Q1 Down 12%? Sun protection and perfume surge 200%+ | 2023 Q1 Skincare and Makeup Review

Category:

Keyword

language analysis information

Weight

Stock surplus

10000

隐藏域元素占位

- 详情概述

-

- Commodity name: Q1 Down 12%? Sun protection and perfume surge 200%+ | 2023 Q1 Skincare and Makeup Review

Overview

Total word count:5630words

Reading time:8-10minutes

1.The transaction volume of the beauty market on Alibaba and JD.com e-commerce platforms is as high as613.3hundreds of millions of yuan, a month-on-month decrease of40.47%。

2.The makeup market is still affected by the shadow of the epidemic and the economy, and its consumer demand is far lower than that of the skin care market.

3. 「49-109」yuan mid-range price is the mainstream price range in the skin care market, and market involution may drive skin care products tothe lower-mid price rangeshift.

4.The consumption frequency and scenario of sunscreen have increased,and the scale of the sunscreen market is continuously expanding and penetrating.

5.The content scene and consumption scene of Douyin are integrated, providing convenient conditions for traffic monetization.

6.Q1A total of beauty makeup planting notes were published on the Xiaohongshu platform60.16ten thousandarticles, with a daily peak of1.02ten thousand。

Capital's sense of smell is extremely keen, and the beauty track is even more concentrated in the involution of capital.2023Since the first quarter of the year, many capitals and international giants have been adding to beauty Brands, such as Estée Lauder Group acquiring a minority stake in the British perfume BrandVyrao,L'Oréal acquired the high-end beauty Brand25.3hundreds of millions of yuanAesop,and the domestic aromatherapy functional skin care Brand Fuyu Manpu announced the completion of tens of millions of angel round financing.

According to industry data statistics, only in2023year3month, the beauty industry has already had more than15financing and investment transactions, with a total financing amount exceeding10hundreds of millions of yuan。It can be seen that the consumer demand for beauty products has never shown a large gap, and the industry capital and market still maintain high expectations and high expectations for the beauty industry.

In order to timely grasp the changes in the industry and seize the opportunities in the beauty market, Usersay launched《2023First Quarter Beauty Market Review of the Year》,analyzing the industry trends of the beauty market from the dimensions of market data, category insights, social media performance, and marketing cases, and showing in multiple waysQ1new social media marketing methods in the beauty track, and deeply reviewing the differentiated competitive advantages of explosive products in the market.

Full report74pages

Original Price¥2999

(Contact customer service at the end of the article to receive coupons)

The beauty market is recovering,

cosmetics3month's total retail sales increased by9.6%

01

Usersay

Beauty market size613.3hundreds of millions of yuan,

year-on-year decrease of12.09%

According to the publicly released data from the National Bureau of Statistics,2023year1-3months, the total retail sales of cosmetics were1043hundreds of millions of yuan, a year-on-year increase of5.9%,among them3month, the total retail sales of cosmetics reached393hundreds of millions of yuanyuan, a year-on-year increase of9.6%,The signs of recovery are very obvious.

