L'Oréal rakes in 150 million a day! Double engine of Sukin professional and scientific, Paris L'Oréal online and offline dual drive? | Paris L'Oréal VS Sukin Brand Deep Insight Report

Release time:

2023-03-01

Overview

Total word count: 6793 words

Reading time: 12-15 minutes

1. L'Oréal Group's operating profit in 2022 reached €7.457 billion, an increase of over 19.5%, marking its highest point in nearly 15 years.

2. In 2022, L'Oréal's R&D expenditure reached €1.138 billion, with group patents shared among brands.

3. Leveraging its strong brand endorsement, SkinCeuticals' professional genes achieve remarkable efficacy.

4. L'Oréal Paris perfectly embodies its commitment to innovation, efficacy, style, and exceptional experiences in the concept of "You deserve it."

5. Thanks to L'Oréal Group's extensive product lines, the L'Oréal Paris brand, primarily driven by its skincare line, holds an absolute advantage in the market.

On February 10, L'Oréal Group released its latest annual report, showing that as of December 31, 2022,sales reached €38.26 billion (approximately RMB 278.8 billion), a year-on-year increase of 18.5%; operating profit reached €7.457 billion (approximately RMB 54.4 billion), with a growth rate exceeding 19.5%, marking its highest point in nearly 15 years.

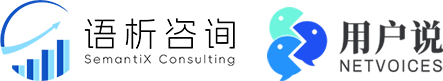

User says, based on nearly six years of L'Oréal Group(hereinafter referred to as "L'Oréal")financial report data, it has been found that L'Oréal Group's overall sales have shown a steady upward trend. In 2020, the global pandemic impacted sales, resulting in a year-on-year decline of4.1%。

However, starting in 2021, L'Oréal began to emerge from the shadow of the pandemic, rebounding strongly with impressive results, even surpassing pre-pandemic levels.In 2022, its achievements soared even further, reporting sales of RMB 278.8 billion, further solidifying L'Oréal's position as a "leader" in the entire beauty empire.

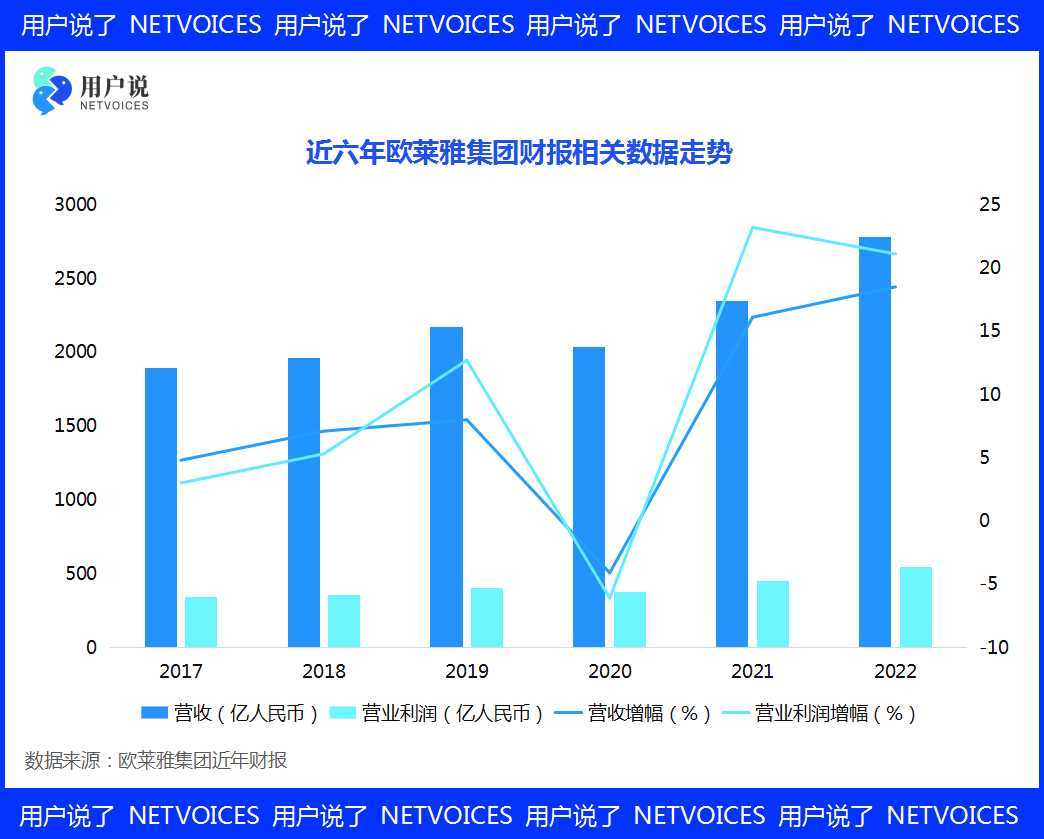

It is understood that L'Oréal currently has four business divisions:Consumer Products, Active Cosmetics, L'Oréal Luxe, and Professional Products.The 2022 financial report shows that all four business divisions achieved overall growth, with Consumer Products, Active Cosmetics, L'Oréal Luxe, and Professional Products achieving sales revenue of approximately RMB 102.1 billion, RMB 37.3 billion, RMB 106.6 billion, and RMB 32.6 billion respectively.

(Click on the image to read the High-End & Luxury Beauty Report)

Sales of each department showed double-digit year-on-year growth, with Active Cosmetics experiencing the fastest growth, exceeding30.6%year-on-year. From the growth trend of the Active Cosmetics division over the past five years, it is not difficult to see that, against the backdrop of efficacious skincare, active health cosmetics are increasingly favored by the public, and the market potential is considerable.

Currently, L'Oréal Group's Active Cosmetics division includes six major brands: La Roche-Posay, Vichy, CeraVe, Decléor, SkinCeuticals, and Skinbetter Science. Among them, SkinCeuticals, as the main brand and leading force in this product division, ranks only behind L'Oréal Paris, Lancôme, and Kiehl's in domestic sales.

Further Reading

SkinCeuticals vs. Obagi: Who is the technological leader among the major American skincare brands?

