Q1 online sales up 6.9% to 104.5 billion? Men's face cream sales surge 284%? Hanshu's Douyin sales reach 1.8 billion? A 500% increase! | 2024 Q1 Beauty Industry Review

Category:

Keyword

language analysis information

Weight

Stock surplus

10000

隐藏域元素占位

- 详情概述

-

- Commodity name: Q1 online sales up 6.9% to 104.5 billion? Men's face cream sales surge 284%? Hanshu's Douyin sales reach 1.8 billion? A 500% increase! | 2024 Q1 Beauty Industry Review

Overview

Total word count:5050words

Reading time:8minutes

1.Market Trends:2024In the first quarter of the year, the total retail sales of the Chinese cosmetics market reached1086.2yuan, a year-on-year increase of4.12%; the total sales of the three major e-commerce platforms (Taobao Tmall, JD.com, and Douyin) exceeded1045.46yuan, a year-on-year increase of6.87%;

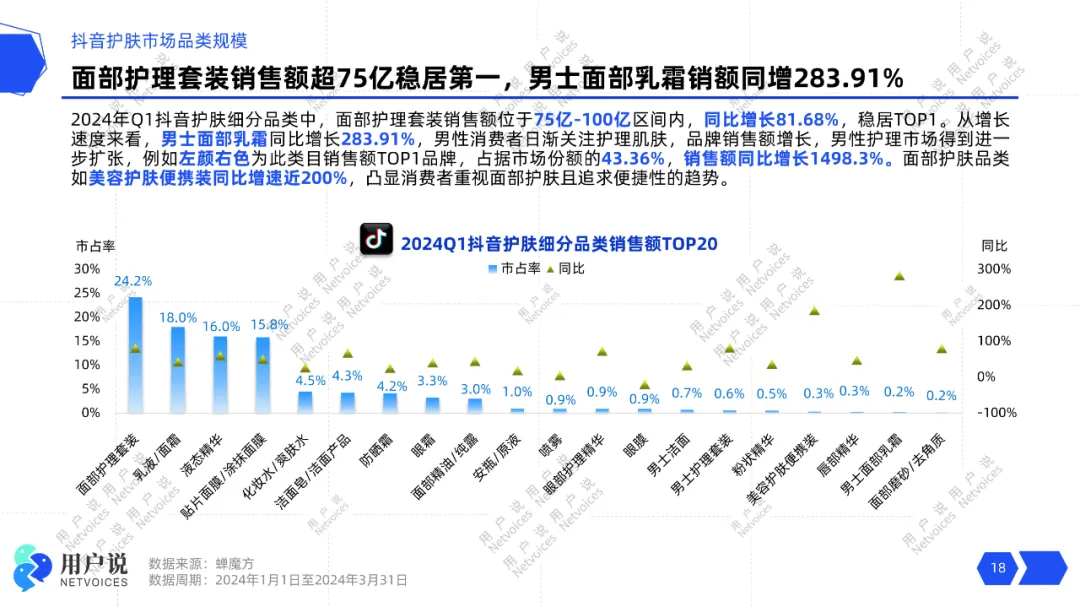

2.Platform Category Performance Breakdown:[Tmall Taobao] Lotion/face cream, and toner/astringent, makeup remover, and lip care showed high growth; [JD.com] men's lotion/face cream, other men's facial skin care, and men's makeup remover surged; [Douyin] men's facial cream, men's care sets, and men's perfume/and lip balm exploded;

3.Douyin platform Brand trends: Perfect Diary, Mao Geping, Youyi andBABIetc. Brandstop10Enter, showing a trend of reshuffling of brands on the Douyin platform;

4.Future Competitive Trends:The first quarter filing data increased year-on-year by33%indicating that market competition will further intensify.

