Q3 Market Up 4.1%? Douyin Up 57%? Strong Momentum in Facial Care? Xiaohongshu's Value Stands Out | 2023 Q3 Skincare and Makeup Review

Category:

Keyword

language analysis information

Weight

Stock surplus

9998

隐藏域元素占位

- 详情概述

-

- Commodity name: Q3 Market Up 4.1%? Douyin Up 57%? Strong Momentum in Facial Care? Xiaohongshu's Value Stands Out | 2023 Q3 Skincare and Makeup Review

Overview

Total word count:5069words

Reading time:8-10minutes

1.Q3Year-on-year growth in cosmetics retail sales4.10%,7Negative growth appeared in the month of8The month with the fastest growth rate.

2.Taobao Tmall, JD.com, DouyinGMVIncreased first, then decreased,The skincare and&makeup market size of the first two platforms has shrunk significantly.

3.Facial care sales are considerable, and Douyin's market share of facial care products has reached87.58%。

4.Average transaction price of lipstickfell below55yuanmark, with international first-tier brands still topping the sales list.

5.A total of77.9tens of thousands of beauty-related planting notes on Xiaohongshu, accounting for nearly1/3。

6.Makeup and domestic products have a high voice,Domestic productsrelated topics areQ3among the top topics on XiaohongshuTOP10。

in“Self-indulgence”With the concept of increasingly becoming deeply rooted in people's hearts, the growth of the beauty industry's voice is still promising. The National Bureau of Statistics announced on10month18that the total retail sales of social consumer goods showed that2023the total retail sales of cosmetics from the first quarter to the third quarter of the year amounted to2966.0hundreds of millions of yuan,year-on-year growth of6.8%,showing huge market potential.

As2023year comes to an end, the beauty industry also enters the fourth quarter. The fourth quarter is a crucial stage for various industries, including the beauty industry, to engage in fierce competition. If we want to seize the opportunities brought about by various consumption nodes as much as possible, a review of the third quarter is crucial.

In order to enable various beauty companies to2023continue to consolidate their competitive position in the last quarter of the year, enhance their value creation capabilities and growth driving capabilities, Usersay launched the “2023Third Quarter Beauty Market Review”based on market performance, product category division, and social media performancefrom three perspectives, reviewing the new changes and trends in the beauty industry, so as to help various beauty companies continue to revitalize themselves in the year-end consumption feast.

Full report82pages

Original price¥2999

(Contact customer service at the end of the article to receive coupons)

The first three quarters2966hundreds of millions of yuan

Q3growth4.1%Douyin's growth is stable

01

Usersay

Q3Cosmetics retail sales are approximately894billion, and

a slight year-on-year increase.

Data from the National Bureau of Statistics on the total retail sales of social consumer goods shows that2023year7month's total retail sales of cosmetics amounted to247.0hundreds of millions of yuan, and8month's total321.2hundreds of millions of yuan, and9month's total325.7hundreds of millions of yuan,Q3The overall growth of cosmetics retail sales was slow. It is not difficult to see from the statistical results that2023in the first half of the year, the retail sales of cosmetics maintained a positive growth trend until7month, when negative growth appeared.7The negative growth in618does not mean that consumer demand for beauty products is gradually disappearing, but rather that most consumers have released some of their purchasing desires due to Women's Day and

8month was the best performing and fastest-growing month in the third quarter. Although its monthly retail sales were not2023the highest in the year, the high growth rate of this month still reflects the huge supply and demand elasticity of the beauty market, and consumers' purchasing demand can be restored and corresponding purchasing behavior can be made in a short period of time.

Although retail sales grew slightly year-on-year in the third quarter, the temporary cooling-off phenomenon in the beauty industry still reminds beauty companies to be constantly vigilant against market“coldness—recovery—coldness”cycleEspecially in the face of major promotional nodes that will appear in the fourth quarter, beauty companies should carefully evaluate the market performance of previous years and each month of the year, so as to provide the optimal solution for production quantity, product inventory, and marketing strategies.