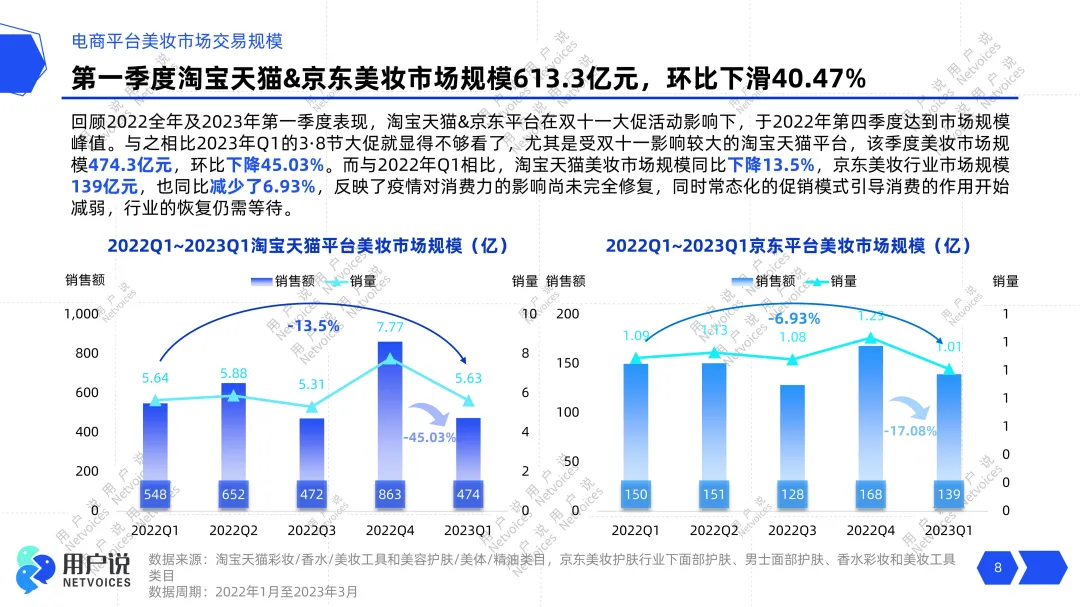

But2023in the first quarter of the year, the beauty market, mainly skin care and makeup, showed a significant decline on e-commerce platforms.According to Usersay statistics, the transaction volume of the beauty market on Alibaba and JD.com e-commerce platforms is as high as613.3hundreds of millions of yuan, a year-on-year decrease of12.09%。

The decline on Alibaba platform is particularly significant,2023yearQ1the scale of the Taobao Tmall beauty market is only474.3hundreds of millions of yuan,a month-on-month decrease of45.03%,a year-on-year decrease of13.5%。From2022Q1-2023Q1time axis, benefiting from the Double Eleven promotion Brand“fight”,Q4the sales of the beauty market reached863hundreds of millions of yuan, a month-on-month increase of nearly83%,reaching the peak level.

In addition, the Double Eleven promotion from1days was extended to one month, the entire timeline was infinitely extended, and consumers showed a certain degree of consumption fatigue, which continued to affect2023yearQ1。

Further Reading

Therefore, even with major promotional events such as the New Year's Festival and Women's Day in the first quarter, it was still difficult to stimulate market momentum. This also reflects to some extent that the role of regular promotional models in driving consumption is beginning to weaken, the impact of the epidemic on consumption still needs to be repaired, and the beauty industry market needs to unleash new vitality.

02

Usersay

SkincareGMVSoaring,

Makeup category increased then decreased

From the perspective of subcategories,2023Skincare category on Alibaba and JD.com in the first quarter of the yearGMVachieved steady month-on-month growth, and both3month to reach the peak of achievements. According to User Say data monitoring,2023yearQ1Alibaba platform skincare category achieved a total of322.22100 million yuanin achievements, three times that of the JD.com platform. In3month,GMVas high as142.29100 million yuan.

It is not difficult to see that the skincare category still controls the main pulse of the beauty market,GMVThe month-on-month increase also releases a positive market signal. It is believed that with the increase in demand for seasonal changes in spring and summer, the skincare category may maintain a sustained upward development trend in the second quarter.

Unlike the skincare category, makeup showed a trend of increasing and then decreasing in the market size of Alibaba and JD.com platforms, both3month experiencing a slight decline to varying degrees.

In addition, User Say found that in the first quarter, many makeup brands failed to withstand the cold winter and began to close stores, remove counters, and withdraw from target markets, such as RevlonRevlon issued a notice of closure, stating that it would cease its independent operations on the Tmall channel from March 15th; the American affordable makeup brand e.l.f. stated that it would temporarily leave the Chinese market, removing all its products from platforms such as Tmall and Douyin; and the domestic new brand HEDONE also stated that it would cease operations on the JD.com platform in the near future.

It can be seen intuitively that the current consumer demand for makeup still has a certain degree of instability, and the makeup market is still affected by the epidemic and the economic downturn, and its consumer demand is far lower than the skincare market.