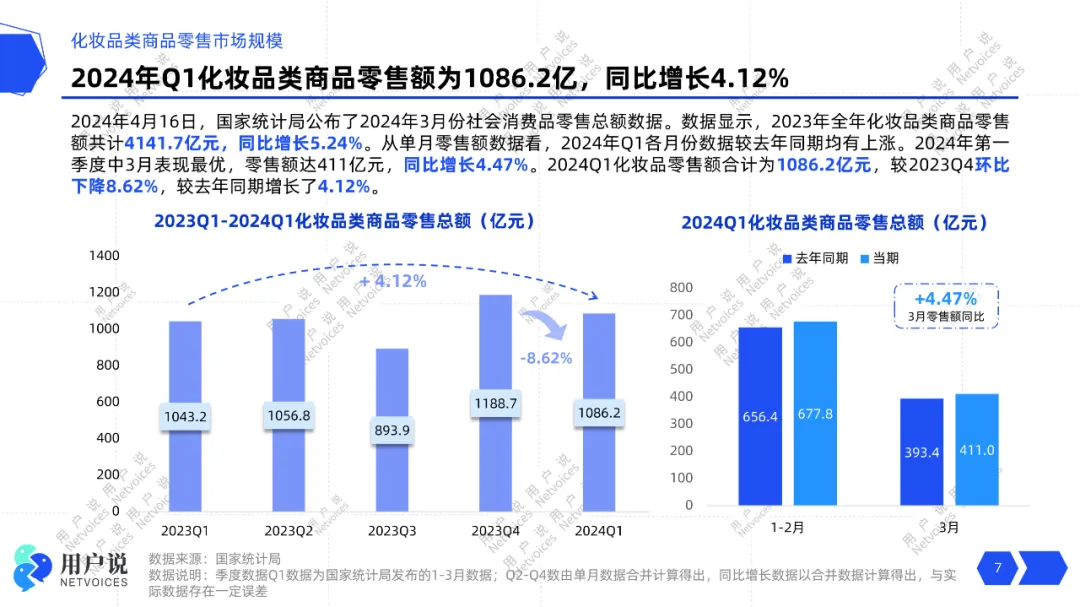

4Month16On the day of, the National Bureau of Statistics released the data for2024year3month's total retail sales of consumer goods. The data shows that the total retail sales of consumer goods120327yuan, a year-on-year increase of4.7%。3In the month, the total retail sales of consumer goods increased year-on-year by3.1%and increased month-on-month by0.26%. The total retail sales of cosmetics in China showed a steady growth trend, especially in3Month,total retail sales reached411yuan, a year-on-year increase of4.47%。2024The total retail sales of cosmetics in the first quarter ofwere1086.2yuancompared with the same period of2023increased by4.12%。

User data shows that the three major mainstream e-commerce platforms—Taobao Tmall, JD.com, and Douyin—2024total sales in the first quarter of the year exceeded1045.46yuan, a year-on-year increase of6.87%. However, the specific performance of each platform varies. The sales of the beauty market on Taobao Tmall in the first quarter were401.68yuan, a year-on-year decrease of16.16%leaving much to be desired. At the same time, JD.com's beauty market sales were114.24yuan, a year-on-year decrease of18.35%The decline of the two major platforms shows that with intensified platform competition and shifting consumer preferences, the beauty market share is being eroded by competitors such as Douyin and Xiaohongshu.

In sharp contrast, Douyin's performance was particularly outstanding, with beauty market sales between400billion and500billion,a significant year-on-year increase of57.65%. This significant growth in Douyin may be attributed to its strong social media influence and unique content marketing strategy, which continues to attract the attention and purchasing power of a large number of young consumers.

Overall,2024the data for the first quarter of the year has shown that the cosmetics market has transitioned from the"era of rapid growth"to the"era of slow growth"。

To help beauty companies accuratelygrasp2024the industry trends and category changes in the first quarter of the year, and quickly find market entry points and development focusesUser Say has specially launched the "Review of the Beauty Market in the First Quarter of2024". This review comprehensively interprets the latest changes and trends in the beauty industry from three dimensions: market performance, category analysis, and social media performance, aiming to help beauty companies shine with unique charm and continue to lead the industry trend in the early consumption frenzy of the new year.