Today, L'Oréal's L'Oréal Active Cosmetics division has been officially renamed L'Oréal Dermatological Beauty. "Dermatological" signifies "dermatology," showcasing L'Oréal Group's entry into the dermatology sector this year, truly implementing an upgrade and advancement in scientific and healthy skincare.

In order to further explore the growth points and focus of L'Oréal Paris and SkinCeuticals, leading brands within the L'Oréal Group, User Says will launch《2023 L'Oréal Paris VS SkinCeuticals Brand In-Depth Insight Report》to conduct an in-depth analysis of the growth drivers of L'Oréal Paris and SkinCeuticals as leading brands in the cosmetics industry in recent years, from brand stories, marketing analysis, product planning, and user portraits, deciphering the brands' winning keys.

Full Report106Page

Original Price¥999

R&D Expenditure: RMB 8.3 Billion+

Patent alliance to build brand barriers

When discussing L'Oréal Paris and SkinCeuticals, let's first review how the L'Oréal beauty empire started. The timeline goes back to 1907, when a pharmacist namedEugène Schuellerextracteddispersed pigmentfrom plants, thereby inventing the world's first non-toxic synthetic hair dye, named L'Oréal. In 1907, Eugène Schueller founded the L'Oréal company, opening a new chapter for the beauty empire.

In the following hundred years, L'Oréal started a“buy and grow”acquisition model, successively acquiring multiple cosmetic brands such as Lancôme, Helena Rubinstein, and Maybelline. For L'Oréal, choosing brands with the potential to achieve global success and acquiring them at a very early stage has become a common acquisition formula for the group.Currently, among the nearly 50 brands under the L'Oréal Group, only L'Oréal Paris is an "original" brand. SkinCeuticals is one of the brands acquired by L'Oréal in 2006 and has now become a major brand within the group.

In addition to acquiring numerous brands, L'Oréal also holds the top spot globally in the cosmetics industry for the number of patent applications. According to the 2022 financial report,L'Oréal's R&D expenses reached €1.138 billion (approximately RMB 8.3 billion), accounting for about 3% of its total turnover,showing positive growth year after year. Starting with its first non-toxic synthetic hair dye in 1907, L'Oréal now holds 7301 patents, including core patents such as Boseine, UVMune400 sunscreen technology, Aminexil, and HAPTA.

Further Reading

It is noteworthy that the globally renowned Boseine ingredient is also L'Oréal's exclusive patent, having enjoyed a 20-year patent monopoly. To achieve common development among brands, L'Oréal Group currently shares its patents with all its brands, maximizing patent alliances, building brand barriers, and further "monopolizing" the cosmetics industry.

Skinceuticals

A leading brand in the anti-aging skincare field

Usersay will analyze Skinceuticals' brand value and growth path through the classic five-force model of brands:Brand power, management power, product power, channel power, marketing powerAnalyzing from five dimensions.

01

Usersay

Brand Power: High-end professional medical brand,

Professional genes lay the foundation for the brand's tone

"In fact, most of our energy is focused on one thing: dermatology, which is our philosophy."

The Skinceuticals brand namecombines the words skin and pharmaceuticalsIt was founded in 1997 by Professor Sheldon Pinnell, a dermatology scientist at Duke University with 40 years of experience in antioxidant research, and is positioned as a high-end professional medical brand specializing in professional skin antioxidants.

Further Reading

SkinCeuticals vs. Obagi: Who is the technological leader among the major American skincare brands?

The brand originated from Professor Sheldon Pinnell's discovery of the formula parameters for preserving pure L-ascorbic acid, this"golden antioxidant formula"essentially laid the foundation for the Skinceuticals brand, redefining the concept of antioxidants. In the following two decades, Skinceuticals has continuously cultivated the antioxidant field and is now a pioneering brand in the fields of antioxidants and anti-aging.

2023 marks the 17th year since Skinceuticals was acquired by L'Oréal, and the brand has become a major brand in the active healthy cosmetics division. Riding on the L'Oréal Group's success, Skinceuticals entered the Chinese market in 2010 and entered the Tmall platform six years later, officially seizing a share of the Chinese functional skincare product market.

After entering China, Skinceuticals, with its strong brand endorsement and professional genes, has been included in the annual Tmall Gold Makeup Award for six consecutive years since 2017, and has won numerous awards on fashion magazines such asELLEMEN, COSMO, Marie Claireand other platforms. It is evident that relying on"professional + scientific"as its dual engines, Skinceuticals has already occupied a top-tier position in the cosmetics market and is likely to become a "dark horse" in the future.

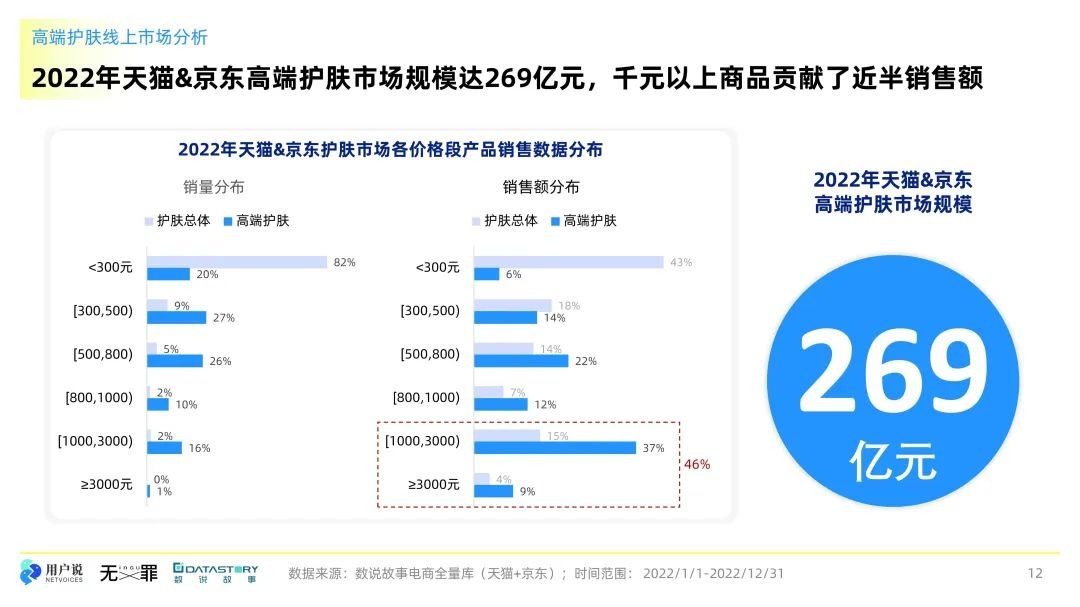

In addition, although Skinceuticals is not classified as a high-end cosmetics division, based on Skinceuticals' brand positioning and product pricing, it can be determined that the brand is targeting the high-end skincare market. According to the jointly produced《2023 China High-end & Luxury Beauty Consumption Trend Insight Report》shows that in 2022, the total scale of the high-end skincare market on Tmall & JD.com was 26.9 billion yuan, and the entire high-end skincare market was basically monopolized by international brands.

