Sunscreen sales exceed 14.4 billion! A 57% surge on Douyin? MISTINE takes the lead? Yuze, Ifidan, and UNNY compete on ingredients?

Category:

Keyword

language analysis information

Weight

Stock surplus

10000

隐藏域元素占位

- 详情概述

-

- Commodity name: Sunscreen sales exceed 14.4 billion! A 57% surge on Douyin? MISTINE takes the lead? Yuze, Ifidan, and UNNY compete on ingredients?

Overview

Total word count: 7075 words

Reading time: 8-10 minutes

1. Douyin's sunscreen sales market share10.78%rose to29.14%。

2.Sunscreen +Demand is prevalent, and the number of registered sunscreen product categories is expected to continue to rise steadily.

3. The efficacy of sunscreen products is no longer limited to simply preventing sunburn and tanning, but has branched out intoantioxidant, firming, soothing, and lighteningetc., sunscreen-oriented efficacy.

4. Douyin platform's female sunscreen TGI index is as high as 143, with high participation and attention,Strong user stickiness。

5. Simultaneously achieving high-factor protection and soothing skinLarge-molecule sunscreen agentsare more favored by people with sensitive and fragile skin.

6. Ifidan sunscreen average transaction price is as high as938.31 yuan,average gram price as high as 22.4 yuan/ml.

7. In 2024, new sunscreen products have emerged withtransparent ingredients, improved film-forming technology and experiencerevolution

“Although natural skin aging cannot be reversed, photoaging can be resisted to a certain extent.”

With the opening of 2024, the sunscreen market has quicklyEnter a new round of fierce competition. Users said that in [Beauty Week New Products], more than 20 new sunscreen products have been launched. Industry giants such as Clarins, Augustinus Bader, and Zhenyan not only continue to strengthen their own product lines, but also witnessU-Time Yan, Fan Beauty Diary, Unique Eileen, and East Beastetc., new Brands bravely take the first step in the sunscreen field. More noteworthy is the strategic cooperation between the leading sunscreen Brand MISTINE and the chemical industry giant BASF. This is not only a major step forward in sunscreen ingredient and technological innovation, but also signifies a comprehensive optimization and upgrade of the supply chain, aiming to promote the sustainable development of sunscreen products.

It can be seen that with the continuous expansion of the sunscreen consumer group, the demand for sunscreen is also becoming morediversified and refined. In order to accurately address the pain points of sun protection and continuously meet the constantly evolving sunscreen needs of consumers, sunscreen Brands at all levels are working tirelessly on sunscreen scientific research and innovation, building high scientific research barriers for Brands, continuously driving volume growth, and accelerating the innovation and iteration of the entire sunscreen track.

According to Euromonitor data, the compound growth rate of the sunscreen subdivision track from 2022 to 2027 is expected to reach9.6%,leading the industry's overall growth, and is expected to maintain high prosperity in the future.

In order to further track the industry trends and dynamics of sunscreen, and capture new concepts and perspectives in the sunscreen market, Usersay has newly launched“2024 Sunscreen Market Consumption Trend Insight Report”,fromconsumer market insights, best-selling product creation logic, Brand analysis research, user portrait demand trends, channel marketing investmentand other dimensions to comprehensively analyze the growth points and breakthroughs in the sunscreen market, and deeply explore how sunscreen single products can detonate the market and achieve breakthrough growth. By deeply understanding the development potential points of the sunscreen consumer market, provide more inspiration and ideas for category entrants, and allow Brands to take the lead in fierce market competition. More hope BrandsThrough this report, they can grasp the key pulse of the sunscreen market, and hope to provide rich inspiration and action guidelines for industry newcomers, and jointly promote the continuous prosperity and innovation of the sunscreen field.

Full report78page

Original price¥899

(Contact customer service at the end of the article to receive coupons)

Market share over 29%

High-factor sunscreen on Douyin may become a trend

GMV 40 billion+ yuan, Douyin market has great potential

As a subdivision track with higher prosperity in the current cosmetics market, the sunscreen category shows relatively objective growth in market size and search popularity. According to Usersay data tracking, in 2023, sunscreen products onAlibaba, JD.com, and Douyin's three major e-commerce platforms have achieved a total sales of 14.4 billion yuan,among which the Alibaba platform still occupies the leading position in the sunscreen sales market with a contribution share of 54.13%.

However, it is worth noting that the market share of sunscreen product sales on the Alibaba platform has dropped from69.9%sharply decreased to53.13%,with a clear downward trend. The lost market share mainly flows to the Douyin platform. It can be seen that the market share of sunscreen product sales on the Douyin platform has increased from10.78%rose to29.14%,the growth rate is amazing. In the future, the commercial value of pan-interest e-commerce will continue to expand, and the Douyin platform is more likely to break Alibaba's leading position in the sunscreen field and become the main sales base for the sunscreen market.

