Over 170 billion yuan in sales on Tmall, JD.com, and Douyin in the first half of the year! Douyin sees 60% growth! Beauty devices surge | 2023 H1 beauty industry review

Category:

Keyword

language analysis information

Weight

Stock surplus

10000

隐藏域元素占位

- 详情概述

-

- Commodity name: Over 170 billion yuan in sales on Tmall, JD.com, and Douyin in the first half of the year! Douyin sees 60% growth! Beauty devices surge | 2023 H1 beauty industry review

Recently, the release of the National Bureau of Statistics' data for the first half of the year served as a shot of confidence. With the economy and society returning to normal operation, macroeconomic policies have taken effect, market demand has gradually recovered, production and supply have continued to increase, employment and prices have remained generally stable, residents' income has steadily increased, the national economy has rebounded and improved, and high-quality development has steadily advanced. In the first half of this year, China's cosmetics retail sales reachedthe highest value in the past decade, exceeding2000yuan,Cosmetics retail outperformed the overall social consumer goods retail market. The cosmetics industry has emerged from its darkest hour and has regained its growth momentum.

According to industry data statistics,2023In the first half of the year, there were a total of global beauty financing transactions.81financing transactions in the domestic beauty market,34investment and financing events,Among them, the proportion of investment and financing events exceeding 100 million yuan is20.6%。In the first half of this year, domestic companies paid more attention to upstream suppliers./service providers and medical beauty, accounting for25.93%and12.35%。Recently, the domestic sustainable and pure makeup Brand“RED CHAMBERZhuzhan”completed tens of millions of yuan in financing, led by Xinyi Capital, followed by Shuiyang Shares, and continued follow-up investment from the original shareholder Puman Venture Capital.

Driven by online multi-channel promotion, policy support, more rational consumption concepts, and clearer consumer needs, the beauty industry is steadily moving forward. In order to timely grasp the changes in the industry and explore the development trends of various categories in the beauty market, Usersay launched《2023First Half of the Year Beauty Market Review》,analyzing the industry trends of the beauty market from various dimensions such as market data, category insights, social media performance, and marketing cases, and showcasing a multi-faceted analysis of the market changes in the beauty industry in the first half of the year, and sensing the direction of the industry.

Full report79pages

Original price¥3999

(Contact customer service at the end of the article to receive a coupon)

GMVover1700billion?

Which is better, Tmall, Douyin, or JD.com?

Cosmetics retail sales hit a new high

The 2023 first-half cosmetics retail report is freshly released. According to data released by the National Bureau of Statistics, in the first half of 2023, among consumer goods,the total retail sales of cosmetics reached207.1 billion yuan, an increase of 8.6% year-on-year。

4year-on-year growth in24.2%,has shown a warming trend in the beauty market, and the subsequent5month6month's year-on-year growth rate slowed down, but6month cosmetics retail sales reached451billion yuan, setting a new high in nearly six years, the beauty industry is trending towards stability and gradual recovery.