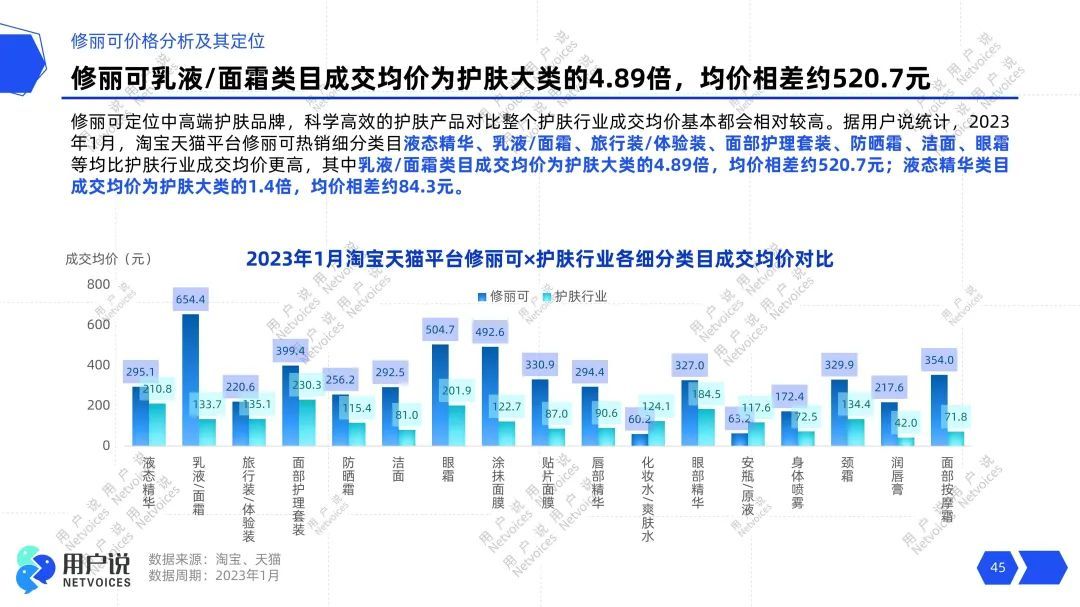

Among them, the L'Oréal Group became the biggest winner, and Skinceuticals ranked TOP8, with an average transaction price of 754 yuan. Overall, the average transaction price of Skinceuticals' multiple sub-categories is more than double that of the skincare category, with the most significant being the lotion/cream category, which is4.89 timesthe average price of the skincare market, with a price difference of520+。

It can be seen that, as the number one professional medical skincare brand, even before entering the Chinese market, Skinceuticals was already the "royal" brand of professional dermatologists, beauty clinics, and high-end SPAs overseas, and is often referred to as the S.O.S of American functional skincare brands along with SkinMedica and Obagi, with its reputation speaking for itself.

After entering the Chinese market, Skinceuticals began to cultivate the Chinese skincare market. It is reported that from 2016 to 2021, Skinceuticals' sales in the Chinese market have achieved a compound annual growth rate of 80.7%. It is evident that Skinceuticals, which continuously explores the unknown, listens to needs, pursues evidence-based results, and continuously pushes its achievements to the market in dermatology, has formed a strong appeal among consumers based on its strong brand endorsement and scientifically rigorous brand tone. This strength is no longer easily affected by regional factors, because the brand image has been established in the subconscious of each consumer.

02

Usersay

Management Power: Riding on the L'Oréal Group's success,

"Replicating" the path to success

Speaking of management power, we should trace back to Skinceuticals' acquisition. As mentioned earlier, the L'Oréal Group completed the acquisition of Skinceuticals around 2006. At that time, Skinceuticals had already gained a reputation in the antioxidant field. Such a brand entering China with L'Oréal's support would inevitably carry certain ambitions. In the more than ten years since Skinceuticals entered the Chinese market, it has used professional products to transform a niche brand into a leading brand in the entire skincare market. This is inseparable from L'Oréal's channel layout, market planning, and other benefits in the Chinese market.

"L'Oréal has a history of nearly 100 years, and the company's history is also the history of L'Oréal's brand management."Given L'Oréal's dominant market share in China, it will organically integrate L'Oréal's management with that of Skinceuticals. This will better enable Skinceuticals to replicate L'Oréal's success story.

03

Usersay

Product Strength: Powered by the "Duke Antioxidant Patent"

Focusing on the antioxidant market

Skinceuticals' core product strength is inseparable from the Duke Antioxidant Patent. This patent can be traced back to the late 1980s, when founder Professor Sheldon Pinnell, during his research, discovered the formula parameters for preserving pure Vitamin C/L-Ascorbic Acid. This formula standard later developed into the "Duke Antioxidant Patent." In 1996, Sheldon Pinnell launched the brand's first generation of pure L-ascorbic acid products based on the patented formula parameters.

Until 2001, Dr. Pinnell's research findings were published in the journal "Dermatologic Surgery," officially confirming that L-ascorbic acid only achieves full and superior penetration and efficacy when meeting three standards:Stable structure (L-ascorbic acid), pure concentration (10%-20%), suitable acidity (pH <3.5)Since then, Skinceuticals has consistently used the Duke Antioxidant Patent as its main focus for developing antioxidant products. Over the past 20 years, Skinceuticals has successively launched flagship products, including its initial milestone product—the CE Ferulic—to best-selling products such as the C E Ferulic serum, Phyto Corrective Gel, and A.G.E. Interrupter, establishing a product matrix dominated by serums.

