly occupied byfacial, lip, and eye makeup,accounting for57.26%、18.03%and10.78%.All three major categories have increased year-on-year, with facial makeup increasing by106.59%,and lip and eye makeup also exceeded80%year-on-year growth.

03

Perfume&Hair care essential oil, emotional skin care stirs up waves

Users say that based on market data, social media voice data, user search index, etc., analyzing the development trend of beauty industry categories, and summarizing six categories that are expected to2024maintain high-speed growth in the year, namely:Lotion/Face cream, hair care essential oil, perfume, essential oil, nail art, neck care。

In recent years, young consumers' pursuit of“emotional value”has extended to the field of skin care.Among the international beauty giants and luxury beauty new products, there are more and more categories related to emotional skin care research, includingneurocosmetics, aromatherapy, and skin feel experienceetc., some even design the product visual packaging in the direction of healing.

Judging from the current consumer market performance, emphasizing productingredients, smell, and experienceetc., can help usersregulate their emotions and aim to heal their mood.Essential oils nourish the skin with oil, perfume reaches the mind through scent, and hair care essential oils care for the mood with natural ingredients and a relaxing experience.

Perfume:“Pleasing others”to“Pleasing oneself”

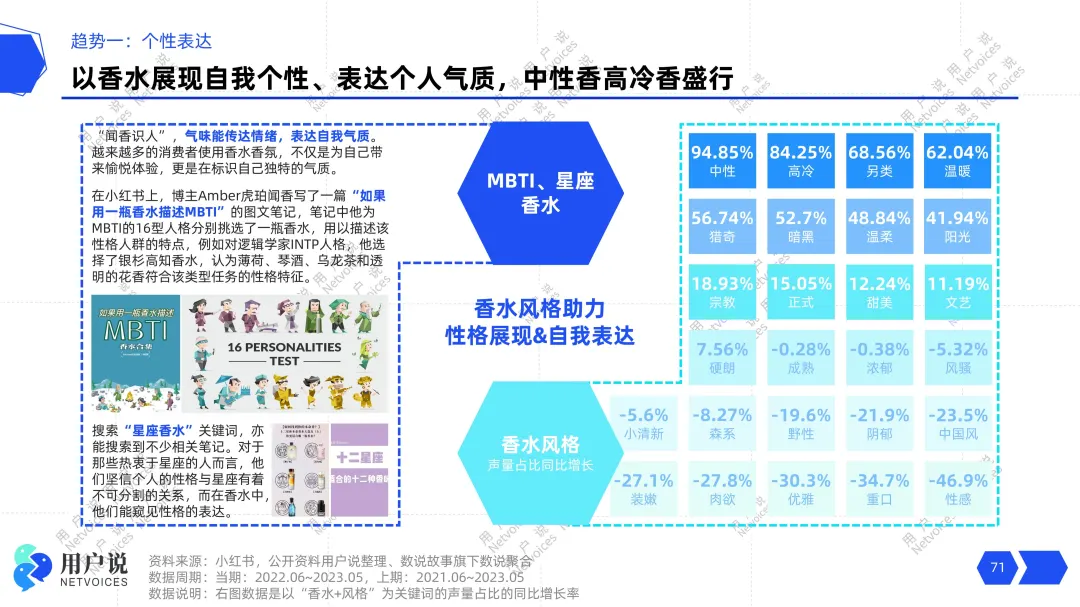

Nowadays, consumers are paying more and more attention to their personal emotions and mental state.Perfume fragrance, as an important category for emotional relief and release, is ushering in a huge opportunity.2023Year perfumevoice ranks first among the sub-categories of cosmetics,Douyin platform perfume/The year-on-year growth rate of balm sales reached78.06%,men's perfume/balm sales have increased by as much as1149%growth rate.