Taking a closer look at the market performance of Douyin sunscreen, we can see that in 2023, the product search volume of sunscreen products on the Douyin platform increased by1091.46%,Total sales exceeded4 billion yuan,year-on-year growth56.64%,approximately 165% of JD.com's sales. In addition, due to the seasonal nature of sunscreen products, the peak sales are mainly concentrated from March to August. However, with“year-round sun protection”concept's continuous rise in popularity, consumers' awareness of autumn and winter sun protection is gradually awakening. The proportion of off-season sales on the Douyin platform is expected to increase in the future, further stimulating the growth of the entire sunscreen market.

Number of registered products increased by 55%, new product forms attract attention

Registration situations often reflect the rise and fall of an industry. In 2021, affected by the global pandemic, the number of registered sunscreen products remained at the level of 1500. In 2022, with the《Regulations on the Supervision and Management of the Production and Operation of Cosmetics》,《Regulations on the Management of Cosmetic Labels》and other new regulations being implemented successively, the industry's standards and review for sunscreen registration have become stricter, which also led to a year-on-year decrease of 7.34% in the number of registered sunscreen products in 2022.

Until 2023, under the dual impetus of economic recovery and the adaptation period of new regulations, the number of registered sunscreen products increased significantly to 2198, with a year-on-year growth of55.56%,among whichMentholatum, Gaozi, MISTINEand other leading Brands contributed the main share. From the perspective of subcategories, sunscreen cream/lotion, as the core subcategory, reached 1746 registered products, an increase of 59.16% compared with 2022. The number of registered sunscreen sprays was 316, which is far less than the volume of sunscreen cream/lotion, but the number of registered sunscreen sprays increased by 95.06% year-on-year, showing remarkable growth.

In fact, in addition to conventional sunscreen products such as sunscreen cream/lotion and sunscreen sprays, sunscreen products have been constantly innovating in form and dosage form in recent years. For example, the Japanese Brand ETVOS launched mineral UAsunscreen powder,the American Brand COOLA launched®digital decompression technology launchedsunscreen stick,ALLIE launched a local color sunscreenblush sunscreenand so on. These new trends have injected vitality and “life force” into the entire sunscreen market. It is believed that with the prevalence of sunscreen + demand, more new forms of products will emerge in the future sunscreen market, and the number of registered sunscreen product categories is expected to continue to rise steadily.

High-factor sunscreens dominate the market, PA+++ products are hot?

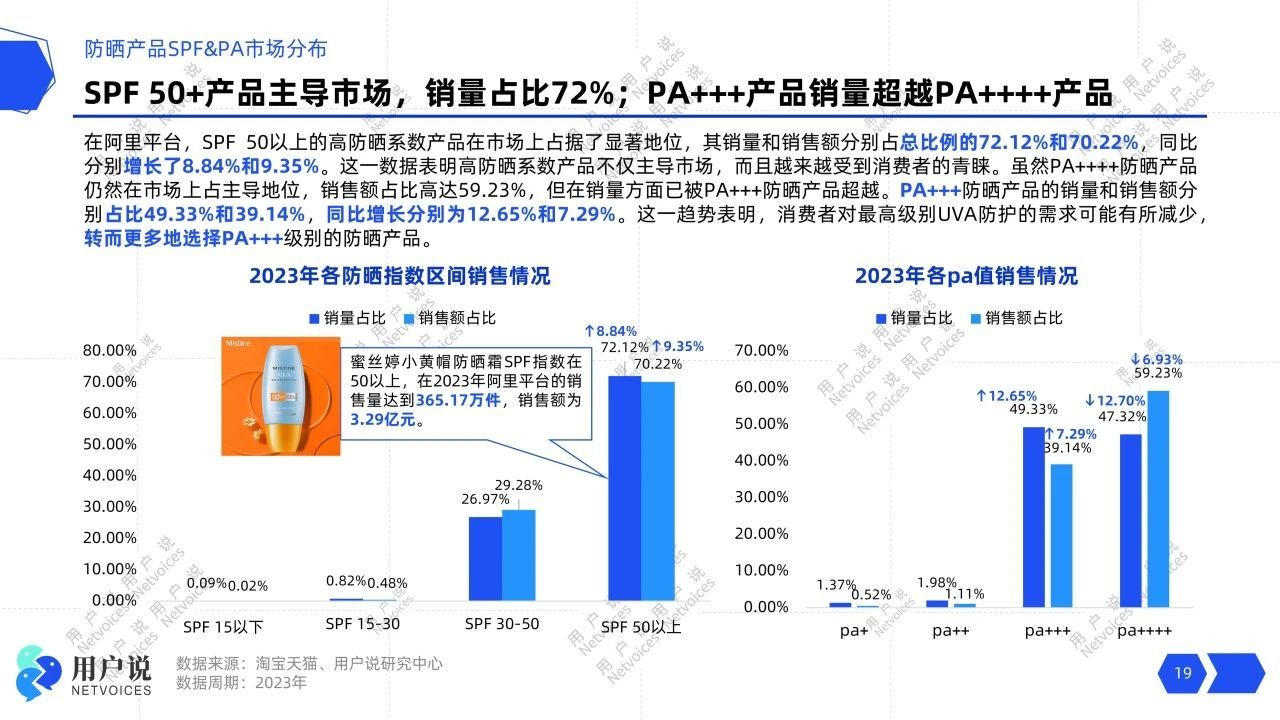

For sunscreen products,protection is paramount。The sun protection factor SPF and sun protection grade PA, as important indicators to measure the sunscreen effect, have naturally become one of the standards for consumers to choose sunscreen products. The SPF value reflects the product's protection against UVB, mainly focusing on sunburning protection, while PA reflects the product's protection against UVA, targeting sun tanning protection.