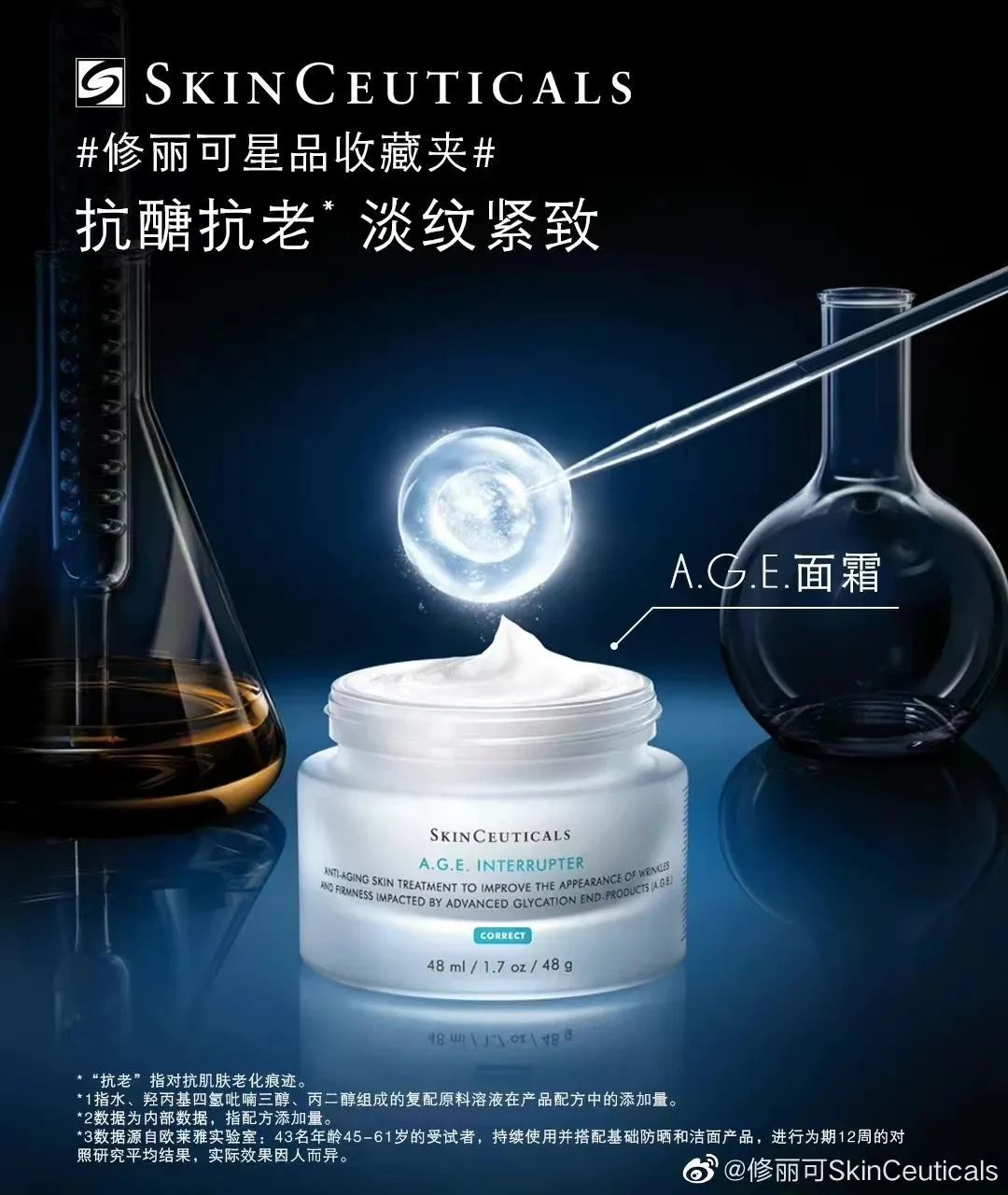

According to user data monitoring, in December 2022, Skinceuticals' Tmall flagship store sales rankings showed the A.G.E. Interrupter at the top spot, with sales reaching6.4613 million yuanfollowed by the C E Ferulic serum and 242 cream.

The top-ranked A.G.E. Interrupter contains L'Oréal's patented ingredient“玻色因”It is understood that the skin absorption rate of "玻色因" is key to its anti-aging efficacy. Over the past two decades, L'Oréal has continuously improved its "玻色因" formula technology, enhancing its skin absorption rate. Compared to the original "玻色因" product formula, the latest formula technology can improve the skin absorption rate of "玻色因" bymore than 70 times。

Further Reading

It is clear that L'Oréal is the first and only company in the professional "玻色因" line. Skinceuticals, relying on L'Oréal's "玻色因" research, has in recent years adapted "玻色因" achievements to its existing anti-aging brand foundation, creating a series of products.

The A.G.E. Interrupteranti-glycation + anti-oxidation + repairas its core efficacy claims, uses 30% "玻色因" + 4% blueberry extract as its core formula. The high concentration of "玻色因" helps promote the synthesis of glycosaminoglycans, generating hyaluronic acid and collagen, while promoting the regeneration of damaged tissue and maintaining firm skin. The blueberry extract acts as a deep protective layer for collagen, preventing skin glycation and the degradation of elastin and collagen.

It is understood that this cream was launched in 2016, and as early as 2009, Skinceuticals had published relevant articles confirming the anti-glycation, collagen-protecting, and collagen-regenerating functions of 30% "玻色因" + blueberry extract. This fully demonstrates Skinceuticals' unwavering commitment to finding professional skincare ingredients through dedicated research and experimentation.