Many new brands have emerged in the perfume track in recent years,2023year's registration number also maintained28.96%high growth.The fragrance market presents a state of diversified competition.Yingtong, a leading enterprise in China's perfume industry, is very optimistic aboutniche fragrances, salon fragrances, and aromatherapy, more diversified perfume and fragrance tracks,and successively cooperated with the Italian home fragrance brandDr.Vranjes,Swedish handmade fragrance personal care brandAmolninternational brands to introduce them to the Chinese market.

Estée Lauder's niche fragrance brandLe LaboThe first store in mainland China is also in2023year5month settled in Shanghai, and officially opened in6month.In the same year12month, Estée Lauder's early investment and incubation departmentNew Incubation Venturesannounced an investment in the Chinese fragrance brandmelt seasonMake strategic investments.The industry has high hopes for the perfume market, giving it broader development space.

In addition, consumers' olfactory aesthetics are constantly upgrading. According to the data insights from the2023China Perfume Industry Research White Paper, some consumers' preferred perfumes are niche international salon fragrance brands, especially among consumers in first-tier cities, this proportion reaches23%。消费者不再局限于大众化的“street fragrances”,but prefer“woody sandalwood”、“green notes”and other niche fragrancesThe perfume industry is playing an increasingly important role in fashion and emotional expression, providing consumers with more choices and personalized experiences.

Hair care essential oil: caring for hair health with natural origins

Stress, environmental pollution, and the use of chemical products can easily damage hair. These factors can cause hair to become dry, brittle, and even fall out. With the continuous upgrading of public awareness of hair care products, the hair care market is showingrefinement, and segmentation of needsdevelopment trend.

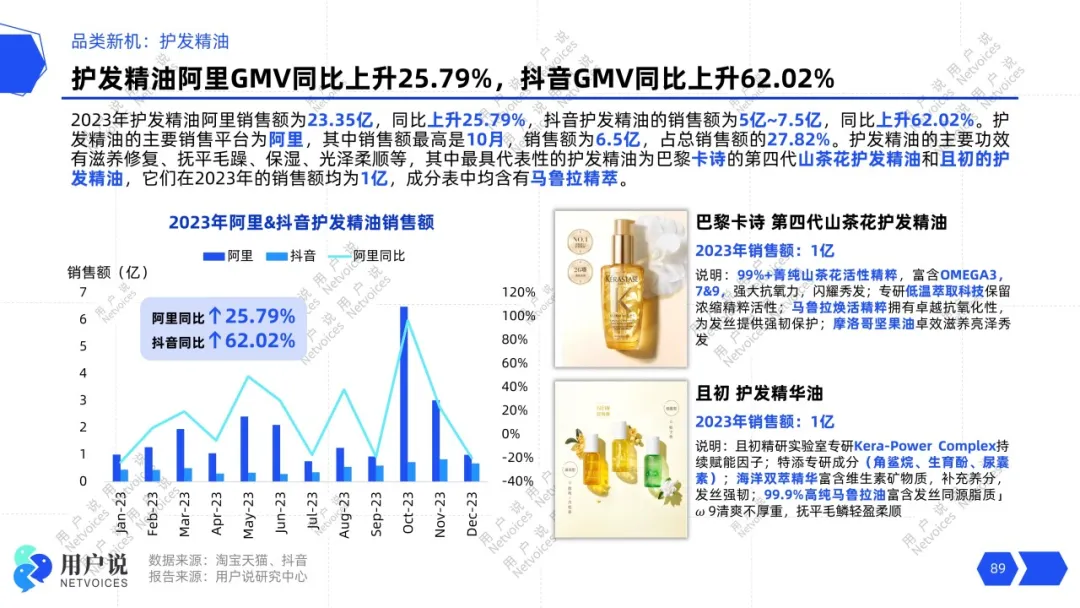

As a popular sub-category in the hair care market in recent years, hair care essential oils have maintained rapid sales growth. As the main sales platform for hair care essential oils, Taobao Tmall2023annual sales reached23.35yuanyear-on-year growth of25.79%The growth rate on the Douyin platform is even as high as62%。

Hair care essential oils usually usenatural plant extractssuch as olive oil, grape seed oil, and coconut oil. These ingredients are considered beneficial for hair, deeplynourishing hair, repairing damage, smoothing frizz, and promoting healthy hair growth, making hair shinier and smoother.