According to the data tracked by User Say, in 2023, sunscreen products with SPF30-50 and SPF50 or above on the Alibaba platform jointly contributed99%of the share, among whichsunscreen products with SPF50 or higher accounted for more than 70% of sales volume and sales value,and compared with 2022increased by more than 8%。This data intuitively shows that high-factor sunscreen products basically dominate the trend of the sunscreen market, and consumers' demand for high-factor sunscreen is becoming increasingly obvious.

In addition, User Say found that although PA++++ sunscreen products have a sales value market share of 59.23%, their sales volume and sales value are both declining, while PA+++ sunscreen products have a sales volume market share of nearly 50%, surpassing PA++++ sunscreen products and achievingboth sales volume and sales value increased。This trend also shows that consumers' demand for UVA protection is no longer simply pursuing the highest level,but rather choosing sunscreen agents based on their own sunscreen needs and skin tolerance.

In addition to high-factor sunscreen,high-wavelength sunscreen is another core topic in the sunscreen field。In 2022, L'Oréal Group joined hands with BASF to launch a breakthrough innovation in the sunscreen industry – Mexoryl 400 sunscreen agent (UVMune 400). As L'Oréal's ten-year painstaking work, Mexoryl 400 sunscreen agent can effectively resist super-long wave UVA radiation of 380-400nm, and is currently the first sunscreen agent on the market that can cover the UVA400 band.

This technology has been applied to La Roche-Posay products under L'Oréal. It can be seen that sunscreen Brands are not only competing inhigh-factor sunscreen,but also deadlocked infull-band high-wavelengthsunscreen, which will inevitably establish its own scientific research barriers and inject more high-tech content into the sunscreen market.

Plant-based ingredients are hot

whitening, anti-oxidation, and anti-allergy are gaining popularity

external and internal maintenance, multi-effect sunscreen becomes mainstream

On November 24, 2023, the National Medical Products Administration (NMPA) announced the No. 62 Notice of Non-compliant Cosmetics in 2023, among which 19 out of 39 non-compliant products were sunscreen products. Similarly, on January 8, 2024, the NMPA announced the No. 4 Notice of Non-compliant Cosmetics in 2024. Among the 37 products listed this time, 16 were sunscreen products. It can be seen that after the release of new regulations in 2021 and 2022, the entire sunscreenmarket supervision has tightened,and the declaration of ingredient efficacy is becoming increasingly stringent,Market and consumer expectations for the efficacy and safety of sunscreen products are rising.。

Data integration from user feedback reveals that the efficacy of sunscreen products is no longer limited to simply preventing sunburn and tanning, but has expanded to include antioxidant, firming, soothing, and lightening effects. Therefore, most current sunscreen products, while providing basic sun protection, also incorporateantioxidant & glycation, firming, spot removal, and soothingas additional ingredients, combining multiple herbal active ingredients to achieve a "multi-effect in one" result.

In recent years,“external protection and internal nourishment”has become increasingly popular, making herbal ingredients the most sought-after raw materials for sunscreen products. Among these, extracts of licorice root, baicalin root, purslane, and mugwort are gaining significant popularity.

Purslane Extract

Purslane extract is rich in flavonoids, polysaccharides, saponins, and other active ingredients, making it a natural moisturizer and broad-spectrum antimicrobial agent. Therefore, adding purslane extract to sunscreen products can providestrong anti-allergic, soothing, and anti-inflammatory effects. Many popular sunscreens on the market contain purslane extract, such as Winona's Sheer Sunscreen Milk, UNNY CLUB's Silky Whitening Sunscreen, and BLACKME's Half-and-Half Little Black Umbrella Sunscreen.

Mugwort Leaf Extract

Mugwort, as the whole herb of the Compositae plant Mugwort, its extract can accelerate the proliferation of keratinocytes and accelerate the metabolism of aging substances in the skin dermis. Adding mugwort leaf extract to sunscreen products can not only effectivelyrevitalize and anti-agebut also achieveantioxidant and anti-inflammatory effects. User feedback reveals thatJapanese and Korean sunscreen Brands are particularly fond of mugwort leaf extract. For example, brands such as Shangpulee, ELIXIR, Anessa, and enfuselle have added mugwort leaf extract to their popular sunscreen products.

Raw materials contribute to the synergistic whitening effect of sunscreens

Sunscreen synergistic whitening effect has become a consensus among sunscreen Brand research and development.Chinese people have always had a strong preference for whitening, which has extended from skincare lines to makeup lines and even to sunscreens, which are considered a "high-risk area." With the improvement of consumers' scientific whitening awareness, whitening needs are becoming more diversified and refined, which, to a certain extent, promotes the innovative development of upstream raw materials and scientific research technology. This development has in turn affected sunscreen products.