Taobao and JD.com saw year-on-year declines, while Douyin grew by60.44%

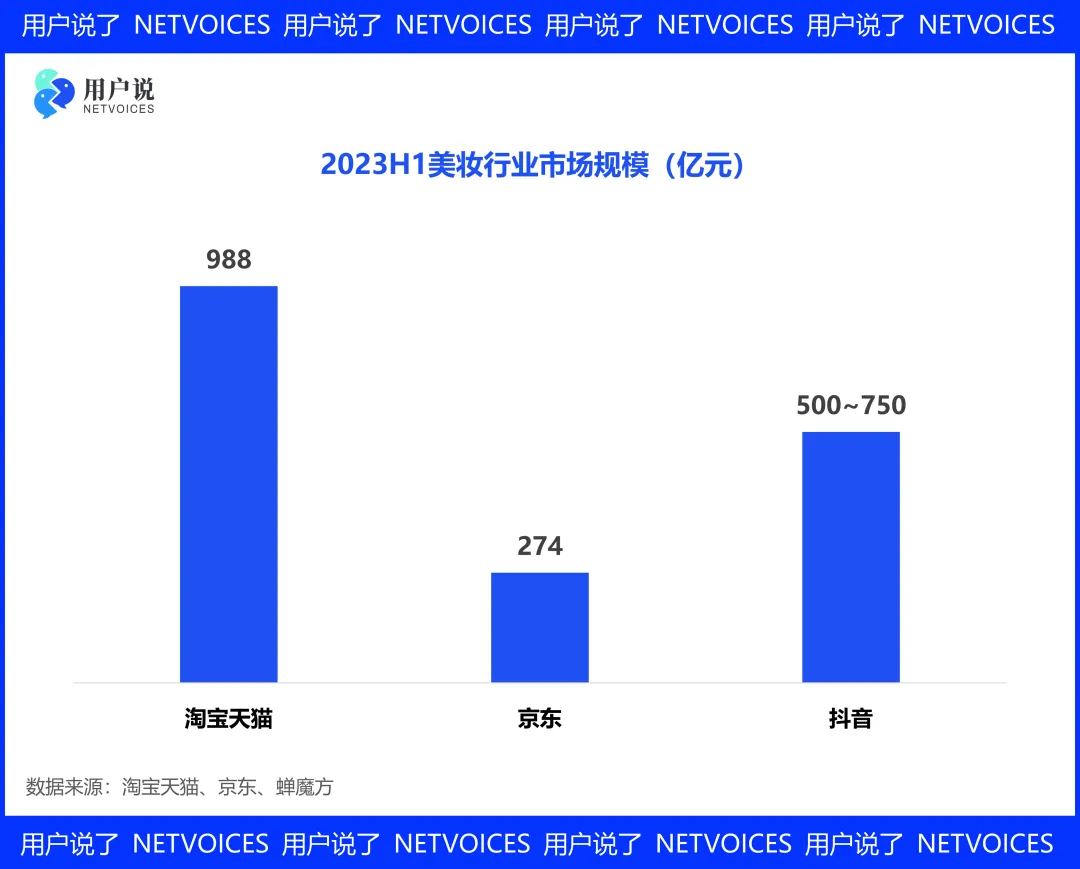

Among online beauty sales channels, Taobao Tmall, JD.com, and Douyin all performed brilliantly.2023In the first half of the year, Taobao Tmall&JD.com&The market size of the beauty industry on the three major platforms of Douyinover1700yuan。Among them, Taobao TmallGMV988billion yuan, DouyinGMVover500billion yuan, JD.comGMV274billion yuan. Taobao Tmall's sales in the first half of the year fell by17.69%,JD.com decreased by8.77%,while Douyin increased by60.44%。Taobao Tmall remains the most important online platform for beauty products, but the rapid growth of Douyin cannot be ignored.

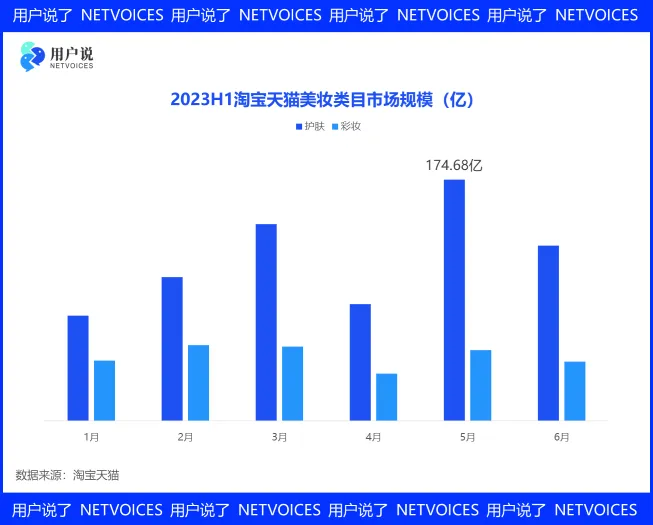

Taobao Tmall platform in the first half of the yearGMV was 98.8 billion yuan, down 17.69% year-on-year, with sales reaching 1.068 billion。Skincare and makeup categories accounted for72% and 28% of Taobao Tmall's beauty market sales, respectively. The skincare category was significantly affected by promotional activities, with sales growth in March and May. Thanks to the 618 promotion, skincare and makeup categories had higher sales in May and June, both reaching their sales peak in May.