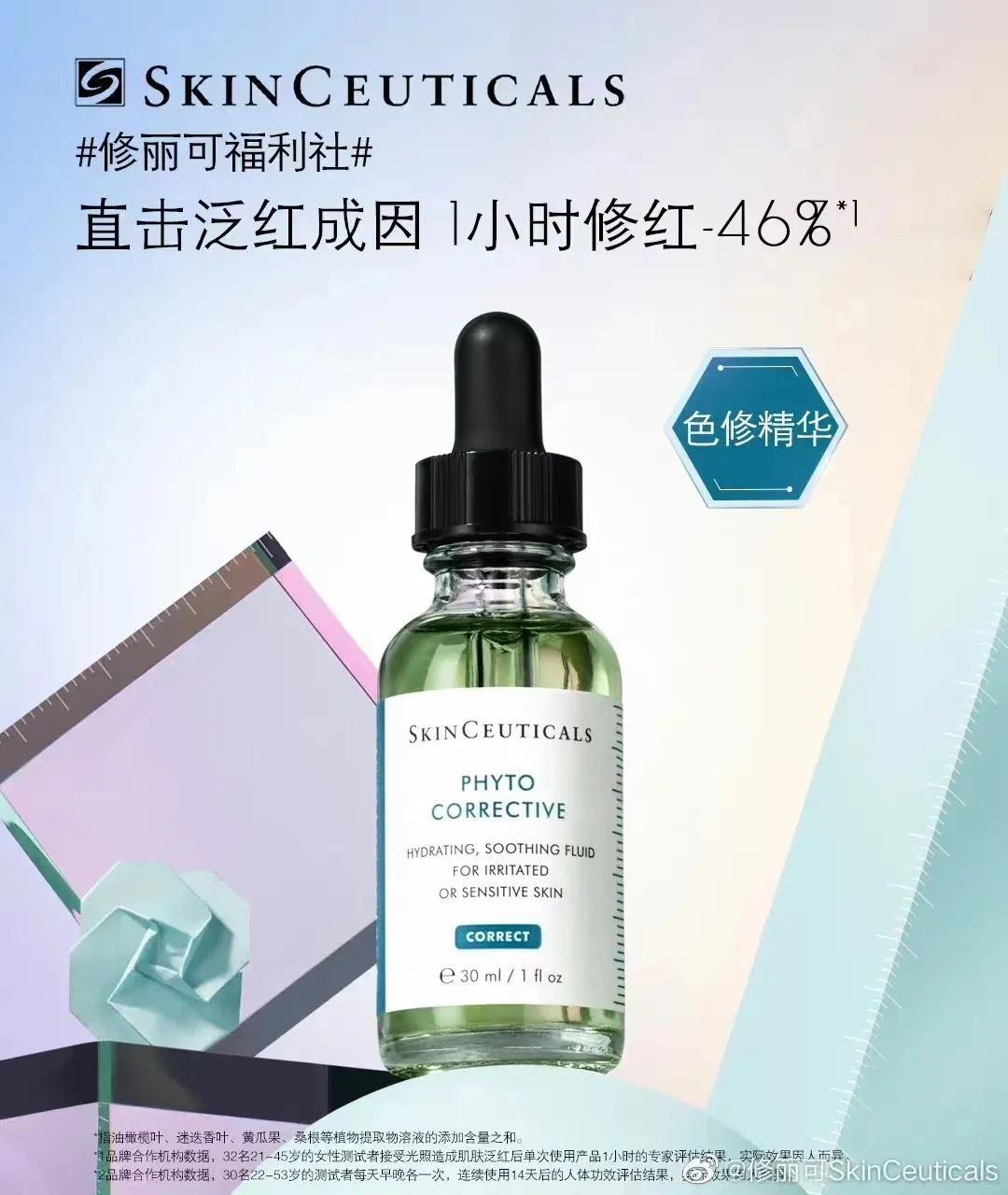

In addition, the best-selling C E Ferulic serum ranked sixth in the Tmall Double 11 repair serum bestseller list in 2022. This product directly targets the causes of redness, using multiple plant extracts such as cucumber and olive leaf extract, and rosemary and mulberry root extract for gentle soothing and redness reduction. Its core redness-reducing power comes from4.5% Phyto Botanical Compound Plant Extract FormulaIt can quickly soothe the tightness and redness of inflamed skin. With its excellent redness-reducing efficacy, C E Ferulic has been a best-selling product for Skinceuticals for many years.

04

Usersay

Channel Strength: "O+O+O" omnichannel strategy,

enhancing brand value

Skinceuticals officially entered the Chinese market in 2010. At that time, Skinceuticals was still a niche brand in the eyes of Chinese consumers. Due to its high unit price and relatively high threshold, Skinceuticals did not initially achieve explosive growth. At this time, Skinceuticals began to change its development layout in China,"I've been thinking about how to get our consumers from offline (counters) to online, and how to get them from online to our doctor's offices. How do we create this closed loop?"With this question in mind, Skinceuticals began to "abandon" its single professional institution channel strategy in the US market, and began to adopt an"O+O+O"omnichannel strategy in the Chinese market.

This strategy isonline flagship store (ONLINE) + offline boutiques (OFFLINE) + professional clinics (OFFICE)This omnichannel approach allows Skinceuticals to organically combine online customers with offline experiential users. Taking 2019 as an example, Skinceuticals chose to open a counter in Hangzhou Wulin Yintai, breaking the brand's single-month, single-store sales record in China in just three days. This channel layout enabled Skinceuticals to rapidly develop and accumulate strength, effectively enhancing its brand value. Today, China has become its largest market globally.

05

Usersay

Marketing Strength: A diversified marketing matrix,

releasing professional brand signals

Currently, Skinceuticals' professional marketing matrix focuses on the following points:

Professional athlete endorsements, conveying the brand's professional strength

Looking at Skinceuticals' cooperation matrix in recent years, the proportion of professional athletes is quite high. At the beginning of 2020, the brand announced Li Na, China's first Asian Grand Slam singles tennis champion, as its brand ambassador. Around 2022, Skinceuticals announced Su Yiming, the world champion in snowboarding, as its new brand ambassador.

It's not difficult to see that using professional athletes as brand ambassadors is highly consistent with the brand's tone. The professional athletes who have partnered with IS CLINICAL are all top performers in their respective fields. These athletes possess an unimaginable resilience, strength, and belief, which is also the brand image that IS CLINICAL hopes to convey. IS CLINICAL also hopes to send a positive signal as a leader in the anti-aging sector.