Full Report84pages

Original price¥2999

(Contact customer service at the end of the article to receive a coupon)

Small Categories, Big Opportunities

Emerging categories are accelerating their rapid growth

Tmall Taobao market shrinks

Lotion, face cream/Lip care/Lip liner shows counter-cyclical growth

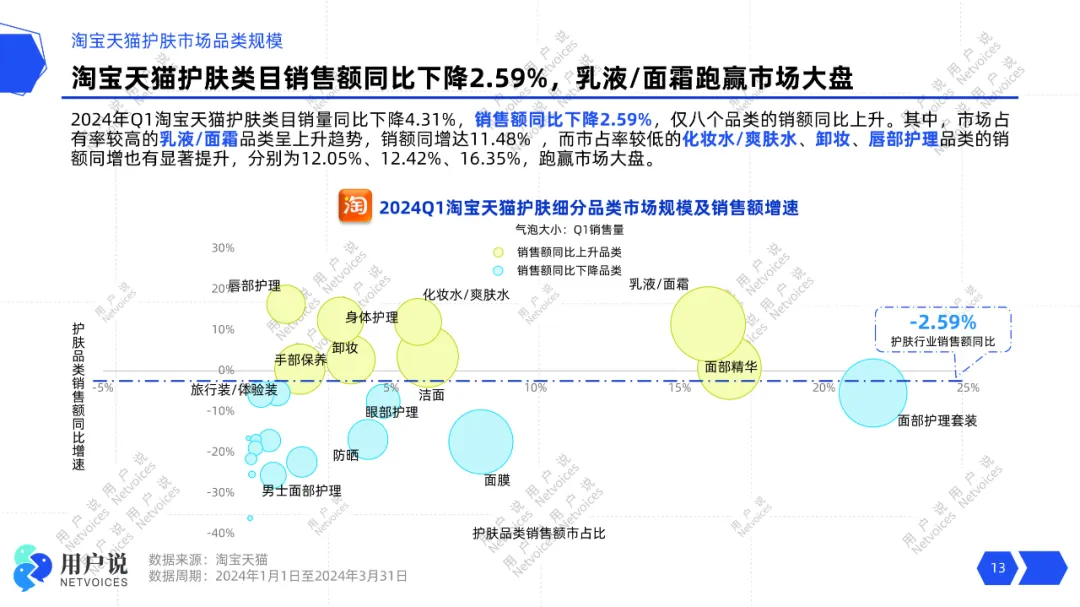

In2024In the first quarter of the year, although the overall sales of Tmall and Taobao showed shrinkage, some specific skincare and makeup categories surged against the trend, revealing unique changes in consumer demand and market potential. Tmall and Taobao, as one of the largest e-commerce platforms in China, have shown a downward trend since last year.The overall sales volume of skincare products in the first quarter of this year decreased year-on-year by4.31%,and sales also decreased year-on-year by2.59%。

However, there are market gaps in the sub-categories, with lotions and/creams showing a surge against the trend, with year-on-year sales growth of11.48%。This figure highlights the stable and growing consumer demand for daily skincare. Similarly, the sales of toners and/astringents and makeup removers also achieved12.05%and12.42%growth respectively, whilethe growth of lip care products reached a staggering16.35%。

In the makeup market, the growth of specific categories is even more striking.Travel-sized/trial-sized products achieved a staggering year-on-year growth rate of128.47%,lip pencils and/lip liners also followed with a growth rate of102.31%,whileBBcreams also saw a year-on-year sales growth of39.14%should not be underestimated.These figures highlight the continued pursuit of novel and convenient products by consumers, representing an opportunity for brands to find the right market. In a seemingly universally declining market, the categories that have grown against the trend provide a breakthrough point, offering valuable insights for brands and market strategists.