03

Usersay

Skincare average transaction price has fallen,

Makeup consumption downgrades

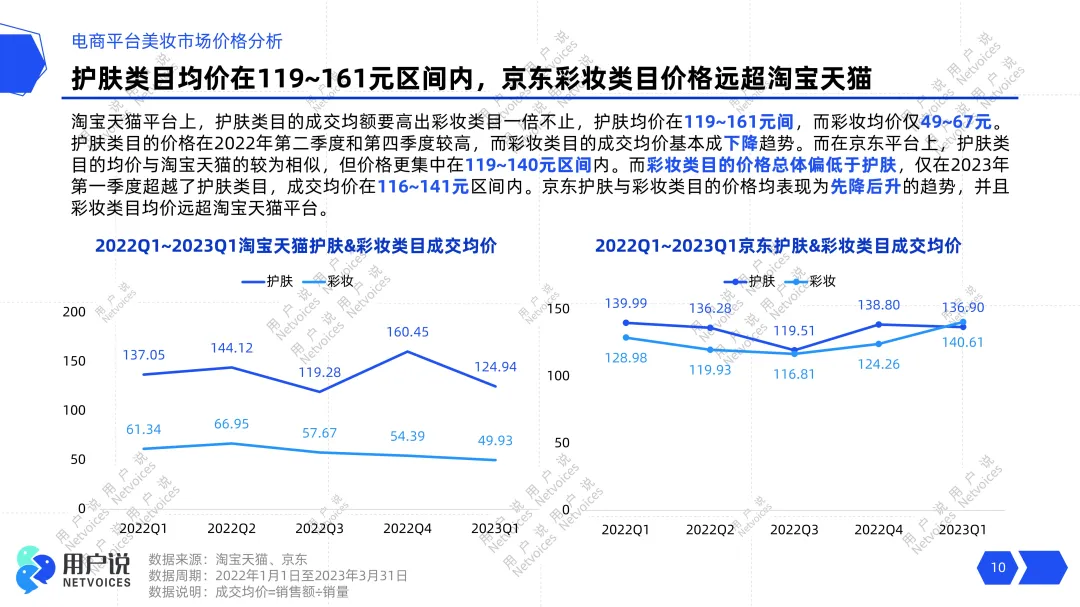

The sales of skincare far exceed those of makeup, which is inseparable from the influence of the high unit price of skincare products. According to data monitoring,2023In the first quarter of the year, the average price of skincare products on the Alibaba platform was between「119-161」yuan, while the unit price of makeup was only「49-67」yuan.

From a horizontal perspective, it can be seen intuitively that the average transaction price of the skincare category is significantly higher than that of makeup. But from a vertical perspective, compared to2022yearQ4,skincare categoryQ1overall average transaction pricedecreased by nearly35yuan,the decline is obvious.

Further Reading

Q3SkincareGMVdecline44%!“Trial size”Become a wealth password? Ouzhiman dominates Douyin |2022Q3Skincare Review

The reasons for this are, firstly, that the year-end promotion has left many consumers“financially drained”,Q1becoming a period of consumer shopping calm, and brands and merchants have to make appropriate price reductions to stimulate consumer demand. On the other hand, the first quarter coincides with the change of seasons at the beginning of the year, and many brands launch new series and new products while adjusting the prices of some slow-moving products to clear inventory.