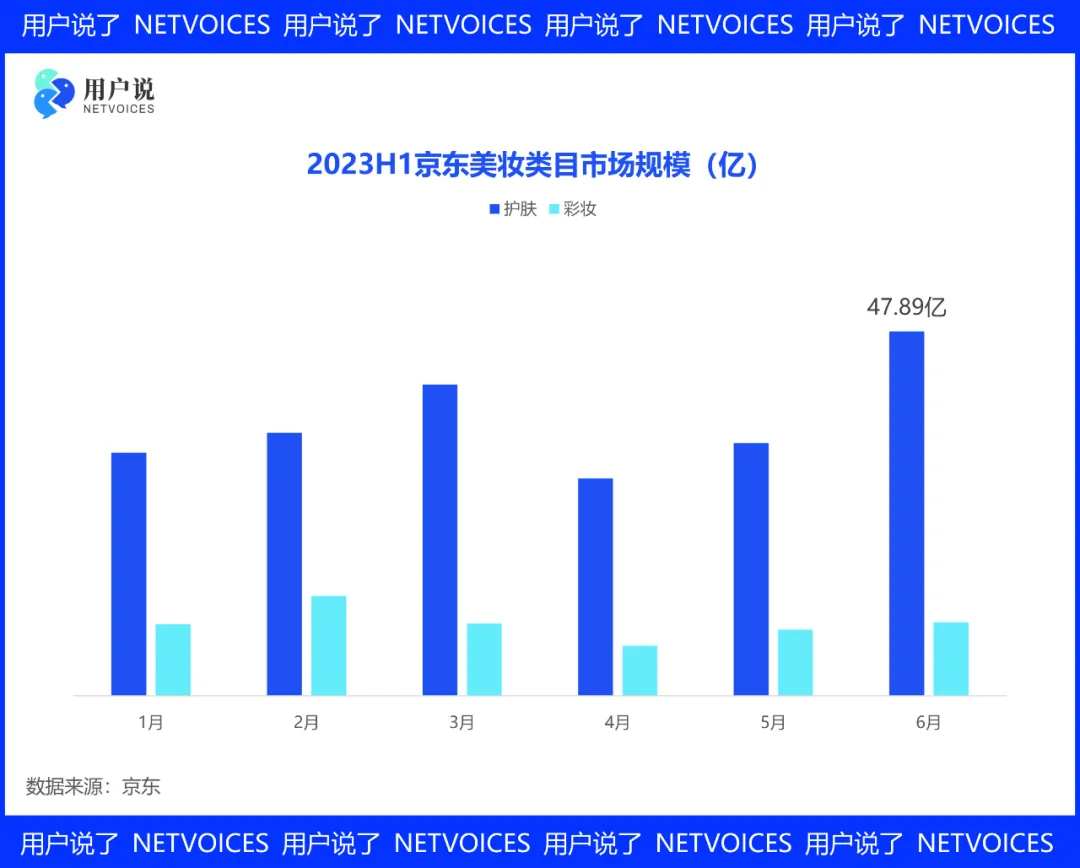

JD.com beautyGMV for27.4 billion yuan,the market size expanded, with skincare products contributing79%. Sales increased gradually in the second quarter, reaching a peak of 4.789 billion yuan in June. Compared to Taobao Tmall's sales peak in May during the 618 pre-sale period, JD.com focused more on efforts in June, but the month-on-month growth rate in June slowed down compared to May.

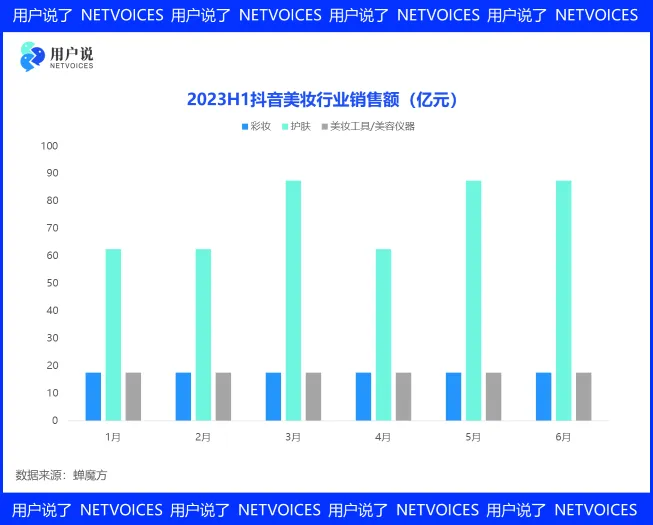

In the first half of the year, the total sales of the beauty market on the Douyin platform were50 to 75 billion yuan, a year-on-year increase of 60.44%。The skincare market inSales increased significantly during the promotional periods in March, May, and June. However, the sales of cosmetics and beauty tools/instruments were not significantly affected by the promotional activities and remained relatively stable.