02

Usersay

E-commerce market size735billion, and

Douyin performed well

The digital economy has opened up diverse sales channels for the beauty industry, with online e-commerce platforms experiencing rapid growth. However, user data shows that,2022yearQ3to2023yearQ3sales on Taobao Tmall and JD.com platforms are not optimistic.Among them, the sales of the JD.com beauty market decreased year-on-year by30.04%,the largest decrease.However, the Douyin platform has shown strong market resilience,2023with year-on-year sales growth of57.36%。

As the average customer acquisition cost of public domain e-commerce platforms such as Taobao Tmall and JD.com continues to rise, their ability to generate traffic dividends is also declining. In addition, the monetization rate of major e-commerce platforms and service providers such as Taobao Tmall and JD.com is diverging, showing an overall upward trend, which has increased the cost of beauty Brands entering e-commerce platforms to some extent. Against this backdrop, social media platforms such as Douyin, which have accumulated huge private traffic, have become an important tool for beauty companies to conduct private domain marketing.

China Internet Network Information Center (CNNIC) released the52th "Statistical Report on the Development of China's Internet," showing that as of2023year6month, the number of netizens in China reached10.79hundred million, among whichthe number of users of online video (including short video) is10.44hundred million。The huge amount of data means that consumers' media usage habits give the Douyin platform huge marketing potential. Beauty brands can maximize the potential consumers accumulated on the platform, thereby achieving business conversion after reaching the consumer group.

03

Usersay

Three-platform skincare categoryGMVincreased first and then decreased,

8reaching its quarterly peak in

As mentioned before,8month was the fastest-growing month in the third quarter,In terms of growth on e-commerce platforms,GMVmonth also reached the peak of this quarter.8After experiencingmonth's beauty consumption off-season,7month's beauty market showed a warming trend. Although8month's beauty market showed a warming trend, the scale of the skincare and makeup markets on Taobao Tmall and JD.com platforms still showed a significant shrinking trend.8This may be because the impact of the epidemic on consumer psychology has not subsided, and consumers will be more rational and purchase more on demand.Not only that, from the market size of Taobao Tmall, JD.com, and Douyin platforms, it can be seen that consumers' skincare needs on each platform are higher than their makeup needs.

Taking the total sales of Taobao Tmall as an example, the platform's makeup sales in the third quarter werebillion yuan, accounting for only129.73of the entire beauty market.1/3。

04

Usersay

JD.com has the highest average transaction price,

with the average price of makeup far exceeding that of Taobao Tmall.