Domestic products rise to the challenge

showing resilient growth potential

01

PROYA skincare4,HUA XIZI makeup2

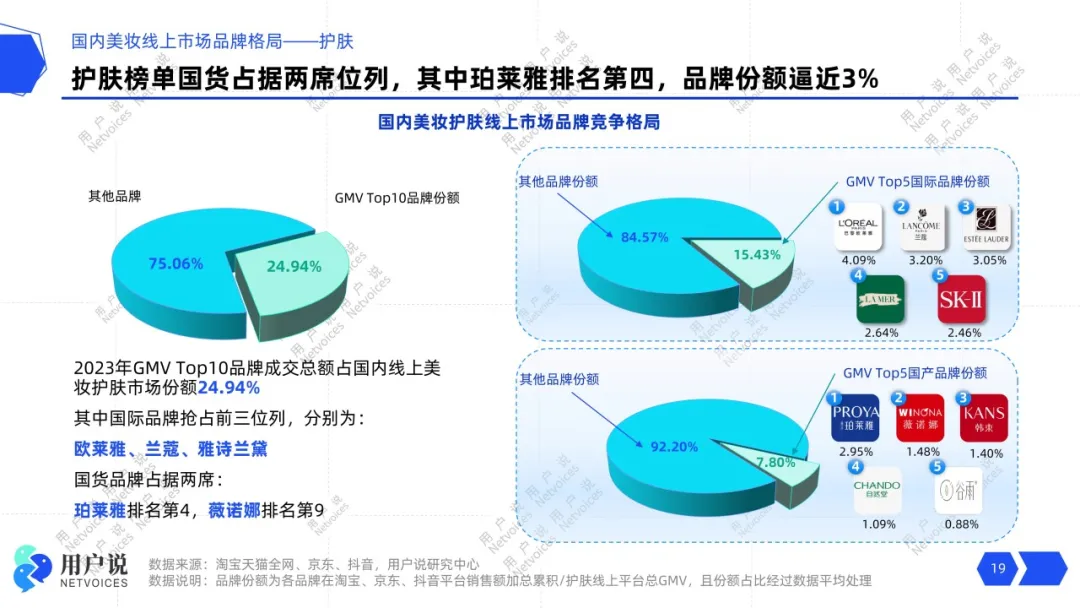

Against the backdrop of intense competition and constant market evolution in the beauty industry, brand performance is particularly crucial. User Say, based on comprehensive data from Taobao Tmall, JD.com, and Douyin platforms, shows that in the skincare category, theCR10is24.94%,TOP3Brands areL'Oréal, LancômeandEstée LauderAmong the top ten brands, only two are domestic brands,PROYA ranks4,and Winona ranks9。