Currently, sunscreen Brands in the industry are using a variety of whitening ingredients and technologies to work together, maximizing the effectiveness of sunscreens. For example, Meifu Bao's small pink tube useshigh-purity nicotinamide, licorice flavonoids, VC derivativesand other ingredients in combination with Sym Relief 100 skin care technology and SolBlock light protection patented technology to achieve whitening, brightening, and spot lightening while providing high-factor strong sun protection, claiming“1 product replaces 3”。

Xiushufeng's Whitening and Beautifying Sunscreen does not simply modify skin tone from the outside but deeply nourishes the skin from the root cause of skin dullness, and can be considered as asunscreen skincare product. This product uses exclusive patented ingredients to build a three-dimensional improvement model, accurately improving spots and dull skin, and restoring the skin's radiance.

As mentioned earlier, new regulations have been successively implemented, which presents both opportunities and challenges for whitening and sunscreen products. To a certain extent, this can standardize the industry access standards for sunscreen products with whitening effects, raise the bar, and promote industry marketstandardization and complianceso that consumers can achieve comprehensive whitening effects while sun protecting.

Effective sunscreens become an opportunity

Sunscreen is no longer the only concern

Sun protection is the primary consideration; refreshing skin feel is a plus.

According to user feedback data tracking, the TOP 1 consumer demand for sunscreen products in 2023 is efficacy, followed by user experience, scenarios, and demographics. Consumers are most concerned about the product's sun protection effect, with a volume of 722,400. However, for sunscreen products, basic functions can no longer meet the ever-growing needs of consumers. In 2023, on the Alibaba platform, products claiming“sunscreen”, “moisturizing”, and “nourishing”functions accounted for 73.75%, 13.66%, and 6.40% of sales respectively, with a year-on-yeardecrease of 14.99%, 15.33%, and 4.29%。

In addition, the efficacy cloud map shows new terms such as "improvement of dullness," "soothing," and "anti-radiation." This shows that the dominant position of conventional sunscreen functions is weakening, and the market is accepting more diverse new sunscreen functions.

User experience, as a core consumer demand for sunscreen products, mainly includes ease of application, whether it is oily or sticky, and its friendliness to the skin, i.e., skin feel. According to user feedback data integration, consumer feedback on sunscreen use experience mainly focuses onrefreshing feeling, smooth feeling, and light feeling. Among them, the refreshing feeling has a volume as high as 1,192,700. In other words, consumers will consider the refreshing and light feeling of sunscreen products more when choosing products, to avoid subsequent problems such as makeup rubbing, and caking.

TGI reached 143, showing strong user stickiness among female sunscreen users.