Douyin Beauty Market Overview84.62% of sales came from live streaming, while product cards surpassed videos with a 10.82% share. In terms of sales channels, key opinion leaders (KOLs) accounted for half of the market, contributing 56.78% of beauty product sales, while Brand self-broadcasting accounted for 28.43%, and store broadcasting accounted for 14.8%.

Further Reading

Tmall makeup remover and face mask sales are showing strong growth,

Big Brands Dominate the Market

Setting products are experiencing rapid growth

Face masks are booming, and makeup remover sales areUP!

2023H1 Sales of Cosmetic Sub-CategoriesTOP5The categories areFacial makeup, lip makeup, beauty tools, and perfume/Perfume and related productsandEye makeup categoryall exceeding30hundreds of millions of yuan, with a combined market share exceeding 90%.Q2Beauty tools sales increased by151.61%。

In the second quarter of facial makeup sub-categories,Loose powder/Loose powder, powder cake, and setting sprayThese three product categories showed the fastest market share growth. The high temperatures in summer easily cause makeup to smudge and skin to produce oil, increasing the demand for setting and long-lasting makeup. Setting products can increase the durability of makeup, maintaining a fresh look for a longer time. In addition, the market share of body makeup also increased quarter-over-quarter by52.26%mostly driven by temporary tattoos.

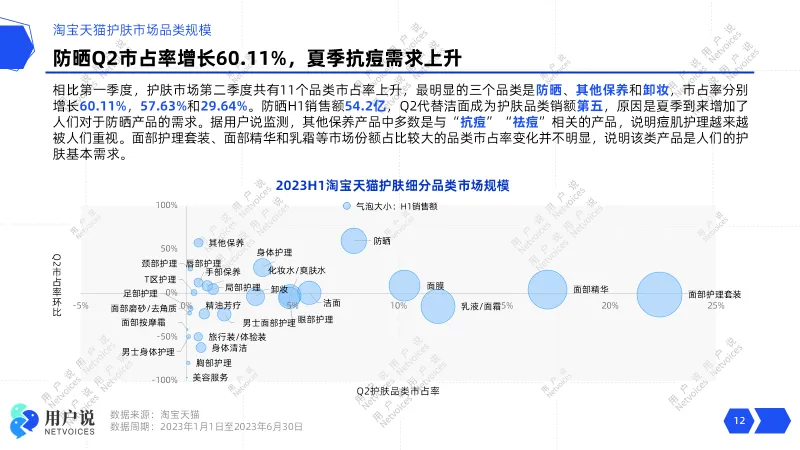

Regarding skincare products, the market size of skincare products on the Taobao and Tmall platformsTOP5areFacial care sets、Facial essence、Lotion/Face cream、Face maskandSunscreen. Facial care sets and facial essenceGMVexceeded 100 billion yuan, respectively at171.7billion yuan and127.1billion yuan. Sunscreen in the first half of the yearGMV47.84billion yuan, andQ2surpassed facial cleanser toTOP5the ranks.

Compared to the first quarter, the skincare market in the second quarter had11categories with increased market share, the three most significant beingSunscreen, other skincare, and makeup removerwith market share growth of60.11%,57.63%and29.64%. In addition, face masks, the fourth largest category in the skincare market, continue to increase their market share, with a quarter-over-quarter growth in market share in the first half of the year of8.66%This significant growth shows face masks are still very popular.