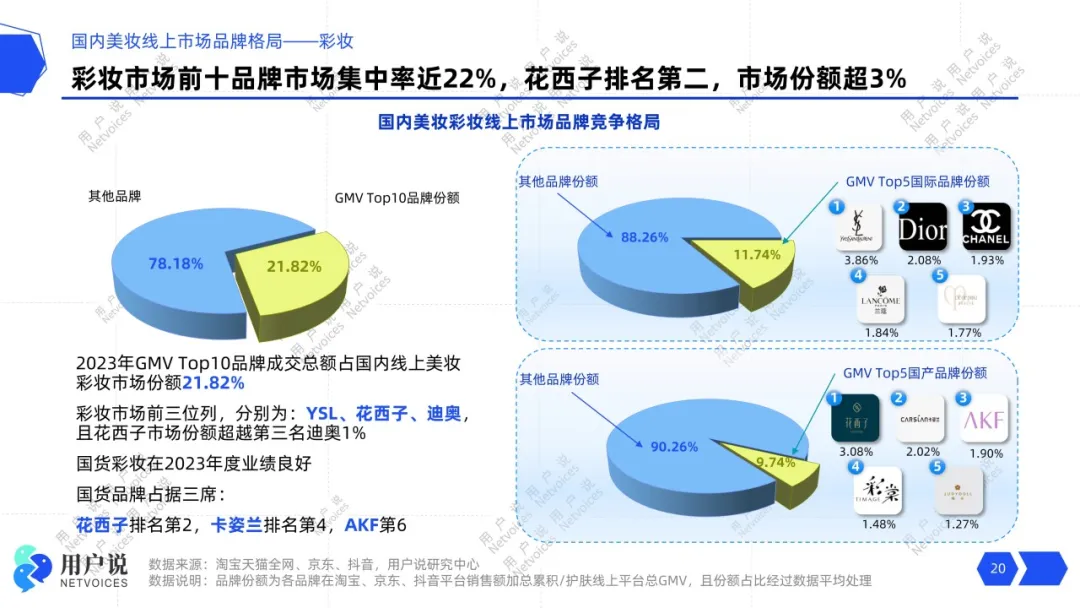

MakeupTOP10Brand market share is21.82%,TOP3respectivelyYSL,HUA XIZIandDiorDomestic brands performed relatively well, with a total ofthree brandsIn addition to HUA XIZI, which ranks second,CARSLAN,AKFare on the list, ranking4and6。

02

Domestic BrandsTOP60all exceed5100 million

Based on the sales ranking of beauty products from Taobao Tmall, JD.com, and Douyin, User Say lists theTOP60ranking. The data shows that the top ten domestic brands areProya, Winona, Hanshu, Natural Hall, Flower Knows, Kfmei, Carslan, Guyu,HBNand OsimPROYA's sales are far ahead, overwhelmingly winning first place.

Previously, User Say, based on internet reputation and behavioral data, quantified the consumer's favorability and liking for domestic beauty brands in the "User Say2023Annual Most Popular Domestic Brand List", PROYA also won first place this year.

Further Reading

PROYA is number one this year! Natural Hall is the runner-up? Hanshu, Ximu Yuan, and Mao Geping are making great progress |2023Annual Domestic Brand List