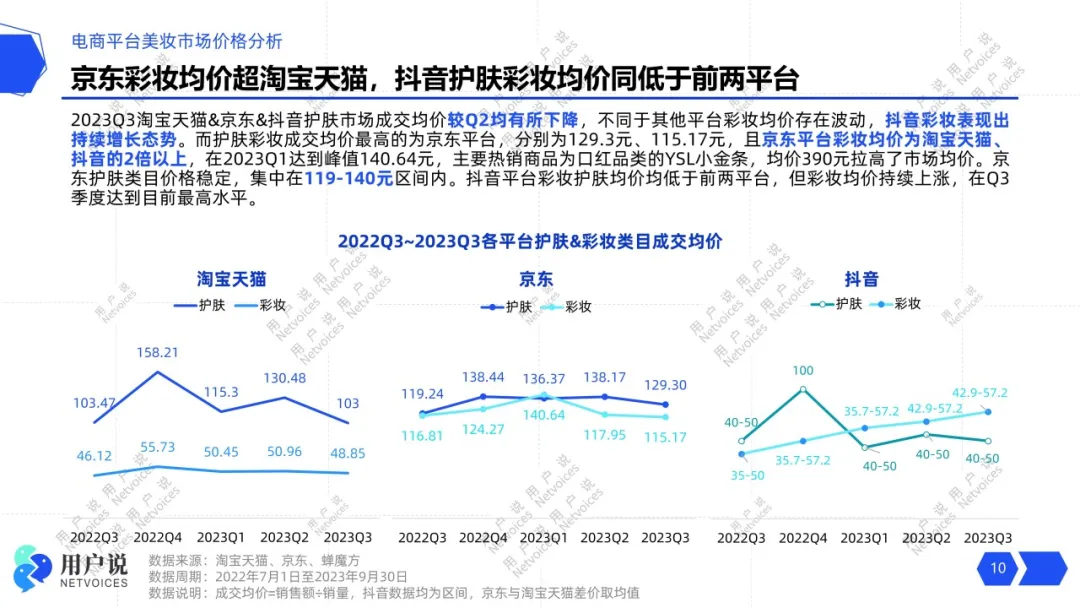

2023In the third quarter of the year, the average transaction prices of the skincare market on Taobao Tmall, JD.com, and Douyin platforms all showed a downward trend, while the average transaction price of the makeup market only increased slightly year-on-year on Douyin. For consumers,purchasing poweris one of the important factors determining consumer behavior. For Brands,pricing poweralso affects whether consumers will pay for their products.

Although in the third quarter, beauty Brands on Taobao Tmall, JD.com, and Douyin platforms all showed their sincerity in pricing power, the average transaction price of JD.com is significantly higher than the other two platforms, positioning the platform towards“high-end”At the same time, this has also become“the hand”。

that pushes some consumers away or to other platforms.In addition, unlike skincare products,most products in the makeup category belong to consumers' non-rigid needs and have strong substitutability.

Especially with the continuous rise in the popularity of domestic makeup, consumers are easily attracted by relatively low-priced domestic products, and makeup products with high average transaction prices are likely to lose their competitiveness in terms of cost performance.

Category structure has stabilized

01

Usersay

Facial care sets are dominant, lotions and creams break through

Q3Facial care takes the lead,55with set sales reaching

billion.2023User data from the third quarter of/year shows that on the Taobao Tmall platform, the sales data for skincare products shows that facial care sets, facial essences, lotions/creams, masks, cleansers, sunscreens, toners9astringents, body care, and eye care10categories exceededbillion in sales.TOP10Among the categories with sales of9in the third quarter,there are

categories related to facial care,covering multiple efficacy tracks such as sun protection, cleansing, moisturizing, and anti-aging.55Looking at the category data of Taobao Tmall, JD.com, and Douyin platforms, the sales of sets are relatively considerable,13categories exceeded

In addition, in the skincare market on the Douyin platform, the market share of facial skincare products has reached87.58%。其中,Lotion/The sales of face cream subcategories reached25-75hundred million yuan, with a year-on-year growth of101.56%,showing strong market value.

By analyzing the sales data of the skincare market on the three major e-commerce platforms in the third quarter, it can be seen that facial care“the appearance economy”has shown great sales prospects under the leadership of the current situation. Especially in“She economy”In the context of , the concept of facial beauty has been widely infiltrated into the consumer group,Facial care, as the current industry trend, is the key for beauty companies to break through.