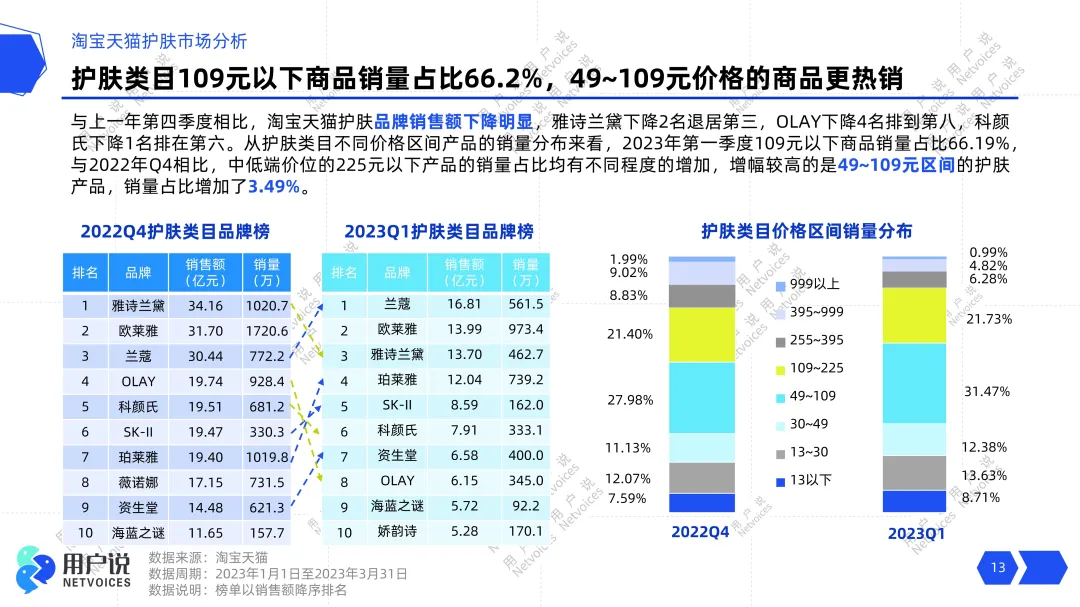

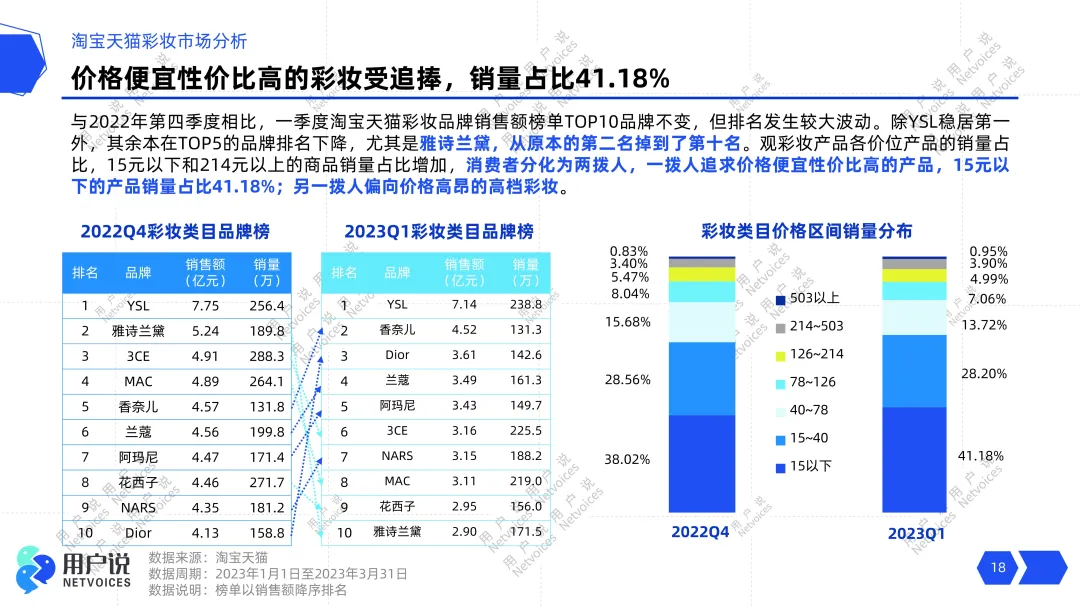

From a sales perspective,2023Q1Skincare category109Products under yuan account for as much as66.2%,among which products in the "49-109yuan range account for31.47%of the total market,2022yearQ4,an increase of nearly3.49%,which is currently the most concentrated and fastest-growing price segment in the skincare category.

It can be seen that the mid-range price, mainly around49-109yuan, is the mainstream price range of the current skincare market, and market competition may continue to push skincare products towards the mid-to-low price range.

On the other hand, in the makeup market, due to the short life cycle of makeup, strong substitutability, and its non-essential nature, consumers will tend to downgrade their consumption when choosing makeup, that is, to obtain products at a low price to meet their current makeup needs.

Further Reading

Two consecutive quarters of decline? Surge in perfume and nail art? Huaxizi dominates Douyin |2022Q3Makeup Review

From the tracked data, we can see that40Products under yuan account for as much as69.38%of makeup sales, with more than 40% of makeup products having an average transaction price of only15Under a certain price point, mainly concentrated in eyebrow pencils, eyeliners, powder puffs, and other products.

In addition, surprisingly,2023yearQ1Makeup Category214Products above a certain price point have seen a certain increase in sales, which means that high-end makeup is still attractive to seasoned makeup users, with high product consumer loyalty and easy repeat purchases.

Unstable Market

How can different categories leverage the market?

Under the condition of an unstable beauty market,2023yearQ1Only9sub-categories in the skincare sector have achieved positive growth, among which body cleansing and hand care sales have increased by more than10%year-on-year. Although the growth rate is the most significant, its sales share is low, belonging to a typical low-penetration, high-growth category.

On the makeup side, sub-categories such as facial makeup, lip makeup, perfume, beauty tools, and eye makeup account for nearly 90% of the entire makeup market's achievements, among which facial makeup, although its market share has declined slightly month-on-month, still51100 million yuanmaintains the top spot in the makeup category sales rankings with a large advantage.