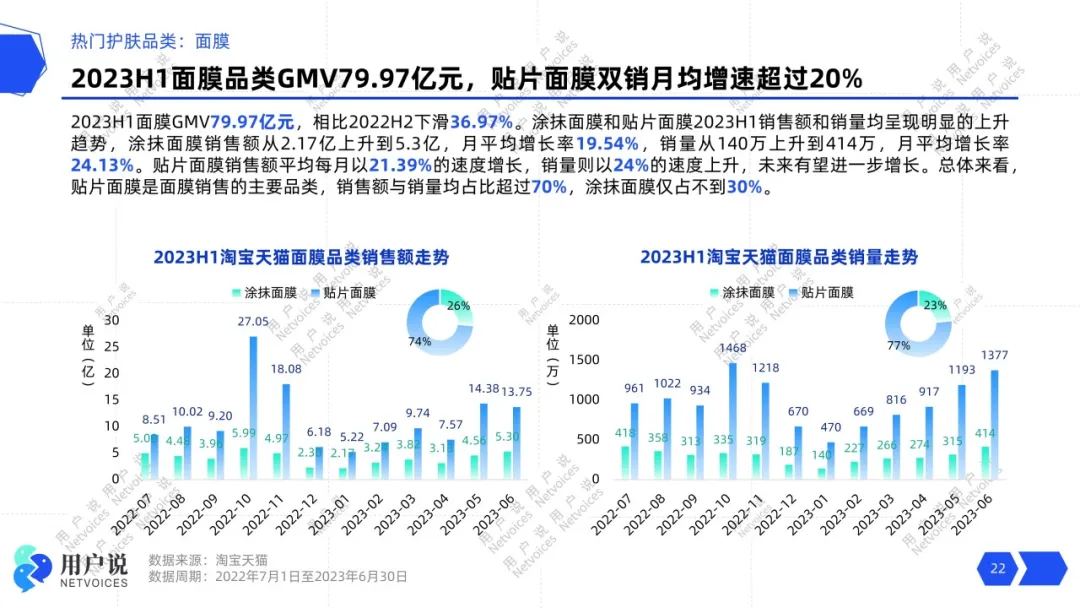

Face Masks: Astonishing Growth, Both Cream and Sheet Masks Increasing

In the first half of 2023, the GMV of face masks on Taobao and Tmall was799.7 million yuan.Both cream masks and sheet masks showed a significant upward trend in sales and volume. Cream mask sales increased from217 million yuan in January to 530 million yuan in June, with a monthly average growth rate of 19.54%, while sales increased from 1.4 million to 4.14 million, with a monthly average growth rate of 24.13%. Sheet mask sales grew at an average monthly rate of 21.39%, while sales increased at a rate of 24%. On the JD.com platform, face mask sales reached 29.65 million units, also demonstrating high market potential.

User Said previously released in conjunction with Nobel, the《2023 Face Mask Trend Insight White Paperanalyzed the growth and development trends of face masks, showing the explosive growth of the face mask category in the Chinese market. The market size of this category has grown from7.87 billion yuan in 2012 to 45.18 billion yuan in 2021, with a compound annual growth rate of nearly 20% over ten years. Furthermore, User Said data estimates that the size of China's face mask market will exceed 72 billion yuan in 2024.

Further Reading

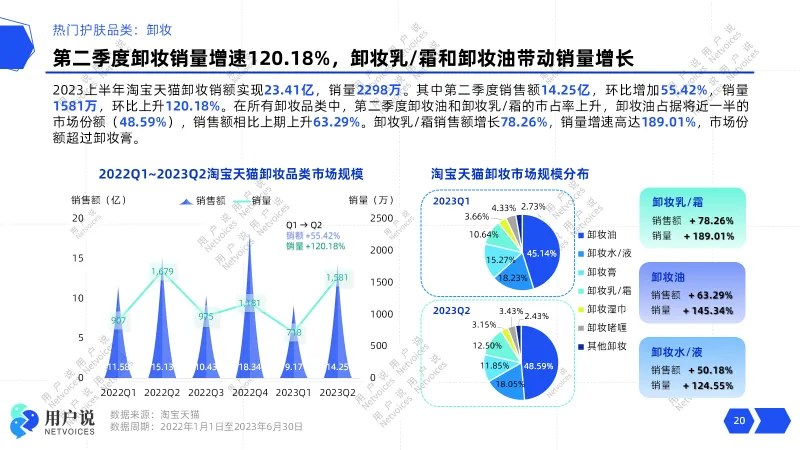

Makeup Remover:Q2Sales increased year-on-year120%with rapid growth in cream-type products

In the first half of 2023, the sales volume of makeup removers on Taobao and Tmall reached 2.341 billion yuan, with sales reaching 22.98 million units. In the second quarter, sales reached 1.425 billion yuan, a quarter-over-quarter increase of 55.42%, and sales reached 15.81 million units, a quarter-over-quarter increase of 120.18%.

Among all makeup remover categories, makeup remover oil and makeup remover creamShuang's market share has increased, with makeup remover oil accounting for nearly half of the market share (48.59%), and sales increased by 63.29% compared to the previous period. Sales of makeup remover creams increased by 78.26%, with sales growth as high as 189.01%, exceeding the market share of makeup remover creams.

In the makeup remover category sales ranking, from the seventh place in the first quarter to the top of the list in the second quarter, its star makeup remover product, Potato MudIce cream makeup remover cream, sold 225,800 pieces in May.