Expansion of user group portraits

Focus on experience details to build product differentiation

01

Male attentionUP,increase in middle-aged and elderly users

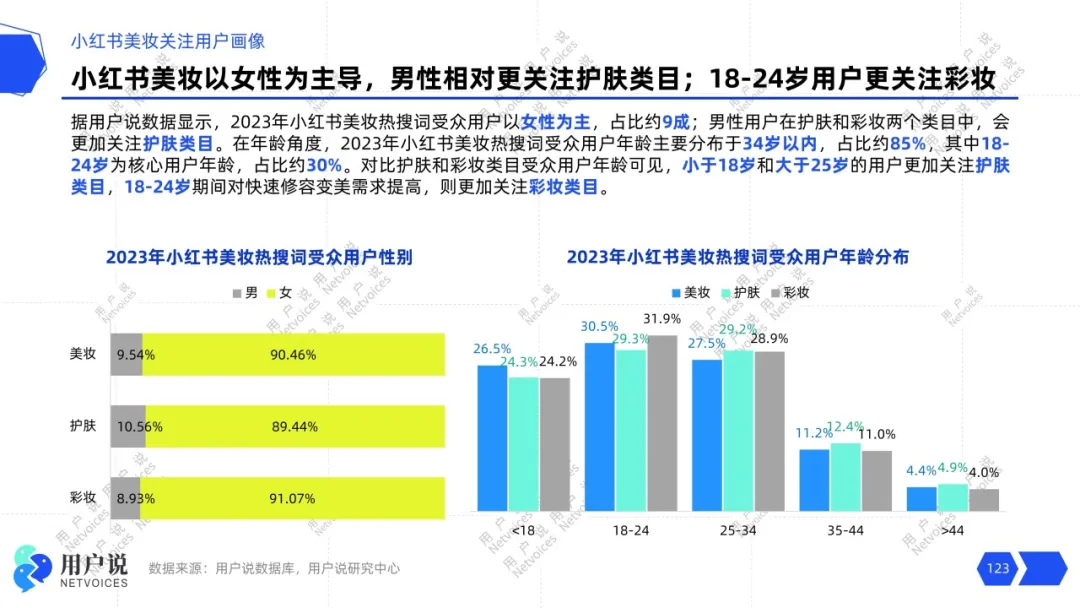

User Say data shows that in the incremental market of Douyin,2023In the beauty industry, the main users are women, accounting for65%above, but year-on-year2022year, it was found that among the users paying attention to the skincare category,the proportion of men has increased by3%It can be seen that men are still paying continuous attention to skincare products. With the progress of thought and personal freedom,more and more male users are willing to invest in beauty spending。

From the age perspective, the age of users paying attention to skincare and makeup on Douyinfocus shifts to51and older age groups,31The percentage of young users under a certain age who follow beauty content has decreased, driven by policy“silver hair economy”development, coupled with an increase in the percentage of older users following beauty content on Douyin.2024Year, Douyin beauty50+The anti-aging market for users aged 50+ is expected to form a much larger incremental market.。

02

Expansion of sensitive skin population, mildness becomes a pain point

No effect, no skincare, user feedback summary2022Year and2023Year's data shows that,Efficacy has been the top priority for skincare users for two consecutive years.but2023Year's efficacy demand volume year-on-year2022Year decreased by3.3%Conversely,The demand for user experience has surpassed the demand for scenarios and ingredients, becoming the second most important dimension.It is evident that the sense of experience and emotional value brought by skincare has become an increasingly important need for consumers.

Upon closer examination, in terms of user experience,Mildness is the largest and fastest-growing user experience need.With the gradual expansion of the sensitive skin population, mildness and non-irritation have become the basic demands of consumers when choosing and purchasing cosmetics. In addition,2023Other rapidly growing user experience needs in the year include brightening effect (e.g., no whitening, no unnatural whitening), overall skin feel (e.g., no discomfort, skin-friendly), and fragrance persistence.

For domestic brands, in addition to efficacy, users are also interested inemerging ingredients are high.Products incorporating unique ingredients often spark heated discussions among consumers, generating significant buzz for the product and brand. In addition, user attention to product texture and packaging design is also noteworthy.

Social media platforms are undergoing transformation,

driving up marketing heat

In order to improve user stickiness for beauty and personal care content, enhance user experience, and encourage consumer participation in consumption activities, various platforms are usingadvancing marketing strategy reforms, strengthening interaction and trust with users, and striving to improve the Brand's position in the competition.。