It is worth noting that the sales volume of perfume products increased by226.61%year-on-year, with astonishing growth. Driven by the surge in summer fragrance demand, the perfume category may usher in a new growth point.

01

Usersay

Sunscreen2monthly sales growth212%,

Is skincare-grade sunscreen with black technology becoming a trend?

With the continuous advancement of blogger education and market education, the consumption frequency and scenario-based use of sunscreen have increased, and the market size of sunscreen is continuously expanding and penetrating.2023yearQ1Sunscreen sales have increased month by month, among which2monthly sales increased by211.97%month-on-month. It is believed that as summer approaches, the market demand for sunscreen products will continue to rise.

Further Reading

Sunscreen Popularity Soars129%? Sales Increase38%? Hard-core Technology Protection |2023Sunscreen Report

2023yearQ1,50-100yuan sunscreen products are the hottest sellers, with sales of500,000+units ofMistineLittle Yellow Hat Sunscreen,300,000+units of Yiyang Sunscreen, and120,000+units of Youyi Sunscreen are all concentrated in this price range.

In addition to the above best-selling products, many sunscreen products with built-in black technology have emerged in the first quarter of the sunscreen market, such as Zhan Yan usingnanometer-level physical sunscreen technologyto launch a pure physical sunscreen product for sensitive skin, Proya using“high-factor sunscreen+light protectionboosterto achieve skincare-grade sun protection through its proprietary sunscreen system, and Xiaomohu using sunscreen black technologyUvinulTinosorb-STRto achieve a combination of physical and chemical sunscreens, providing younger skin with more protective products.

In the increasingly competitive sunscreen sector, the single function of sun protection alone can no longer meet the advanced consumer needs of consumers. Anti-photoaging, skin-friendly and nourishing, and full-spectrum sun protection are becoming increasingly important as differentiated advantages and best-selling selling points for sunscreen products, and black technology sunscreen will become a market trend.

02

Usersay

Setting Spray Sales Increased by73.89%,

Average Order Value will fall below50?

With summer approaching, in addition to sunscreen products receiving much attention from the market, consumers' demand for setting products has also increased dramatically. According to data, the number of effective registered setting sprays has increased from2017in11to2022in423items, maintaining a steady growth trend.

2023yearQ1Taobao Tmall setting sprays contributed1.37achievements, with a total of252.11units sold, and sales increased year-on-year by73.89%. In addition, user feedback tracking data shows that2023yearQ1the average transaction price of setting sprays continues to decline, and3the average order value in the month almost fell below50yuanbecoming the lowest value in the past year. It can be clearly seen that the price range of setting sprays has shifted downward, to a certain extent activating the vitality of the market and promoting the upward development of the category market.

From the perspective of Brands,2023yearQ1setting spray achievementsTOP10five Chinese Brands accounted for, namely PURERAY,KATO-KATO,Focallure, Colorkey, andCOLORKEY. Among them, PURERAY ranked fourth with1051.4achievements, belonging to the first echelon together withURBAN DECAY,Make Up For Ever, and shu uemura.

Further Reading

Stay put, don't come off|2019Top Ten Setting Spray Brand Value Analysis Report

As a best-selling brand of setting spray, ranking fourth in sales revenue and first in sales volume, Boreme's backstage moisturizing setting spray uses the brand's research and development lab's water-moisturizing and lustrous film-forming technology and a micro-pressure pump head design with micron-level apertures. This allows for long-lasting makeup and creates a makeup effect that prevents smudging, effectively targeting pain points such as makeup removal and caking.

Increase in Douyin live broadcast sessions,

Beauty instrument brands have a significant competitive advantage

01

Usersay

Related live broadcast120tens of thousands of sessions,

Douyin becomes a traffic pool for the beauty track

“It is only a matter of time before international high-end brands enter Douyin e-commerce, just like the previous entry into Tmall and JD.com.”

——Li Fuping, founder of the start-up brand Puyang

As one of the fastest monetizing platforms currently, Douyin has become an important battleground for many beauty brands to compete for.2023yearQ1DouyinMakeup category related live broadcast50.76tens of thousands of sessions, skincare category related live broadcast reached75.87tens of thousands of sessions, diversified live streaming has accelerated the rapid development of Douyin's beauty market. Many start-up brands have achieved traffic high points through self-broadcasting, store broadcasting,+and key opinion leader broadcasting.