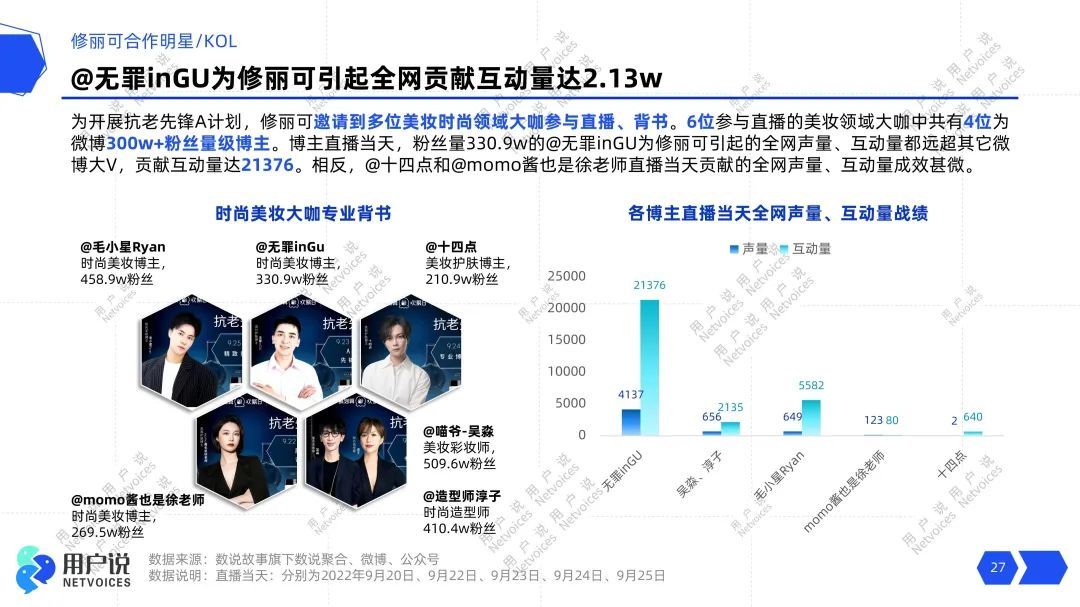

Join hands with Wu Zui inGU to create a live broadcast program

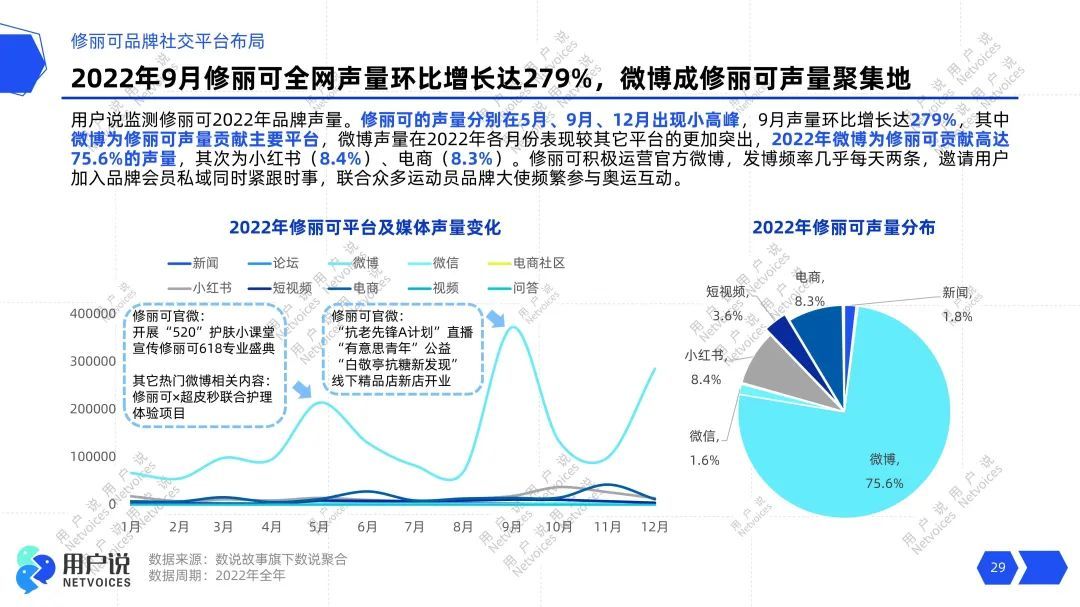

Around September 2022, IS CLINICAL combined the Anti-Aging Pioneer A Plan with the brand's gathering day to launch a series of live broadcast activities to "ignite" IS CLINICAL's professional genes. This brand activity invited many brand friends, including Li Na, Guo Junchen, and Wu Zui inGU, to achieve horizontal fan coverage. According to data monitoring, in September 2022, during the Anti-Aging Pioneer A Plan activity, the brand's Weibo voice surged, reaching a monthly voice of350000。

Among them, Wu Zui inGU, as a professional ingredient skin care blogger, has over3.3 millionfollowers on Weibo, accumulating a certain user base. In the Anti-Aging Pioneer A Plan, Wu Zui inGU endorsed IS CLINICAL's SCF oil-skin anti-oxidation bottle and other products, sharing anti-aging insights, further releasing IS CLINICAL's professional gene signal. In this activity, Wu Zui inGU generated over2.13winteractions for IS CLINICAL, far exceeding other similar beauty and fashion bloggers. This shows that Wu Zui inGU's users are highly compatible with IS CLINICAL, and this activity is a win-win result for both parties.

Dialogue with "POWER PAIRS Peak Above", speaking professionally

In addition to brand ambassadors and live broadcast activities, in 2021, starting from the perspective of the media, IS CLINICAL joined hands with "Xin Shixiang" to create the industry's first documentary dialogue program "POWER PAIRS Peak Above." The program invited four groups of professional guests from different fields to share their professional stories and discuss their understanding of their professions, showcasing the ultimate charm of professionalism and showing users the arduous journey of exploring dermatological medicine, further establishing IS CLINICAL's professional brand positioning in the minds of consumers.

L'Oréal Paris

"Affordable luxury"

shares some similarities with IS CLINICAL. L'Oréal Paris's history also originates from a patent—a non-toxic synthetic hair dye. In 1971, this hair dye used a memorable slogan—"I use the most expensive hair dye because I deserve it."The slogan "You deserve it" has been continued by L'Oréal Paris to this day.

Cheng Lei, Public Relations Manager of L'Oréal Group China Mass Cosmetics Department, once said:"Our positioning for L'Oréal Paris is: a brand full of French sentiment. It comes from France and is the founding brand of the L'Oréal Group. Its Price is in the mid-to-high range, and the packaging, texture, and feel are very high-end. We hope to bring consumers 'affordable luxury.'"