JD.com's overall market is sluggish

Men's skincare breaks through, with facial oil blotting papers soaring

Similarly, in

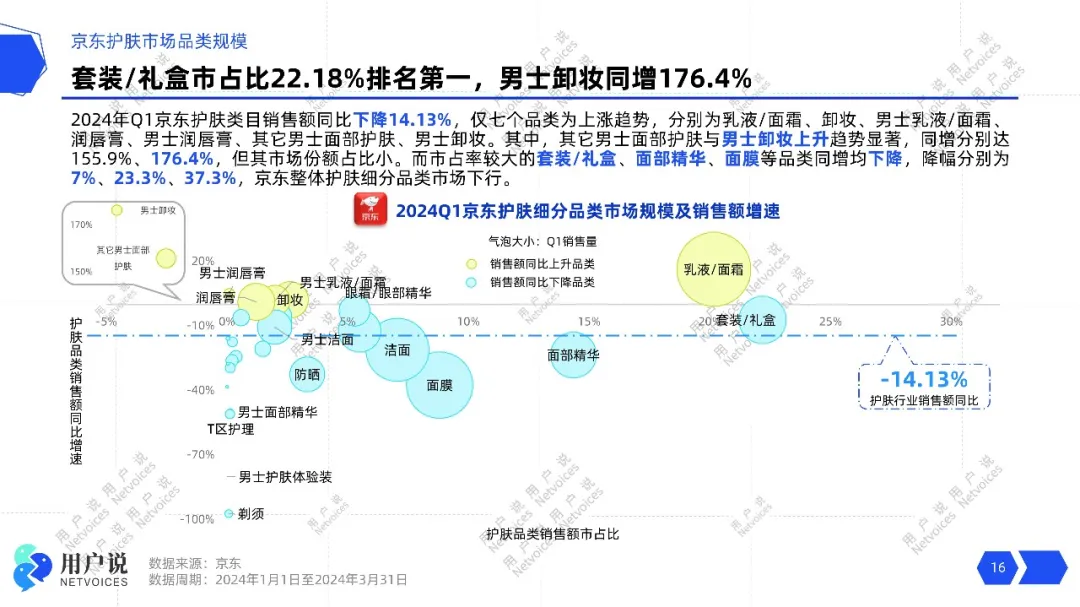

the first quarter of the year, although JD.com's overall skincare and makeup market was sluggish, some categories performed exceptionally well, which is worth paying attention to by the industry.2024The overall sales of skincare products decreased year-on-year by

14.13%,but seven categories showed growth in the segmented market, with men's skincare products being particularly noteworthy.Men's lotions andcreams, other men's facial skincare, and men's makeup removers saw year-on-year sales growth of up to/155.9%176.4%、,showing strong growth momentum. This data reflects the rise of the men's skincare market and the growing consumer demand for men's skincare products.In the makeup market, overall sales decreased year-on-year by

7.47%,but some categories with lower market share achieved rapid growth, the most striking of which is facial oil blotting paper.The year-on-year sales growth of facial oil blotting paper was as high as1090.4%,a shocking figure. From the fourth quarter of last year to the first quarter of this year, the sales volume of facial oil blotting paper has soared from almost zero toten thousand, achieving an astonishing surge. Contouring25shadow and setting spray also rose rapidly with growth rates of/324.7%210.3%andrespectively.The data behind these figures reflects the changing preferences of consumers for skincare and makeup products, as well as the rise of emerging categories in the market. The growth of men's skincare products highlights the increasing importance placed by male consumers on personal image and skincare, while the surge in specific categories such as facial oil blotting paper reflects the strong consumer demand for oil-control products. These changes are worth further consideration by brands and retailers, to understand consumer needs in detail and make corresponding adjustments to market changes.

Douyin's overall market is up

Men's creams and men's perfumes and balms sweep Douyin

The overall increase in Douyin's market share, in

the first quarter of the year, the segmented market for skincare and makeup products on Douyin showed an astonishing growth trend. In the skincare category, the sales of men's care products showed explosive growth. Data shows that2024men's facial creams have seen a staggering year-on-year increase of283.91%,whilemen's care sets also achieved82.5%year-on-year growth。This series of data undoubtedly confirms a trend: more and more men are beginning to pay attention to skin care. This is not only a pursuit of personal image, but also a reflection of a healthy lifestyle.In the makeup market,

men's perfumebalm sales increased by/1797.18%1797.18%which is astonishing. Behind this number lies the new consumer demand for men's beauty products and the huge potential of the market. As men pay more and more attention to their own image, men's perfume/and pomade, as part of their personal image, have naturally become the focus of market attention. In addition,setting spray, as another fast-growing makeup product, with a year-on-year growth rate of210.27%also shows that consumer demand for makeup setting products is increasing day by day, and please pay attention to the user-said category report for more exploration of setting products.