For e-commerce platforms, major promotional shopping nodes are often the core elements that can activate market vitality and bring positive impetus to the market.2023yearQ1There are mainly two major promotional events in the Douyin market, namely1the New Year's Goods Festival at the beginning of the month and3the Good Things Festival at the beginning of the month, among which3Month8Day related live broadcast number reached19604sessions, reaching the peak of the first quarter.

According to data released by Douyin,Douyin's total number of users has exceeded9100 million, with daily active users reaching7hundreds of millions of yuan. In other words, at least7100 million users are watching short videos at different times every day. Douyin's content scenarios are often integrated with consumption scenarios, which to some extent provides conditions for traffic monetization.

02

Usersay

Young people are targeting makeup,

Older consumers value skincare

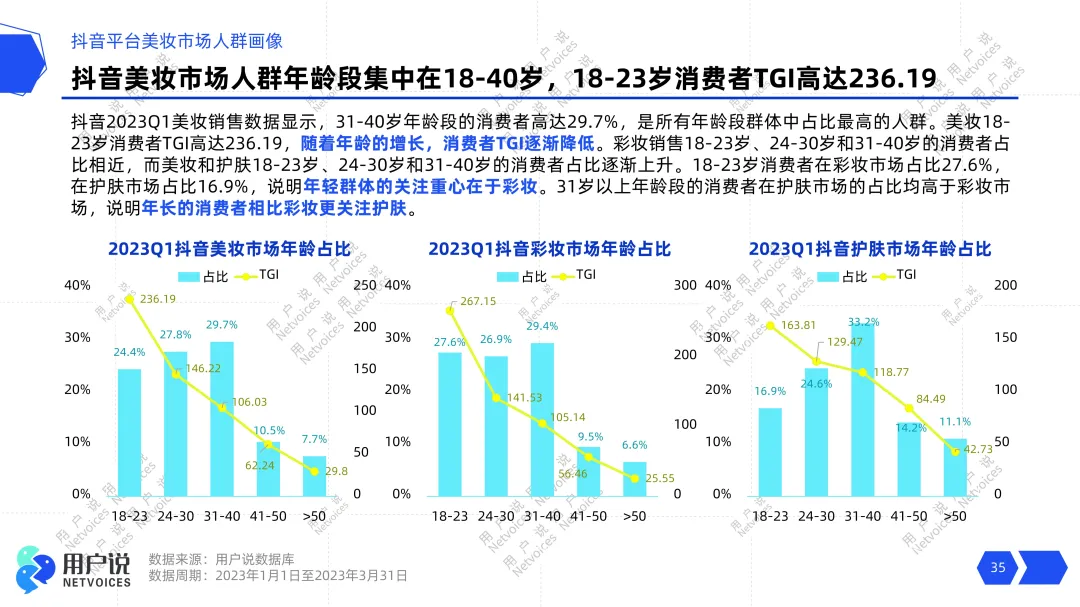

2023Q1Douyin's beauty sales data shows that31-40year-old users are the main force of beauty users. As the core user group of Douyin, users in this age group have sufficient economic strength and time cost, and are easily able to convert from content scenarios to consumption scenarios.

While18-23year-old users have a low sales data share, theirTGIindex is as high as236.19, showing a great market preference, indicating that the Douyin platform has become a core traffic pool for many young users' attention to beauty products.

From the perspective of the segmented market,18-30year-old users account for54.5%of the makeup market, while in the skincare market, the proportion decreased to41.5%, it can be clearly seen that on the Douyin platform, young consumers focus more on the makeup category, while slightly older users prefer to focus on skincare products.

03

Usersay

Yamen beauty instrument daily sales4000w+,

Shop3Month promoted to the top of the sales list

On the Douyin platform, the threshold for beauty brands to enter is relatively low, and how to stand out among a large number of brands has become one of the difficulties for many brands.

For international brands, the brand and products themselves already have a certain degree of popularity, so these brands will mainly promote and attract new customers from the dimensions of new products and limited editions.

For domestic products, especially emerging brands, it is more necessary to continuously cultivate and plant grass through this large Douyin traffic pool to achieve the purpose of breaking through the circle.