01

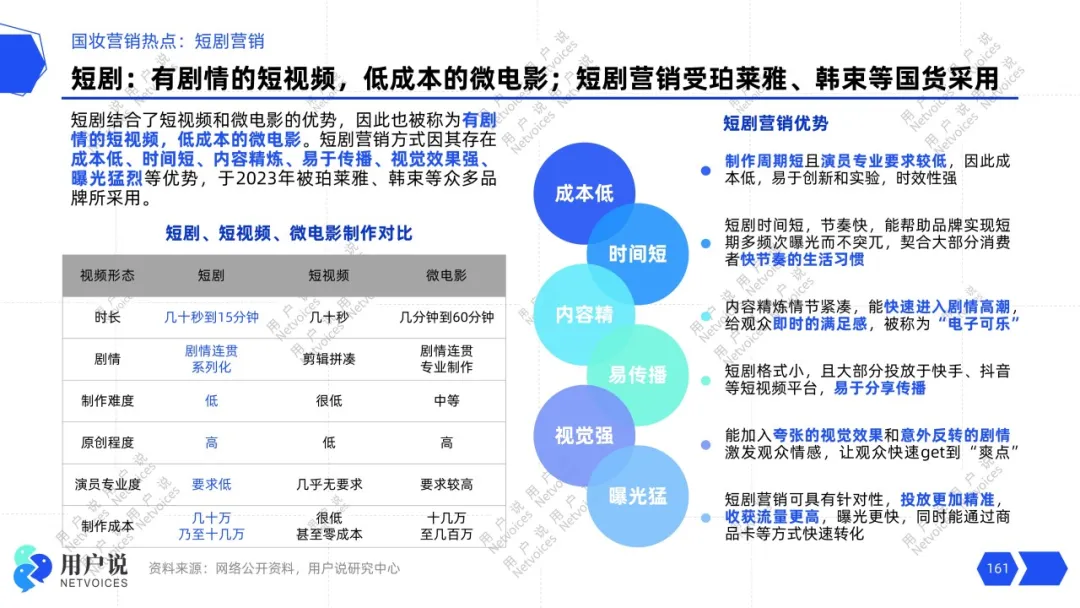

Douyin and Kuaishou: Short-form drama marketing ignites popularity

2023In the year, the most popular marketing method for domestic beauty brands wasshort-form drama marketing.Short-form dramas combine the advantages of short videos and micro-films, withlow cost, short time, concise content, easy dissemination, strong visual effects, and high exposureadvantages. It can meet the fragmented and fast-paced viewing needs of users, while also possessing the companionship and emotional satisfaction of longer dramas, creating ahuge audience marketattracting a large number of loyal fans on platforms such as Douyin and Kuaishou.

Domestic BrandsHanshuused short-form drama marketing to become the number one beauty brand on Douyin in the year, with a Douyin Brand scale of2023~5025100 millionHanshu, starting inyuanmonth, frequently collaborated with Douyin influencer2023year2Jiang Shiqi to release a total of@series of short dramas, with a total of5billion views,48.6with an average ofseries. Each short drama consists of9.72100 million/independent short stories, but all have the heroine's growth and relationship with the male lead as the main theme. This does not affect the independence of each video's story, but uses the development of the relationship to attract viewers to continue16following the drama.“In addition to collaborating with Hanshu, Jiang Shiqi also collaborated with the emerging domestic brand”。

CKato customize the short drama "I Guess You Love Me," todrive traffic for Ka white mud facial cleanser. This short drama also caused a stir on Douyin,Kawith a total ofviews.10.3with an average of。