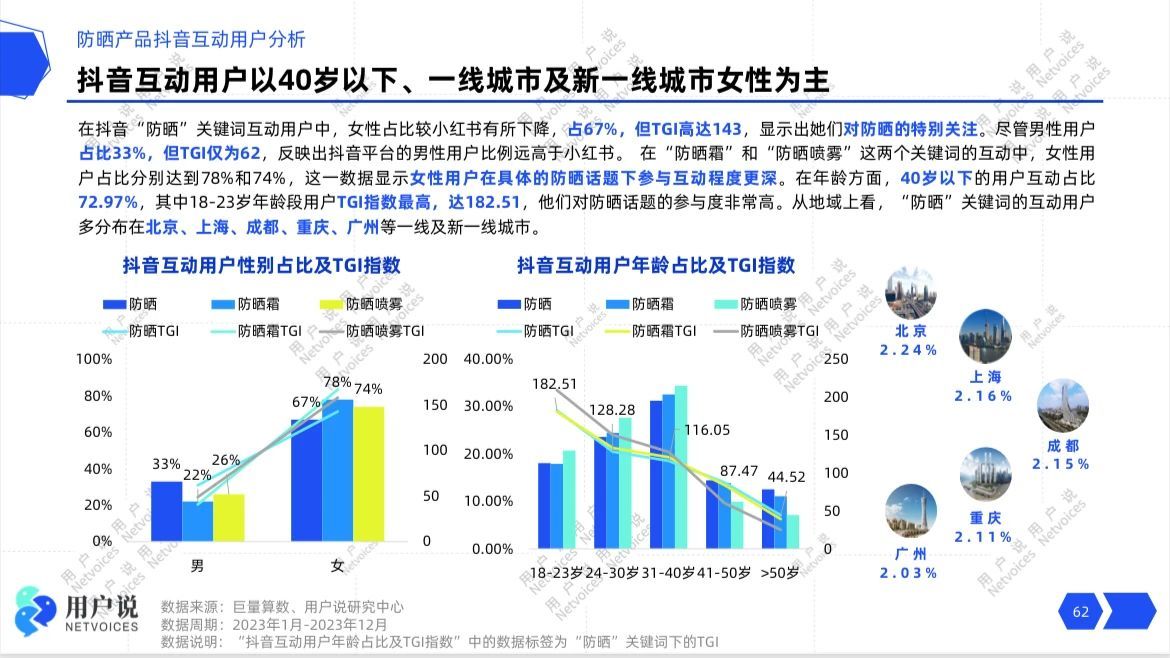

The age range of sunscreen users is wide, and there is no clear age boundary. On the Xiaohongshu platform, the main interactive users of sunscreen are in the [18-24] and [25-34] age groups,accounting for more than 60% in total.Similarly, on the Douyin platform, the user interaction rate for those under 40 years old is as high as72.97%Among them, the TGI index for users aged 18-23 is the highest, reaching 182.51. This shows that,consumers under 40 years old are the main force in the sunscreen marketwith a particularly strong awareness of sun protection and self-care. This group has a high level of engagement with new products, new topics, and new functions, which may further stimulate the development of the sunscreen market.

From the perspective of gender of interacting users, among users interacting with sunscreen keywords on Xiaohongshu,women account for over 88%occupying an absolute dominant position. In contrast, on the Douyin platform, women account for 67% of users interacting with sunscreen keywords, significantly lower than Xiaohongshu, but it's worth noting that the TGI index for women using sunscreen is as high as143This means that although the proportion of female users on Douyin is lower, this group's preference and attention to sunscreens are quite high, and user stickiness is strong.

It can be seen that,young women remain the main consumer group for sunscreen productsBrands can seek new inspiration from the needs of young women, and through continuous cultivation, discover more new growth points in the sunscreen market.

Mistine is far ahead

Domestic brands cultivate Douyin to achieve a breakthrough

Market "reshuffle"? Domestic sunscreen brands target the Douyin market

For a considerable period of time, the Chinese sunscreen market was dominated by Japanese and Thai brands, with a very limited market share for domestic brands. However, in recent years, with the rise of domestic brands and the dual impact of the Japan nuclear contamination issue,the sunscreen market is poised for a major "reshuffle".。

On the Taobao Tmall platform, among the top 10 sunscreen sales brands in 2023, MISTINE took the lead with1.08 billionin absolute share, followed by Anessa, Lancome, Shiseido, and Winona. Although domestic brands only haveWinonaandFlower Knowson the list, the two together achieved a GMV of 480 million yuan, with Winona, the leading domestic sunscreen brand, contributing 360 million yuan in achievements, entering the top 5 and expected to compete with Shiseido, a leading Japanese brand.

From the perspective of sunscreen sales volume, MISTINE achieved the highest sales volume, selling over 10.33 million sunscreen products on Alibaba's platform in 2023, surpassing Anessa by nearly 5.68 million units, which is quite amazing.

In addition, according to Youshuo's data, domestic brands performed particularly well on the top 10 list of sunscreen sales on Douyin. Meikang Fendai, Flower Knows, Yariche, and Touzhimi all made the list, together contributing nearly 800 million yuan in achievements. The market share of domestic sunscreen brands on Douyin is much higher than that on Alibaba's platform. This shows that many domestic sunscreen brands are starting to target the Douyin platform as their "battleground." In the future, Douyin is expected to become the main battleground for the competition among domestic brands.

Next, Youshuo will focus on analyzingYuze, Yifidan, and UNNY CLUBthe paths of these three domestic brands' rise in the sunscreen market.