A Major Reshuffle in the Douyin Brand Landscape

The Surge of New Makeup Brands, Hanshu's Explosive Growth500%!

In the brand landscape, we have observed some striking trends. Although the ranking of skincare brands is relatively stable,the makeup category shows significant fluctuationsSpecifically, the dominance of the Taobao Tmall makeup field has shifted fromYSLtoCle de Peau Beaute,the latter rising to the top of the list in2024the first quarter of the year. At the same time,NARShas leaped from its previous ranking to second placemen's care sets also achievedYSLunexpectedly fell to fourth place. These changes reflect the rapid shift in consumer preferences and the volatility of market dynamics. For more detailed brand data and analysis, please refer to the report.

In addition, Douyin, as the fastest-growing social media platform, has demonstrated the huge potential and plasticity of Brands, especially in the skincare Brand landscape. Domestic Brands have performed particularly well on the Douyin platform, such asHanshuandProyaremain firmlyTOP2in position, whileOushimianhas newly entered the list, and La Mer has been squeezed out of the top ten. Domestic BrandGuyuehas leaped to fifth place, demonstrating the strong rise of domestic Brands and increased market acceptance.

In the makeup segment, the overall sales on the Douyin platform show an upward trend. It is worth noting thatPerfect DiaryBrand has jumped to the top spot with an astonishing25.79%month-on-month growth rate,sales reaching2.5billion and5hundreds of millions of RMB. At the same time, includingMao Geping, Youyi andBABIand other new brands have successfully enteredTOP10the list, with sales in1billion and2.5the hundreds of millions, showing the vitality and market opportunities of new entrants.

These data and trends not only show thatdomestic beauty products are rapidly occupying the market, but also reveal deeper changes in consumer behavior. It is enough to show that if brands can perceive new changes, adjust their market strategies in time, and use the growth of Douyin to enhance their brand influence and market share, they will have the opportunity to maintain their competitiveness and attract consumers.