02

Usersay

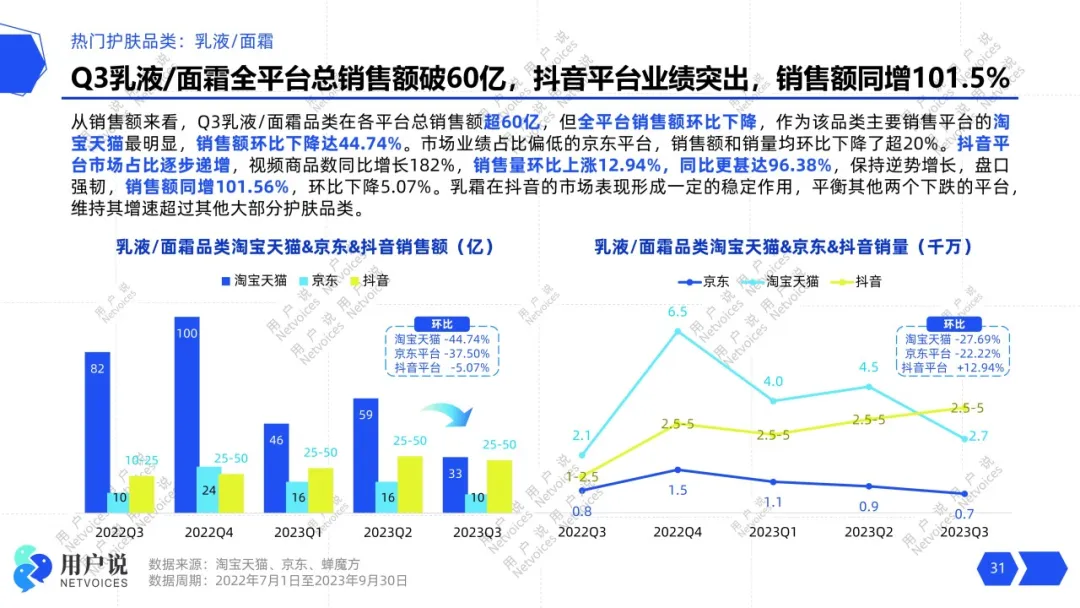

Total sales of creams across all platforms exceeded60billion, and

Douyin's sales advantage is significant

2023In the third quarter of the year, lotions and/The total sales of face cream categories on e-commerce platforms exceeded60hundreds of millions of yuan, andHowever, the sales of lotions and/face cream categories on Taobao Tmall decreased month-on-month by44.74%,and JD.com's sales decreased month-on-month by more than20%。Although the sales situation of Taobao Tmall and JD.com is not optimistic, thelotion and/face cream sales on the Douyin platform increased month-on-month by12.94%,and even as high as year-on-year96.38%。

Currently, the daily active users of the Douyin platform have reached8.8100 million, and Chinese people spend more than2hours on Douyin every day on average. This level of user activity and stickiness gives the Douyin platform great sales potential, and it is also one of the reasons why it has achieved outstanding results in the sales of beauty products. As brand owners, various beauty and skincare companies need to make good use of this short video traffic pool to improve the monetization rate of their products.

03

Usersay

The average transaction price fell below55yuan,

Lipstick“Volume increased, but value decreased”

Lipstick categories have always been a major category in the cosmetics market,2023In the third quarter of the year, the sales of lipstick categories were12.31hundred million yuan, down month-on-month by7.99%,but sales increased month-on-month by6.48%。Sales increased, but sales decreased. The reason is that the market for lipstickThe average transaction price fell below55yuan mark。The decline in lipstick prices did not only occur in2023In the second quarter of the year, the average transaction price of lipstick categories fell to59.5yuan.

Although the average transaction price of lipstick showed a significant decline in the third quarter, the Taobao Tmall lipstick sales brand listTOP10is still occupied byYSL、Dior、MACand Chanel and other international first-line brands. Among them,YSLsales increased month-on-month by5.14%。The data on the sales list shows thatAt present, when the average transaction price of the lipstick market is falling, consumers have not shown obvious price sensitivity, but still prefer lipstick products with guaranteed quality and high brand awareness.

In addition,2023In the third quarter of the year, the best-selling products in the Taobao Tmall lipstick category were still the star products of major Brands——DiorDior's Fierce Blue Gold Lipstick (Q3sales8.37ten thousand units),YSLSaint Laurent's small gold bar lipstick (Q3sales6.88ten thousand units),CHANELChanel Charm Velvet Lipstick (Q3sales3.25ten thousand units).

With first-line brands occupying a place, and domestic niche brands constantly squeezing into the market, the competition among lipstick brands is extremely fierce. However, under such fierce competition, the products that can win the favor of consumers are still the long-standing flagship products of well-known brands. This also inspires various skincare and cosmetics brands to quickly establish“the awareness of major single products”,create products with memorable points and differentiation, and achieve“brand building through products”sustainable growth.