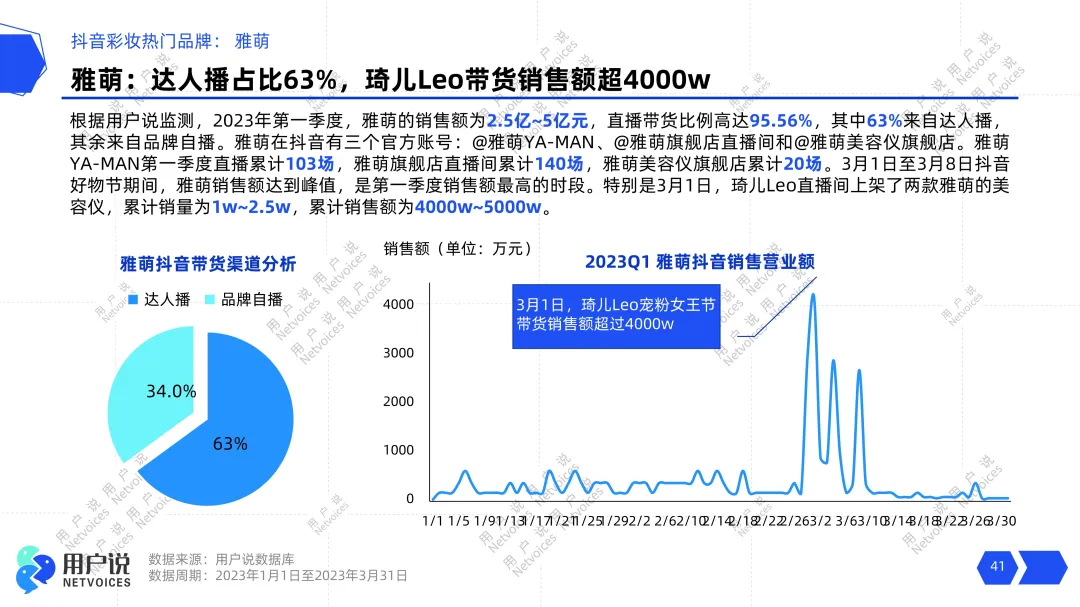

Users said that through data monitoring, it was found that2023yearQ1the beauty instrument brands have a clear advantage in the Douyin makeup industry,3Monthly salesTOP10BrandsYamen, Jimo, MiguangAMIROare all beauty instrument brands. Among them, Yamen's Douyin store——Yamen's official flagship store has leapt to the top of the Douyin makeup small store list in3month with sales exceeding 100 million.

According to industry forecasts,2020year to2025year, the growth rate of household beauty instruments may reach20%,2026The market size is expected to exceed200100 million yuan. It can be seen that under the multiple influences of beauty needs and market marketing, beauty instruments are increasingly becoming“essential”products, becoming a category that many brands are adding to and betting on.

Further Reading

Currently, in the home beauty instrument market, on the one hand, professional imported beauty instrument brands such as Ya-man andReFastill occupy a dominant position in the market. On the other hand, domestic beauty instruments are following the trend, with emerging domestic brands such as Miguang andAMIRO、BIOLABconstantly leveraging new engines for the category market.

Ya-man, as a professional brand in the field of home beauty instruments, is the first to propose the concept of「Hospital-Home full-cycle high-efficiency anti-aging」concept of beauty instrument Brand, and is currently the leading brand in the beauty instrument sector.

On the Douyin platform, Ya-man's first-quarter sales were2.5hundreds of millions of yuan-5100 million yuan, with live streaming contributing95.56%of sales. Like most brands, Ya-man also uses a combination of self-broadcasting and+key opinion leader broadcasting, building an account matrix.

From the sales trend on Douyin,3the Douyin Good Things Festival at the beginning of the month activated Ya-man's Douyin market vitality, and sales reached a peak level. Among them,3Month1Qi'erLeocontributed sales of4000w-5000w,accounting for approximately15%。

of the total first-quarter sales. It can be seen that Ya-man has increased brand exposure through high-quality anchors, and has consolidated user mentality in a multi-dimensional and multi-coverage way to achieve traffic monetization. It has now become a relatively mature beauty Brand on the Douyin channel.