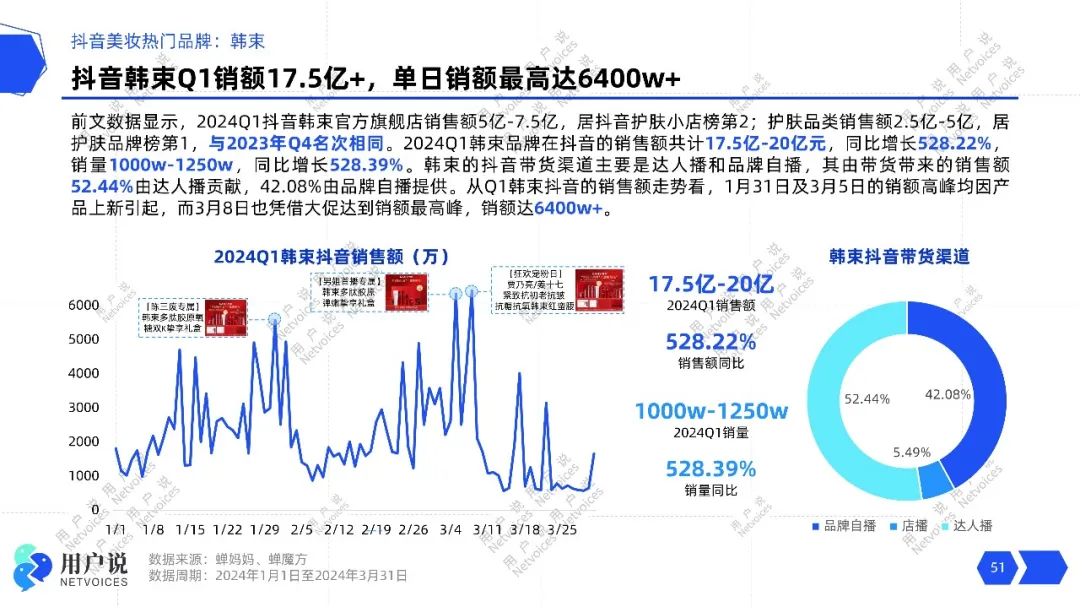

Hanshu Dominates Douyin Skincare

Douyin MakeupBABI、UODOUnlimited Potential

The beauty market on Douyin has always been a volatile and fiercely competitive battlefield, and the recent first-quarter rankings are particularly eye-catching. In the skincare field,Proya, Hanshu and Guyuethree major Brands have launched fierce competition, maintaining5billion and7.5hundreds of millionsin sales volume, demonstrating their respective strengths. However, when we turn our attention to the Brand rankings, Hanshu's performance is truly remarkable. Its astonishing growth rate puts it far ahead of other Brands,sales exceeding17.5billion and20hundreds of millions. Even more striking is that the sales contributed by Hanshu's Brand live broadcast reached2.5billion and5hundreds of millions, which fully demonstrates that Hanshu has a highly loyal fan base and strong Brand influence on the Douyin platform.

In the makeup field, the changes in Douyin's rankings are also eye-catching. AlthoughYSLremains undefeated in the store rankings, some different dark horses have emerged in the Brand rankings.Perfect Diary occupies the first position with a sales volume of2.5billion and5hundreds of millionsmen's care sets also achievedAKFalso performed quite well, ranking third. Among the top ten Brands, sales are basically maintained at1hundreds of millions, while emerging Brands have shown huge potential.BABI、UODO、DPDPand other Brands have won the favor of users with their unique advantages, showing their ability to stand out in fierce competition.

Brand performance on the Douyin platform depends not only onproduct quality and marketing strategiesMore importantly, it is necessary to establish emotional connections and brand trust with users. At present, Douyin, as a vibrant and innovative social shopping platform, provides tremendous development opportunities for brands, while also requiring brands to constantly innovate and adjust their strategies to adapt to changes in consumer demand.

HanshuQ1Sales17.5hundreds of millions+

The growth momentum is fierce, and the growth528.22%

The performance of the Hanshu brand on the Douyin platform is clearly a phenomenal case, demonstrating its leadership in digital marketing and social e-commerce.2024Data from the first quarter of the year further confirms this.Its official flagship store sales are between5billion and7.5hundreds of millions, firmly holding the second place in Douyin's skincare store ranking; while on the skincare brand list, it maintains the first position with2.5billion and5hundreds of millions in sales, demonstrating the stability of its brand influence and market acceptance.

Even more striking is that the Hanshu brand's overall sales in2024the first quarter of the year reached a staggering17.5billion and20hundreds of millions of yuan,a year-on-year increase of528.22%Sales volume even reached1000tens of thousands to1250tens of thousands,The growth rate is also528.39%. This explosive growth not only demonstrates the success of Hanshu's market strategy but also reflects the enormous potential of Douyin as a sales platform.

Specifically, Hanshu's sales channels through Douyin mainly include KOL live streaming and brand self-broadcasting. The video content of KOL live streaming not only increases the brand's visibility but alsoactually converted into52.44%of sales, while brand self-broadcasting provides42.08%of sales contribution. It is particularly noteworthy that Hanshu's sales peaks are often related to new product launches and large-scale promotional activities. For example,1Month31Day and3Month5Day's sales peaks were due to the launch of new products, while3Month8Day's sales peak was due to a large-scale promotional activity, with daily sales exceeding6400tens of thousands of yuan. The success of this strategy not only depends on accurate market insight but alsoreflects the ability to quickly respond to market changes and consumer needs.。

Hanshu's performance in2023year is equally noteworthy, having ranked first in the Douyin channel for several consecutive months inGMVranking, and with33.4hundreds of millions of yuan in annualGMVwon the first place in Douyin e-commerce beauty brand's annual ranking. This consistently leading performance not onlyproves Hanshu's advantages in terms of brand and product, but also demonstrates its influence and operational effectiveness in user operation. The Hanshu brand case provides a valuable reference model for other brands, especially in terms of leveraging social media platforms for brand building and sales growth.