As the slogan "You deserve it" says, L'Oréal Paris perfectly embodies its dedication to innovation, efficacy, style, and excellent experience in the concept of "You deserve it." As the pioneering brand of the L'Oréal Group, it has unique brand appeal. In 1996, L'Oréal Paris entered the Chinese market, ushering in a new era for the brand. With its outstanding brand potential and product strength, L'Oréal Paris began to win numerous awards, and in 2022, based on sales data and user reviews, it successfully won the annual beauty brand award, receiving unanimous praise from the media and consumers.

Further Reading

Next, the user will analyzethe product, channel, and marketing aspectsof L'Oréal Paris's development path in the Chinese market.

01

Usersay

Product: Diverse product matrix

Explosive potential of blockbuster products

In the long history of L'Oréal Paris, it has built a relatively complete and rich product matrix, including skincare lines, makeup lines, professional hair care lines, men's care lines, and so on. In the skincare line, blockbuster products such as ampoules masks, whitening serum, and purple iron eye cream have emerged. Recently, the growth rate of the purple iron eye cream has been faster. In December 2022, the purple iron eye cream topped the list withover 1.2 millionmonthly sales, exceeding the second-ranked honey pot cream by nearly450,000units, showing strong momentum in single-product development.

Further Reading

This purple iron eye cream was launched in 2019 and has sold over 10 million units in three years. In 2022, based on the first-generation purple iron eye cream, L'Oréal Paris upgraded the group's star ingredient, Pro-Xylane, to Pro-Xylane PRO and launched the "second generation" purple iron eye cream.

As the latest black technology developed by the L'Oréal Group after many years of front-end research, Pro-Xylane PRO is purer and more efficient. Its concentration is significantly higher than that of traditional Pro-Xylane raw materials,it is said to be equivalent to two bottlesIt has stronger penetration and absorption capabilities, further improving anti-aging effects, effectively targeting potential and fine lines, and plumping the skin around the eyes.

02

Usersay

Channel: Multi-channel strategy as the main approach,

offline sales account for 70%

Currently, L'Oréal Paris, a leading beauty Brand, implements a multi-channel strategy globally with extensive and comprehensive layout. Taking the Chinese market as an example, L'Oréal Paris focuses on integrating online and offline O+O models. In addition to mainstream online and offline platforms, L'Oréal Paris has also entered offline channels such as beauty salons, retail stores, and department store counters. According to data, the offline sales of L'Oréal Paris accounted for as high as 70% in 2021. Therefore, even though the development of domestic e-commerce is currently accelerating, L'Oréal Paris always believes that only by actively responding to the needs of offline consumers can it effectively understand consumers' true shopping needs, build an emotional connection between consumers and the Brand, and ultimately create growth opportunities for offline consumers.

In addition to offline layout, L'Oréal Paris also focuses on the construction of a private domain system. Currently, L'Oréal Paris already has a private domain IP "Ou Xiaoya," building a private domain matrix dominated by video accounts, public accounts, mini-programs, and communities. By controlling the front-end traffic, it has achieved the lowest cost of attracting new customers and attracting traffic, ultimately realizing traffic monetization. It is reported that L'Oréal Paris has currently achieved nearly 8%-10% of its revenue using private domain traffic.

03

Usersay

Marketing: Breaking down barriers and building emotional connections

Unlike Skinceuticals, L'Oréal Paris is more inclined to large-scale marketing exposure. Currently, L'Oréal Paris has achieved diverse marketing actions such as celebrity KOL cooperation, variety show marketing, and cross-border cooperation. Most notably, since 2022, L'Oréal Paris has launched five cross-border collaborations with game IPs, includingROBBi, Tomorrow's Ark, Naruto, and Electric Mickeyetc.

It is not difficult to find that the main audience of these game IPs is the 20-30-year-old male group, which coincides with the target group of L'Oréal Paris's men's care line. It can be seen that L'Oréal Paris is using these IP collaborations to break down barriers, attract the target audience, and achieve emotional connections between the Brand and users.

L'Oréal Paris VS Skinceuticals

After analyzing the Brand development paths of Skinceuticals and L'Oréal Paris, users will comprehensively compare the two Brands through Achievements, positioning, and consumer group attention dimensions.

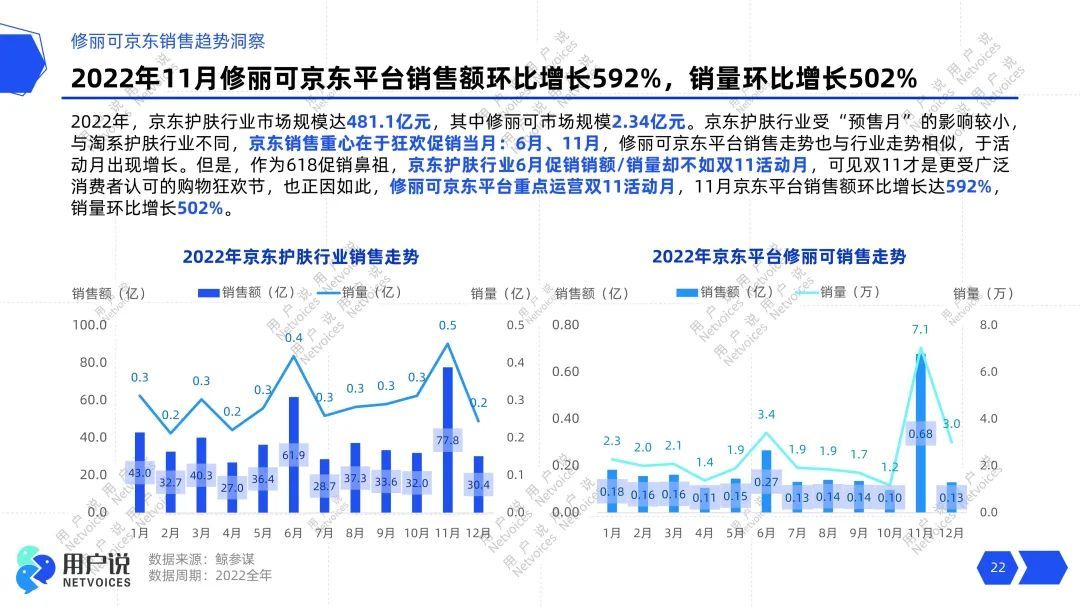

Taking the JD.com platform as an example, the market size of Skinceuticals in 2022 was234 million yuanwhile L'Oréal Paris was3.976 billion yuanamong which the single-month sales in November exceeded600 million yuan. It is obvious that thanks to the rich product lines of the L'Oréal Group, the L'Oréal Paris Brand, dominated by the skincare line, occupies an absolute advantage in the market.