02

Xiaohongshu: Community to e-commerce comprehensive upgrade

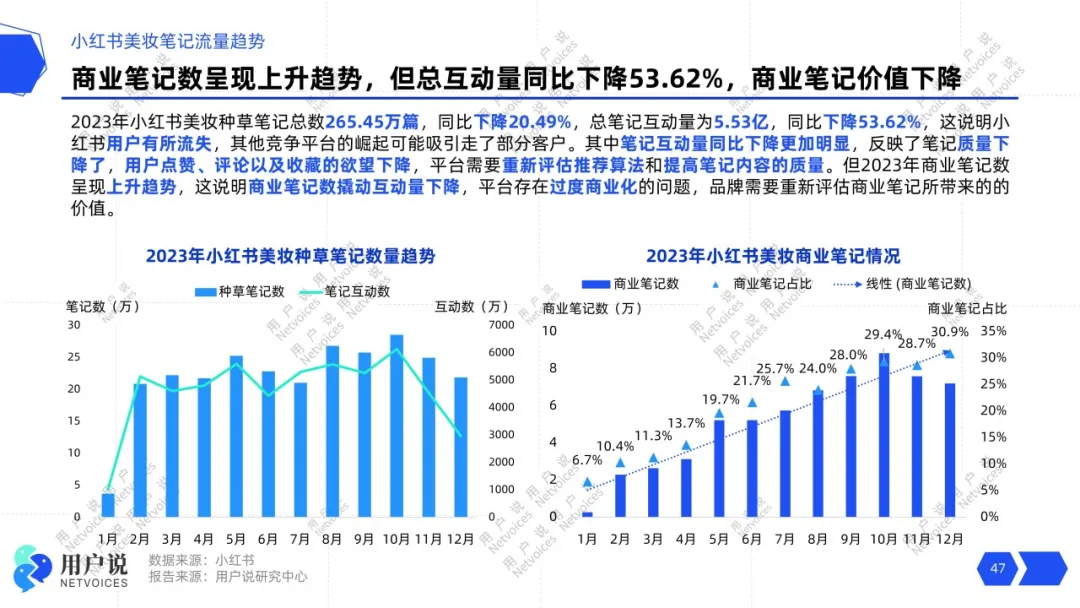

2023In the year, the total number of Xiaohongshu beauty planting notes was265.45ten thousand articlesa year-on-yeardecreased20.49%The total interaction of notes was5.53100 million,year-on-year decrease of53.62%There was some loss of beauty users. However, the number of commercial notes showed an upward trend, but the ability to leverage interaction decreased, and the platform hasexcessive commercializationissues, and Brands need to re-evaluate the value of commercial notes.

Among them, the number of skincare planting notes increased year-on-year byincreased3.94%and the number of makeup planting notes increased year-on-year bydecreased50.18%Xiaohongshu's planting content is more inclined towards skincare and has higher popularity. Beauty-related note topics are more inclined towardsround face, domestic products, studentsand other concepts.

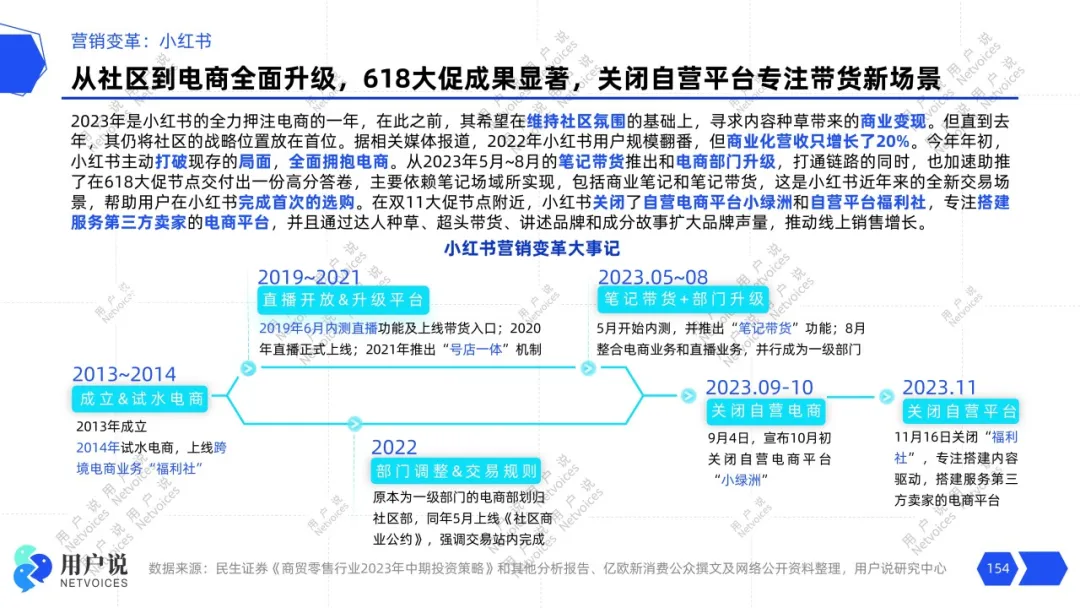

2023The year was a key year for Xiaohongshu's full commitment to the e-commerce field. Before that, Xiaohongshu has alwaysFocusing on maintaining community atmosphere and aiming to achieve commercialization through content creation。2022The number of Xiaohongshu users doubled year-on-year, but commercial revenue only increased by20%。To address this challenge, Xiaohongshu2023rapidly adjusted its strategy at the beginning of the year,fully embracing the e-commerce model。