Qichu customized makeup remover cream for different skin types, potato mud texture suitable for various skin types, including sensitive skin, natural fragrance of big red orange, refreshing and oil-free after washing; ice cream texture is specially developed for oily and sensitive oily skin, small cucumber fragrance, oil control and no acne, turmeric leaf extract, coral algae extract and red melon fruit extractTriple plant extract to cleanse and brighten skin, washing away dullness and oil.

Further Reading

Brands fiercely compete, makeupYSLFirmly occupies the first place

From January to June 2023, the top 10 skincare brands sales ranking on Taobao Tmall was strongly occupied by eight brands: Lancôme, Estée Lauder, La Mer, L'Oréal, Proya, Shiseido, Helena Rubinstein, and Olay.

Among them, Lancôme and L'Oréal's sales performance is comparable, and both are competing forTOP1, each occupying the first place in the skincare brand ranking for 3 months in the first half of the year. Proya performed well in March and April, and entered the TOP3 in April. La Mer's performance was unsatisfactory, falling from third place in January and February to sixth place in May, and only rising one place to fifth place in June. 修丽可 entered the list 4 times and hovered on the edge of the list, while Clarins and Mistine made a fleeting appearance in January and April respectively.

From January to June 2023, in the Taobao Tmall makeup brand sales ranking TOP10, except for YSL which has been consistently ranked first, the rankings of other brands have fluctuated frequently, and the competition among brands has been fierce. Chanel performed well in the previous months, but declined significantly in June; Dior and Armani's rankings gradually declined; the domestic brand Flower Knows performed well, with its ranking steadily rising; 卡姿兰 only entered the list in April, ranking ninth.