Xiaohongshu's commercial value is highlighted

Domestic products have become“topic king”

01

Usersay

Beauty planting notes77.9ten thousand articles,

cumulative interaction1.62with set sales reaching

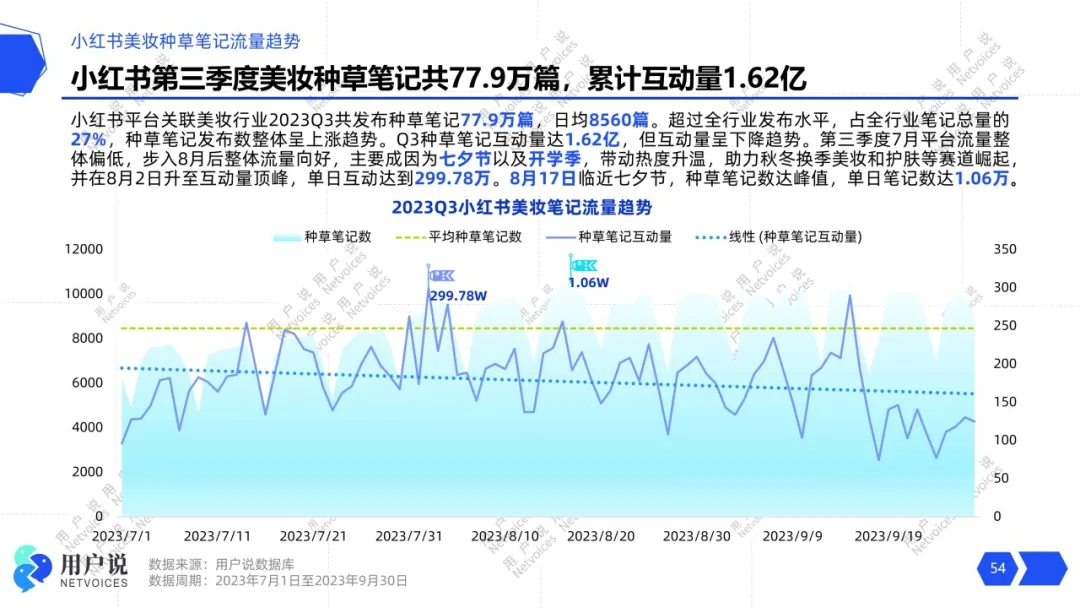

《2121st Century Business Herald》on2023year8month30A report on the day pointed out that,2022Compared to the beginning of the year, the number of Xiaohongshu e-commerce users has increased12times, and the number of merchants has increased10times, with an overall increase in user repurchase rate of1.7times. User data also shows that,2023In the third quarter of the year, Xiaohongshu platform had a total of77.9notes about beauty and makeup, averaging8560notes per day, accounting for27%。

“Grass-planting”and“Weed-pulling”are two typical labels on the Xiaohongshu platform. As a social media platform whose user portraits are mostly young women, grass-planting and weed-pulling on Xiaohongshu are often related to skin care and makeup products. XiaohongshuCOOConan revealed that,there are approximately300requests for links and purchases“related content posted in the comment section of Xiaohongshu notes every day, and the number of daily active users with purchasing intentions is close to”ten thousand people.4000Moreover, bloggers, buyers, and principals who have settled on the Xiaohongshu platform are a key link in the platform's e-commerce marketing. With the help of notes published by these groups, they can convey commercial value to consumers in a user-understandable form through their professional introduction and analysis of various skin care and makeup products, combined with real usage experience, connecting supply and demand in the interaction.