Yuze: Developing the large-molecule sunscreen market

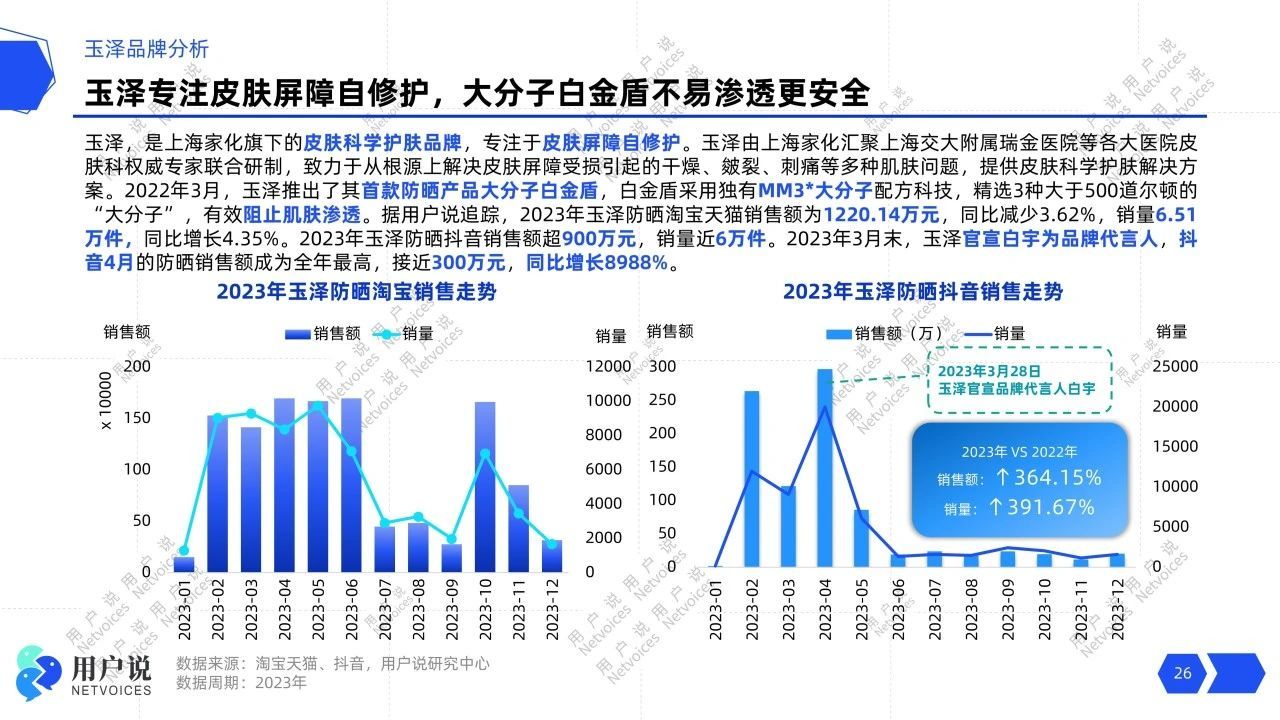

Established in 2009, Yuze, along with brands like Liushen and BaiCaoJi, is affiliated with Shanghai Jahwa United Co., Ltd. The brand focuses on skin barrier self-repair, positioning itself as a "skin barrier repair expert," aiming to solve skin barrier damage from the root cause,dryness, roughness, chapping, acne, stinging, rednessand other skin problems, providing consumers with scientific skincare solutions.

As a brand jointly developed by Shanghai Jahwa and leading dermatologists from Shanghai Jiao Tong University Affiliated Ruijin Hospital and other major hospitals, Yuze was one of the earliest domestic brands to adopt the“medical research cooperation driven brand”model, also known as "cosmeceutical." Therefore, in the early stages, Yuze products were mostly sold to hospitals and pharmacies. Around 2019, Yuze began to enter CS channels and experiment with then-popular Taobao live streaming. Since then, Yuze has expanded its market and brand awareness, becoming a leading brand in the dermatological skincare market.

Currently, Yuze's product line covers cleansers, masks, creams, lotions, and body care. Yuze's layout in the sunscreen market was relatively late; it wasn't until March 2022 that it launched its first sunscreen product, the large-molecule Platinum Shield. Despite its late start, this product has become one of Yuze's best-selling items.

According to Youshuo's data tracking, in 2023, Yuze sunscreen products achieved a total of12.2014 million yuanin achievements on Alibaba's platform, selling 65,100 sunscreen products. Sales were significantly higher from February to June due to seasonal factors, averaging 15 million yuan. In October, with the boost from major e-commerce promotions, Yuze's monthly sales once again exceeded 1.5 million yuan.

Unlike the Alibaba platform, the sales of Yuze sunscreen products on Douyin fluctuated greatly, and were less affected by major promotions. In 2023, Yuze's Douyin sunscreen salesexceeded 9 million yuanwith nearly 60,000 units sold, with sales and sales volume both increasing by over 360% year-on-year. In late March 2023, Yuze officially announced the actor Bai Yu as the brand's spokesperson, and Bai Yu's drama "Longcheng" premiered on April 15. With the dual support of the TV series and the celebrity's influence, fan economy was further stimulated. Therefore, in April, Douyin sales of Yuze sunscreen reached 3 million yuan,an increase of 8988% year-on-year.

As Yuze's first sunscreen product, the large-molecule platinum shield is one of the few large-molecule sunscreen products currently on the market. What are large-molecule sunscreens? Studies have shown that the human skin barrier can block the entry of some external substances, but it cannot prevent the entry of small molecules. When the molecular weight is as large as about 500Da, skin absorption will rapidly decrease.

In other words, for the skin, traditional small-molecule chemical sunscreens are easily absorbed by the skin, and their ability to resist light damage is relatively low, while large-molecule sunscreens have a large molecular weight, less skin penetration, and relatively less damage and irritation to the skin. Therefore, it can simultaneously achievehigh-level protection and skin soothingLarge-molecule sunscreens are more favored by people with sensitive and fragile skin.

Yuze's large-molecule platinum shield, specially developed for sensitive skin, uses a unique MM3 large-molecule formula technology, carefully selecting three molecules larger than 500 Daltons, including methylene bis-benzotriazolyl tetramethylbutylphenol, bis-ethylhexyloxyphenol methoxyphenyltriazine, and ethylhexyl triazone, to achieve excellent light stability while providing broad-spectrum, high-level sun protection.In order to practice the brand positioning of "skin barrier repair expert", Yuze also added ectoine, Ophiopogon japonicus, ginger root extract, commiphora myrrha resin, and biological sugar gum to the sunscreen, maximizingexternal protection, internal skin nourishmentsunscreen purpose.