Douyin beauty instrument growth rate204%,

Jimo,NOWMISoaring6000%+

Major categories sales increased year-on-year

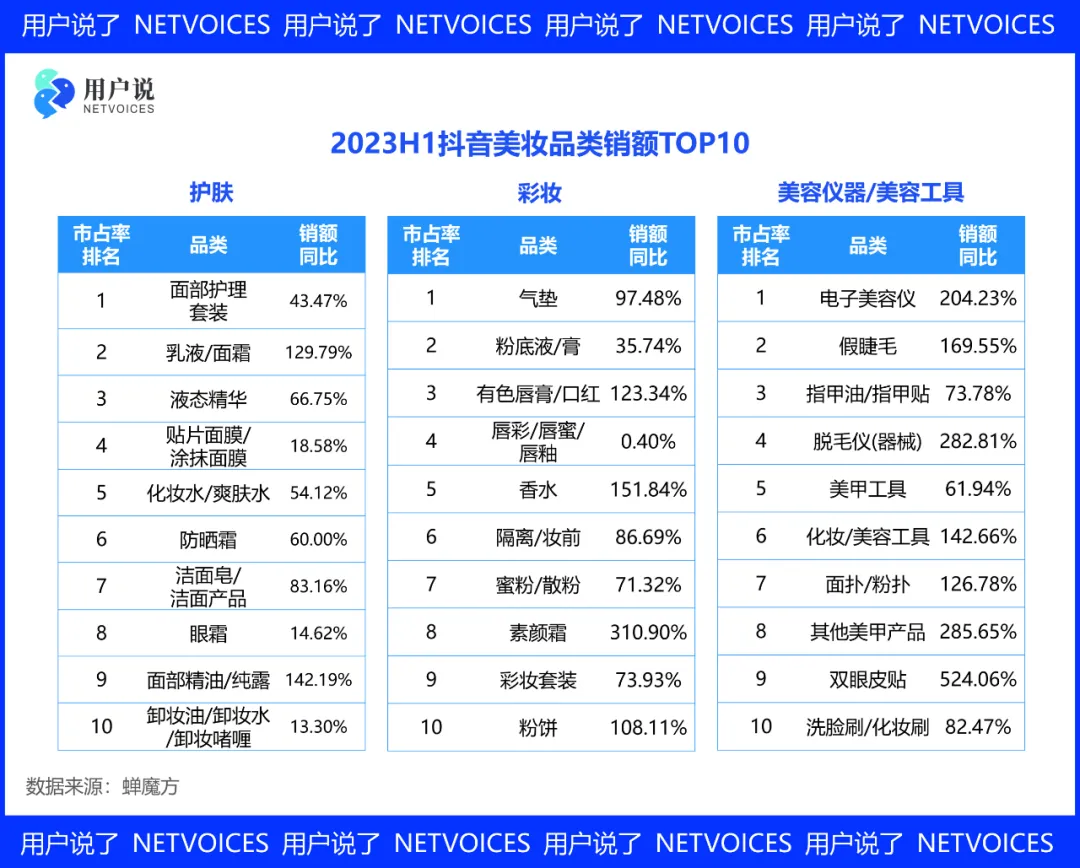

In the first half of the year, the sales of beauty categories on Douyin generally showed an upward trend, and the market share of skincare productsTOP3 categories: facial care sets, lotions/creams, and liquid serums all achieved year-on-year sales growth, with lotions/creams achieving a growth rate of 129.79%. In addition, the growth rate of facial oils/toners was also relatively fast, reaching 142.19%.

In the makeup category, BB cream, perfume, and powder showed outstanding performance, with year-on-year sales growth of310.9%, 151.84%, and 123.34% respectively.

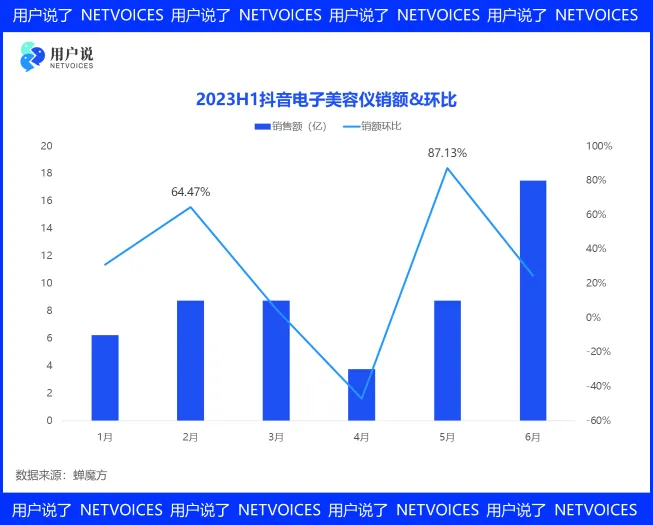

Beauty instrumentIn the beauty tools category, many tools have achieved significant sales growth, compared to other categories with lower market share. Electronic beauty instruments, accounting for 55.59%, performed even more brilliantly. The total sales of electronic beauty instruments on Douyin in the first half of the year were2.5 billion to 5 billion yuanand its year-on-year sales growth reached204.23%. Beauty instrumentsexperienced rapid month-on-month sales growth in February and May, reaching a peak in June, with sales in the range of 1 billion to 2.5 billion yuan.

Beauty instrument brand dark horse

The top three skincare brands areL'Oréal, Hanshu, and Proya. L'Oréal's performance on the Taobao Tmall platform is also among the best, while Hanshu focuses more on the Douyin platform.

Hanshu focuses on brand live streaming, except forFebruary, Hanshu's official flagship store ranked first in the Douyin beauty brand live streaming ranking. Hanshu has multiple official accounts. In June, the top 3 accounts in terms of brand live streaming sales were @Hanshu Official Flagship Store, @Hanshu Skincare Flagship Store, and @Hanshu Official Flagship Store Selection Account. All three stores broadcast 24 hours a day without interruption. By extending the live streaming time to attract users at different times on Douyin, the products are tagged with [celebrity same style], leveraging the star effect to increase sales.

Makeup rankingThe top 10 are Flower Knows, AKF, Julieo, 卡姿兰, Perfect Diary, Judydoll, YSL, FV, 彩棠, and A'pieu. It is worth mentioning that YSL's sales increased by 6682.23% year-on-year.

Beauty toolsIn the beauty instrument ranking, Jimo, Miguang, and YA-MAN are all well-known beauty instrument brands. NOWMI's sales increased year-on-year by6561.98%while Jimo reached an astonishing35136.39%. These two dark horses gave the Douyin beauty instrument market a major impact in the first half of the year, and also proved the ability of the Douyin beauty live streaming market to create popular brands.

This user said launched《2023 H1 Beauty Market ReviewUsing cosmetic retail sales as a starting point, observe the domestic cosmetic registration situation on Taobao and TmallJD.com, Douyin's three major platforms' beauty sales, category structure, brand rankings, user portraits, and the performance of Xiaohongshu's beauty section, and analyze the marketing methods of brands such as Helena and Winona, and conduct an in-depth review of the changes in the beauty market in the first half of the year.