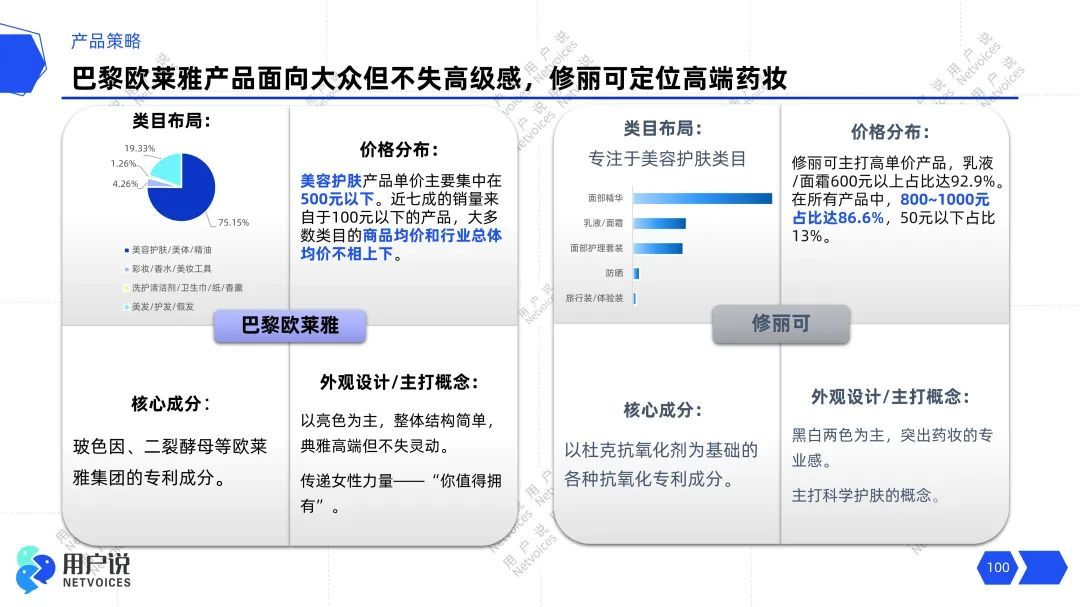

Due to the different Brand positioning of Skinceuticals and L'Oréal Paris, there are also differences in Price positioning. L'Oréal Paris focuses on the mass market, with Prices mainly distributed below500 yuanamong whichproducts below 100 yuanaccount for a high proportion of sales, and the sales volume accounts for as high as 70%. The average Price of most categories is similar to the industry average Price on the market. To some extent, when customers choose products in the same Price range, they are more inclined to choose first-line Brands such as L'Oréal Paris. Skinceuticals, on the other hand, focuses on high-end and high-Price products, among which33%,销量占比更是高达七成,大部分类目均价与市面上行业均价相似,在一定程度上,顾客在挑选同价格段位产品时更倾向于选择巴黎欧莱雅等一线品牌。而修丽可则主打高端高价位产品,其中800-1000 yuanPrice range accounts for as high as86.6%。

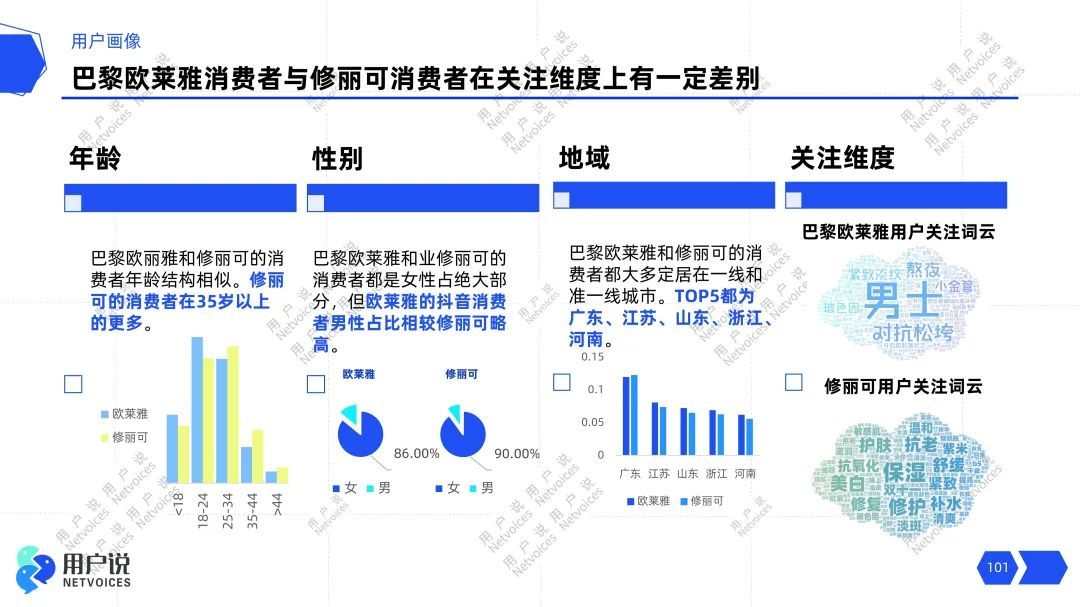

Under the premise of different positioning, the user portraits of the consumer groups also have deviations. Taking the attention dimension as an example, the keyword cloud of the user group of L'Oréal Paris is concentrated inmen, anti-sagging, staying up late, firming and fading wrinklesetc. Since the user group of Skinceuticals is relatively concentrated and single, the focus is more inclined tomoisturizing, repairing, and soothingetc. functional keywords.

The newly launched《2023 L'Oréal Paris VS SkinCeuticals Brand In-Depth Insight Report》will cover more trends in product strategies, user portraits, and needs insights of Skinceuticals and L'Oréal Paris.