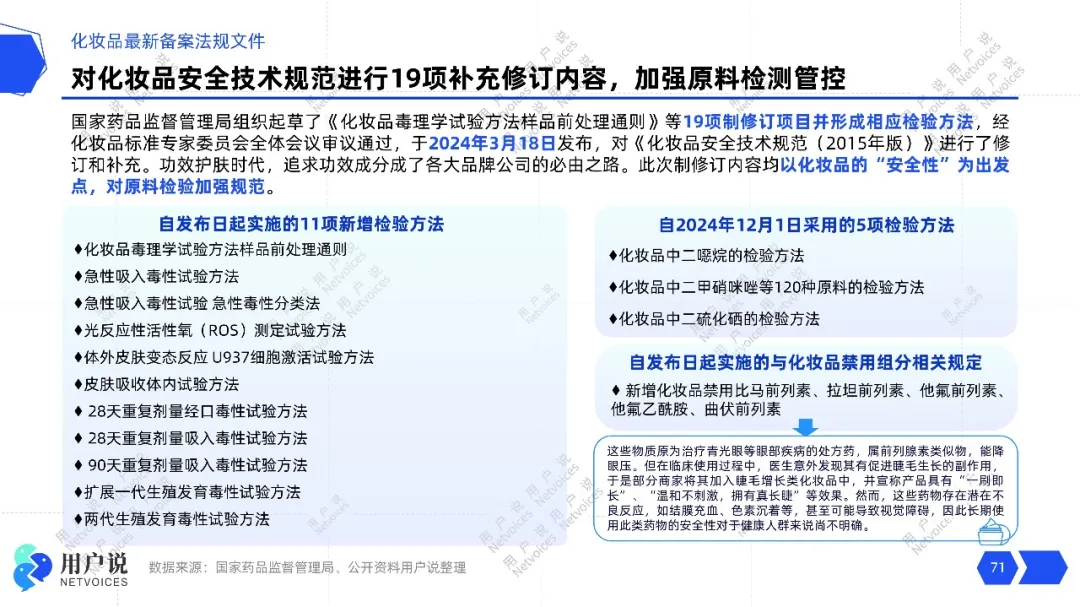

Stricter policies, safety is the starting point.

Filing data increased simultaneously,33%Competition will further intensify.

From market demand to product supply,

Every link will Enter fine and professional management.

In today's cosmetics industry, as consumers' demands for product safety and efficacy continue to increase, the formulation and implementation of relevant policies have become particularly important.2024In the first quarter of the year, the National Medical Products Administration took further stringent measuresand made important updates and improvements to the regulatory framework for the cosmetics industry. This move signifies the government's determination to ensure public health and safety, and also reflects the new trends and challenges in the development of the cosmetics industry.

The National Medical Products Administration organized the drafting and revision of“General Rules for Sample Pretreatment in Toxicological Tests for Cosmetics”and a total of19standards and specifications. These revision and amendment projects were deliberated and passed at the plenary meeting and officially released on2024year3Month18Day. These updates not only revised and supplemented the “Cosmetics Safety Technical Specification (2015year version)”, but also strengthened the testing standards for cosmetic raw materials, ensuring that all cosmetic raw materials undergo strict safety assessments before use.

The implementation of this policy is based on a highly responsible attitude towards consumer health, and it also reflects the regulatory department's continuous promotion of industry safety standards. This change in the policy environment also requires enterprises to increase investment in research and development, especially in safety testing and product verification. Only those enterprises that can ensure product safety while innovating and meeting consumer needs can stand out in the fiercely competitive market.

Therefore, from policy making to enterprise implementation, from market demand to product supply, every link in the cosmetics industry needs more refined and professional management.