Makeup notes interaction reached

02

Usersay

ten thousand,8338Affordable evaluation is highly concerned

User data shows that,

In the third quarter of the year, Xiaohongshu had a total of2023notes on skin care, with an interaction volume of47.18ten thousand, and a total of6386.3makeup notes, with an interaction volume of26.97ten thousand. In the8338.38third quarter, the number of makeup notes was less than the number of skin care notes byten thousand, but the interaction volume of the former exceeded the latter by20.21The reason is that skin care notes have higher professional requirements, and different products will show different effects on consumers of different ages and skin types.20%。In skin care notes, prohibited words, risk words, and sensitive words will hinder the widespread dissemination of notes on the platform. For example, when introducing anti-inflammatory skin care products, users must use

anti-inflammatory“to weaken the introduction of their effects. A slight carelessness will lead to the risk of notes being throttled, shielded, and forcibly deleted.”Compared with skin care notes, makeup notes can intuitively present the specific effects of the product by combining the specific makeup and makeup feel shown in the notes, and visualize the product value, while avoiding touching on topics related to skin medicine and health. In the discussion of makeup notes,

sharing“recommendation”、“affordable”、“evaluation”、“These four keywords have the highest discussion rate. This shows consumers' attention to the Price of makeup products, and makeup products with relatively low Prices are more attractive to consumers.”Makeup sharing ranks first,

03

Usersay

Domestic products enter the topic list

The Xiaohongshu hot beauty topic list in the third quarter of the year shows that today's makeup, makeup sharing, and beauty improvement topics occupy the top three positions on the list,TOP10

2023Among them,today's makeup“topic discussion has gained”ten thousand new interactions.4183.6Maslow's hierarchy of needs theory believes that human needs are arranged in a certain order, and defines physiological needs as the lowest level of needs and self-actualization needs as the highest level. The high popularity of makeup and beauty improvement topics reflects users' attention to themselves and their emphasis on self-improvement, aiming to present their best

front“appearance. The topic data echoes the note interaction data in the previous text, further demonstrating”the value and unlimited possibilities of Xiaohongshu, this social media platform, in the marketing of makeup products.Unlike the previous two quarters,

domestic product topics successfully entered the top ten of the topic list in the third quarter, gainingten thousand new interactions, of which1753.8month's new interactions contributed9of the total interactions this quarter.91%。Against the backdrop of the resurgence of national tide culture, domestic skin care and makeup products are already in a state of overtaking on a curve.

On the one hand, because domestic Brands have localized characteristics, they can maximize the arousal of consumers' national feelings and cultural pride. On the other hand, domestic Brands such as Huaxizi and Perfect Diary can create symbolic symbols that cater to the national tide psychology of consumer groups in terms of spokespersons, product copywriting, packaging design,social media dissemination and hypeand other aspects. Based on the fact that consumers' enthusiasm for domestic products is still continuing to grow, domestic Brands should seize the opportunity to put their products into suitable platforms and communities to stimulate consumers' purchasing interest.

The year-end promotion is approaching,

how to fight a good“consumption war”?

This issue analyzes from three perspectives: market performance, product category division, and social media performance2023A comprehensive review of the beauty industry in the third quarter of the year has been conducted. Statistical data clearly shows that after several promotional periods in the first half of the year, the beauty market showed a cooling trend, but a rebound quickly appeared in the short term. Major promotional periods at the end of the year are still highly likely to meet consumer purchasing needs. In the skincare industry, facial care products account for a large market share,Consumer demand for lotions, creams, and other facial products is surging。

However, comparing major e-commerce platforms, Taobao Tmall, JD.com, and Douyin have shown significant differences in performance, especially JD.com, which is significantly weaker than the other two platforms in terms of sales revenue and volume,The e-commerce marketing potential of JD.com platform remains to be seenIn addition, as a social media platform,Xiaohongshuhas a competitive edge in social media performance, and itsability to convert community value into marketing valueis prominent.

Whether it is products, Brands, or e-commerce platforms, they may not be able to escape the laws of their own life cycles. However, the height of the apex of their growth parabola and the upward slope can be determined, and these are key factors influencing the period of high profits for businesses.

The User Say released《2023Third Quarter Beauty Market Review of the Yearreport uses massive and intuitive data to analyze the shortcomings and advantages of various e-commerce platforms in the beauty market, covering the supply and demand trends of multiple beauty product categories, summarizing the latest registration information in the current beauty industry, and conducting an in-depth review of the changes in the beauty market in the first half of the year.