Ifidan: High unit price creates differentiation

Ifidan belongs to Bienchi Love Co., Ltd., and was founded in 2007 by French nobleman Charles-Edouard Barthes. As an anti-aging Brand specially developed for sensitive skin, Ifidan has a globally exclusive QAI anti-aging skincare formula, which combinestriple collagen, coenzyme Q10, mulberry bark extract, and amino acidsThese four active ingredients are fused to activate the skin from the inside out, delaying cell aging. It is a gentle anti-aging formula specially developed for sensitive skin.

Currently, Ifidan has applied this formula to its entire product line, including sunscreens. Ifidan's triple collagen essence sunscreen is specially developed for sensitive skin, inspired by skin collagen, achieving three effects in one: skin nourishment + anti-aging + anti-aging. It combinessunscreen, essence, makeup primer, and isolationfunctions into one all-in-one sunscreen.

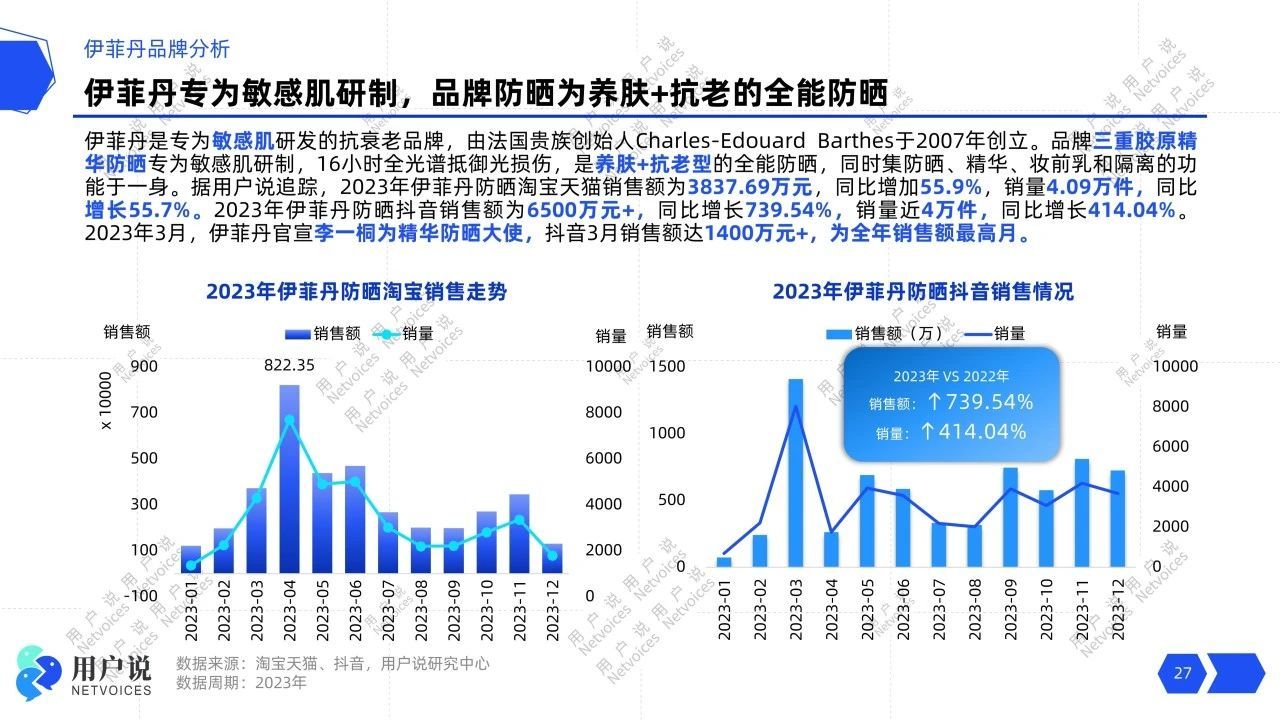

According to user data integration, in 2023, Ifidan sunscreen sales on Taobao and Tmall were38.3769 million yuanwith sales of 40,900 pieces. Both sales volume and sales value increased by more than 50% year-on-year. However, it is worth noting that in 2023, Ifidan's Douyin sunscreen achievements have far surpassed the Alibaba platform, with annual sunscreen sales exceeding 65 million yuan,a year-on-year increase of 739.54%a total of more than 40,000 sunscreen products were sold,a year-on-year increase of 414.04%. In March 2023, Ifidan officially announced Li Yitong as the brand ambassador for its essence sunscreen. That month, Douyin sales soared to over 14 million yuan, demonstrating a significant celebrity economic effect.

In addition, users have noticed that as a luxury Brand, Ifidan sunscreen's average transaction priceis as high as 938.31 yuanthe average price per gram is as high as22.4 yuan/ml. In fact, the average transaction price of sunscreen products on the Douyin platform in 2023 was only 56.34 yuan. In other words, Douyin consumers actually prefer sunscreen products with high cost performance, but Ifidan is an exception. It first locked in the high-consumption group of Douyin sunscreen, creating the Brand's differentiated advantages through full-chain skin care efficacy and essence-level ingredient compounding, standing out among a large number of sunscreen products.