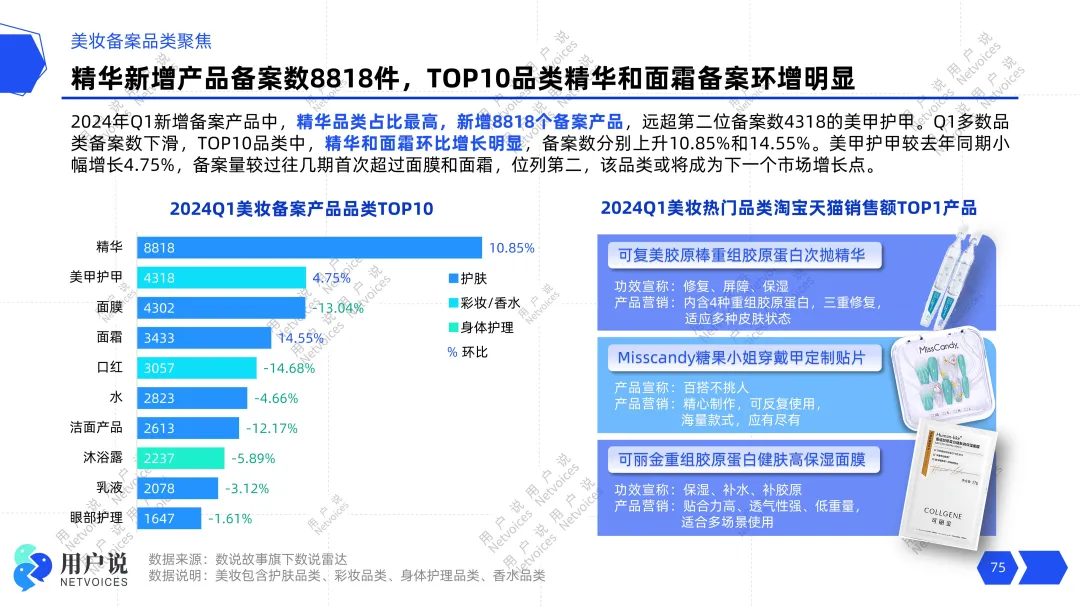

Makeup registration increased.11%

Essence, nail art and nail care grew rapidly.

The filing data of the cosmetics industry reveals a series of interesting trends and changes. Compared with the same period last year,2024the number of filings in the first quarter of the year increased overall, especially the number of makeup filings increased by11.67%。This growth shows the continued demand for makeup products among consumers, and may reflect people's pursuit of beauty and personalized makeup.

It is worth noting that the number of skincare and makeup registrations showed a significant decline in the fourth quarter of last year compared to the previous year. This may be due to the influence of some management regulations, leading to more cautious registration by enterprises. However, with the objective laws of the market and the continuous existence of consumer demand,Cosmetic product registration numbers are expected to rise again in the second quarter.This trend shows that despite stricter regulations, market demand for cosmetics remains strong, and businesses are actively responding to market challenges while proceeding cautiously with registrations.

Among the newly registered products,essences account for the highest proportion,reflecting consumers' emphasis on skincare and their pursuit of high-efficiency skincare products. The fact that nail and nail care products are among the fastest-growing categories in terms of registration numbers also reflects the increasingly important position of nail culture in the minds of consumers. Furthermore, while registration numbers are declining overall, those for skincare products such as essences and creams have increased, possibly due to consumers' focus on and pursuit of skincare efficacy.

Although the increase in registrations for nail and nail care products is relatively small, this category is expected to become the next market growth point.This trend deserves close attention from both industry insiders and outsiders because, as nail culture becomes more widespread and consumers pursue personalized manicures, the potential of this category may gradually be unleashed.

In general, changes in cosmetic registration data reflect a complex interplay of market demand, regulations, and consumer trends.In such a volatile environment, businesses need to keenly capture market dynamics, flexibly adjust product strategies to adapt to changing consumer demands, and closely monitor changes in regulatory policies to ensure that products comply with regulations before being launched.Only in this way can they remain invincible in the face of fierce market competition and provide consumers with higher-quality and safer cosmetic products.

《2024First Quarter Beauty Market Review》This report uses a large amount of intuitive data as a basis to conduct an in-depth analysis of the performance of major e-commerce platforms in the beauty market, revealing their shortcomings and advantages. At the same time, the report also covers the supply and demand trends of multiple beauty product categories, comprehensively presenting the current landscape of the beauty industry from various perspectives. Through an in-depth interpretation of registration data, this report further understands the registration status and growth trends of different categories, thus gaining insight into market development trends. In addition, it focuses on several high-growth Brand marketing cases, hoping that this report will provide everyone with a window into a deep understanding of the beauty industry.