In2023year5month to8During the month, Xiaohongshu successfully connected the community and e-commerce through the launch ofnote-based merchandiseandE-commerce departmentupgrade, successfully connecting the community and e-commerce, contributing to618significant commercial achievements during the big promotion. During the Double11promotion period, Xiaohongshu further adjusted its strategy, closing its self-operated e-commerce platform Xiaolvzhou and self-operated platform Welfare Society, focusing on building a more third-party seller-oriented e-commerce platform.

ThroughKOL planting grass, super-head merchandise, brand stories, and ingredient analysisetc., Xiaohongshu cleverlyincreased brand exposure, further driving the growth of online sales.This series of measures not only achieved a successful business transformation, but also won Xiaohongshu a more prominent position in the fiercely competitive e-commerce market, and also raised expectations for more innovation and breakthroughs in Xiaohongshu's e-commerce field.

03

Zgeneration interest trends, building marketing solutions

Bilibili's ecological and cultural soil is profound, and its users are mainlyyoung people with a strong desire to consumeandhighly dependent on the platformyoung people. The platform is built aroundUpmain building marketing solutions. The promotion of beauty and personal care products is mainly concentrated in the fashion-beauty area, and film and television areas, etc., where there are more female users. Adoptinterest marketing3idelivery modeleffectively helps Brand content assets to accumulate and reach the target audience. Achieve in-site voice support.

Support and guidance of Brand main measures throughecological marketing, product launch and Brand renewalto create topics. For exampleIPmarketing, etc., integrated with content, finally achieving fan accumulation, Brand integration into the content normalized position.

L'Oréal Men's through cooperation withBstation launchedIPcross-border cooperation, effectively reachingZgeneration of consumers and seizing the minds of young people. The activity adoptshigh degree of fitIPinteractionto attract the attention of young people, strengthen Brand awareness and favorability, and through “European style awards”press conference,UPmain unboxing competition,IPmain creator interaction, on-site experience planting grass, customized barrage lottery, etc.multifaceted gameplayeffectively reachZgeneration, rapidly accumulating Brand account fans. Achieve full-cycle in-sitevolume6.4billion,IPCarnival live broadcast peak popularity207million,IPcall for action topic total views1918million, Tmall search higher than similar products80%high fever。

year of counterattack

China's beauty industry is still vibrant

2023year did show the cosmetics industrycounterattack and turnaround trendsuccessfully bridging the downturn of last year, showing the vitality of renewed growth. This change is reflected in the fierce competition for market share on various online platforms, and brands are more focused on improvingproduct strengthanduser strengthshowing a steady growth trend.

User said "2024China's cosmetics industry development trend report" report on2023yearmarket size, category opportunities, Brand distribution, user needsand other aspects were reviewed, and the hot directions of the beauty industry were comprehensively analyzed. The report deeply studied the changes of domestic Brand and their consumer groups, and analyzed the marketing logic and transformation mode of social media platforms such as Xiaohongshu, Douyin, Kuaishou, and video accounts.

This report helps to comprehensively construct and analyze2023China's beauty market dynamics in 2023, providing industry players with an in-depth insight and clear direction for the overall situation next year.2023The development trend of the beauty market in 2023 has injected new vitality into the entire industry, indicating that20242024 will be a key year for domestic beauty brands to surpass international brands。At this hopeful moment, industry participants should closely pay attention to the hot spots and blue ocean mentioned in the report, flexibly respond to market changes, seize more opportunities, and achieve sustainable growth.