UNNY CLUB: Adapting to multiple scenario needs

Since its establishment in 2014, UNNY CLUB has always adhered to minimalism as its Brand philosophy, simplifying complexity and making it suitable as a carrier for Brand aesthetics and attitude. Currently, UNNY CLUB's sunscreen product matrix mainly includes sunscreen lotions that focus on physical and chemical three-in-one full-spectrum sun protection, and sunscreen sprays that specialize in "water-feeling sunscreen" black technology.Unlike Ifidan and Yuze, UNNY CLUB's sunscreen products focus on waterproof and sweat-proof technology WSPROOF™, which means that after applying the sunscreen and encountering water for 40 minutes,。

the UA filtration rate is still as high as 97%In addition, the SPF sun protection factor can still reach 36 after bathing. In other words, UNNY CLUB's sunscreen products can not only meet the basic needs of daily commuting, but also meet the needs of various scenarios such as outdoor sports and beach surfing.Users have found that in 2023, UNNY CLUB sunscreen products achieved comparable sales on Alibaba and Douyin platforms, basically remaining at the same level. It is worth noting that the sales and sales volume of UNNY CLUB sunscreen products on the Alibaba platform have both declined, while at the same time,

Douyin platform achieved a double increase in sales and sales volumeIt is not difficult to see that UNNY CLUB, using live broadcasts, KOL cooperation, video promotion, and other comprehensive Brand promotion matrices, has established a traffic pool on the Douyin platform, prompting many UNNY CLUB consumer groups to switch from Taobao and Tmall to the Douyin platform. The Douyin platform may become the core channel for UNNY CLUB's continued cultivation in the future.。

Sunscreen new products roll to new heights

Ingredient transparency, skin feel experience, film-forming technology revolution

While reviewing the development trends of sunscreen products in 2023, new sunscreen products in 2024 have already shown the industry's innovation trends and characteristics, undoubtedly reflecting the Brands' commitment to meeting consumers' growing demand for efficient, comfortable, and aesthetically pleasing products.

First,

The trend of ingredient transparency is significant成分透明化的趋势显著Consumers have found that the details pages of sunscreen products more openly display information about sunscreen agents and their protective wavelengths. This practice not only promotes consumer understanding of product ingredients and enhances trust, but also improves the overall transparency of the products.

Next, in terms of skin feel, Brands are competing througha refreshing, non-greasy user experienceto grab market share. By refining the description of product skin feel, such as "non-greasy upon initial use, and does not cause dryness with continued use," Brands emphasize the unique selling points of their products, catering to consumers' pursuit of a comfortable user experience.

In addition, the emphasis on film-forming technology has also become a major highlight of this year's new sunscreen products. By combining hard film and soft film technologies, sunscreen products can provide more uniform and long-lasting protection, while also improving their waterproof and wear-resistant properties, making the products stand out in the market.

In terms of technological innovation, this year's sunscreen products are also full of highlights, such asProya's Air Super Film Protection TechnologySuch innovation not only enhances the market competitiveness of the products, but also sets new standards in terms of protection performance and user experience.

In addition, the use of patented ingredients further demonstrates the Brand's technological strength. For example, products using patented ingredients provide consumers with more effective protection solutions, showcasing the Brand's technological innovation capabilities. Finally, the improvement in aesthetics is also a significant feature of this year's new sunscreen products. Brands attract consumers through carefully designed packaging and page tones, enhancing the visual appeal of the products and further strengthening their market competitiveness.

With theyear-round sun protectionandscenario-based sun protection conceptbecoming increasingly popular, we are witnessing a key moment, the consumer population of sunscreen is rapidly expanding, and the market's desire for innovation is unprecedentedly high. If Brands want to occupy a favorable position in this wave, they should focus oningredient innovation, R&D investment, protective efficacy, and in-depth development of scenario-based applicationsThis strategy not only promotes the continuous progress of sunscreen raw materials and technologies, but also brings unprecedented growth momentum to the entire market.

The "2024 Sunscreen Market Consumption Trend Insight Report" conducts in-depth exploration and understanding of this year's sunscreen trends. Through in-depth analysis ofMeifu Bao, Shuyu Ke, La Roche-Posay, Xiufu Sheng, Anessa, BlankMe, Niveaand other mainstream Brands, the report not only reveals the current market situation, but also provides rich insights for Brand strategic planning and innovative development.

Innovation in the upstream and downstream of the sunscreen industry all points to a common goal: to meet the growing consumer demand while driving the sunscreen industry towards higher levels of technological innovation and sustainable development. It is through this continuous effort and innovation that sunscreen products have gradually become an important part of people's year-round skin protection. Users say they firmly believe that,Through the joint efforts of the industry and continuous innovation, the sunscreen market will continue to maintain its vigorous development momentum, bringing consumers more safe, effective, and sunscreen solutions suitable for various life scenarios.