Beauty notes traffic continues to rise,

square and round faces become the new focus

01

Usersay

grass planting notes600,000+,

high interaction volume of video notes

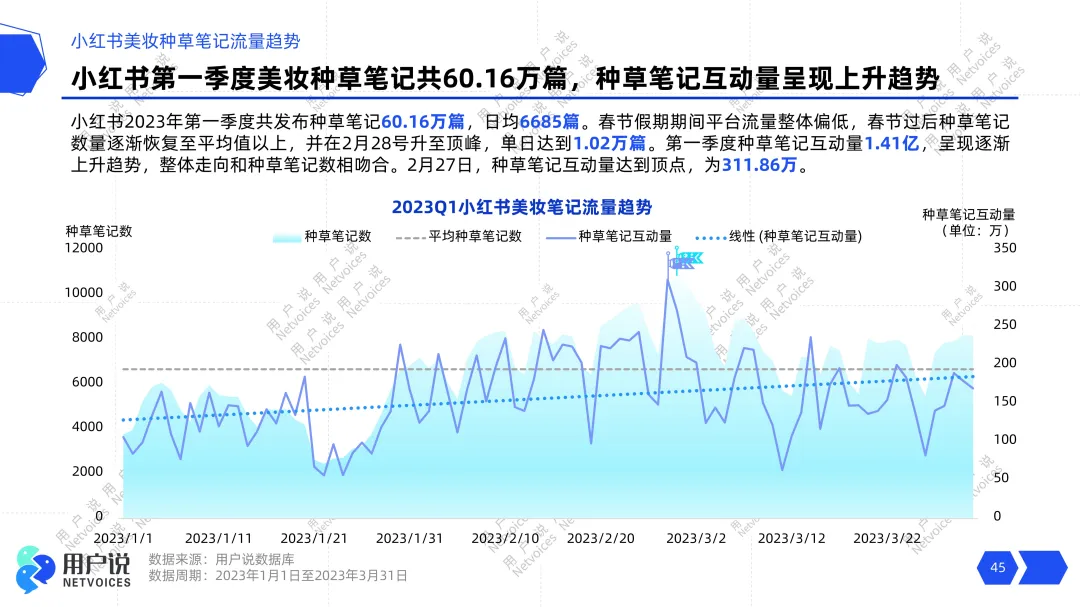

As another traffic pool in the beauty market, the Xiaohongshu platform2023yearQ1has published a total of beauty grass-planting notes60.16ten thousand articles,daily average6685ten thousandarticles, with a daily peak of1.02articles. In addition, the trend of interaction volume of grass-planting notes is basically consistent with the number of notes, and the highest daily interaction volume can reach311.86ten thousand. It can be seen that Xiaohongshu, as the most mainstream social media platform at present, is the main position for many users to obtain, exchange, and share beauty information.

From the content form, the interaction volume of Xiaohongshu video notes is better than that of graphic notes. In the early days, graphic notes were the mainstream form of Xiaohongshu, but with the continuous popularity of short videos, the content expressed in graphic notes has gradually been replaced by short videos. Although2023yearQ1the proportion of graphic notes in Xiaohongshu beauty grass-planting notes is high, the interaction volume is far lower than that of video notes.

It can be seen that compared with video notes, consumers are obviously less enthusiastic about graphic notes, and single pictures and texts can no longer capture consumers' attention,KOLandKOCIt is also difficult to realize traffic monetization through graphic notes. In the future, diversified video notes may become the mainstream.

02

Usersay

Face shape becomes a concern for beauty users,

square and round faces enter the hot topic list

Xiaohongshu, as a huge traffic pool, gathers diverse beauty content, breaking the boundaries of circles and aesthetics.Q1Xiaohongshu beauty topics are mainly about makeup sharing and beauty, and the core topics include“Today's makeup”、“Daily makeup check-in”、“I'm good at becoming beautiful”etc., among which13.66ten thousand peopleparticipated in the discussion of the“makeup”topic,“My Lipstick Diary”topic has added nearly87.91100 millionviews.

In addition, users said that they found that in the first quarter,“Guotai Min'an face”became popular again because of the Spring Festival Gala, which drove the voice of related topics such as square and round faces. The square and round face topic performed well inQ1outstanding performance, with the number of related topic notes reaching21149articles, and the interaction volume is almost1527.6ten thousand。

It can be seen that with the advancement of the subdivision and diversification of beauty, consumers have broken away from the single aesthetic trap and are pursuing more diversified beauty aesthetic needs.

The user said that the launch of《2023First Quarter Beauty Market Review of the Year》will conduct an in-depth analysis of the industry data and explosive product analysis of the beauty market in the first quarter, and reviewOLAYand Proya's marketing cases of leading Brands.