Cleansing products break the 18 billion yuan mark! Is it the rise of domestic cleansing products? CeraVe, Fulimanpu, and Ocean Supreme leading the way?

Category:

Keyword

language analysis information

Weight

Stock surplus

隐藏域元素占位

- 详情概述

-

- Commodity name: Cleansing products break the 18 billion yuan mark! Is it the rise of domestic cleansing products? CeraVe, Fulimanpu, and Ocean Supreme leading the way?

Overview

Total word count: 8596 words

Reading time: 10-12 minutes

1. In 2023, the total sales of cleansing products onTaobao, Douyin, and JD.comreached a total of18.25 billion yuan,with a year-on-year increase of 6.4%.

2. Cleansing products have broken through the traditional forms of creams, lotions, and pastes,cleansing powder, cleansing beans, cleansing honeyand other diversified products have attracted much attention.

3. With more than 500 million yuan in cleansing product Achievements, Jiaorunquan ranks first on Douyin, exceeding the sales of Zhiben.

4. Cetaphil has tailor-made a cleansing product for Chinese consumers—Amino Acid Cleanser。

5. Mid-tier and junior key opinion leaders (KOLs) on Xiaohongshu havehigh return on investment and high fault tolerance rates,making them the preferred choice for cleansing Brand marketing investment.

6. Many cleansing Brands have begun to introduce the concept of fragrant cleansing, organically combining fragrance with cleaning to achieveemotional cleansing。

7. In the cleansing product market,prebioticsare gaining popularity, and many cleansing Brands are using prebiotics as a starting point to Enter the micro-ecological functional skincare market.

The Book of Rites states:“Every five days, boil water for a bath, and every three days, wash hair. In between, if the face is dirty, boil water to wash it.”As early as the Shang and Zhou dynasties, people used rice water to cleanse their faces, achieving basic facial cleansing. Today, the cleansing product field has presented a variety of ingredients, technologies, and product forms.

Since ancient times, cleansing has been the most “unbreakable” link in the underlying logic of skincare, and has always been a skincare necessity for consumers. According to data tracking by Usersay, over83.66%of consumers indicate that cleansing is an indispensable step in their daily skincare routine, followed by toner and face cream. This shows that cleansing maintains a crucial position in the entire skincare market.

In recent years, the cleansing market has shown a situation of fierce competition, with a heated battle between domestic and international Brands. According to Tmall’s best-selling facial cleanser ranking,Zhibenhas surpassed the cleansing category leader, Freeplus, and has topped the list for eight consecutive weeks, becoming a rising star Brand in the cleansing category.

In addition to Zhiben, domestic Brands such as Hongzhi, Ximu Yuan, and Youshiyan have also become core contributors to the cleansing market. Furthermore, first-tier international Brands such as Clinique, CPB, and POLA continue to improve their ingredients and technology, launching new cleansing products. The entire category shows unprecedented market resilience.

The Brand battle for the cleansing market in 2024 has quietly begun,how can the cleansing category explore and develop new methods? What is the secret of leading domestic cleansing Brands? And how can overseas leading Brands actively develop the cleansing market?

In order to further analyze the growth trend and development trend of the cleansing category, Usersay has launched a new“2024 Online Cleansing Product Category Report”,based on data from Taobao Tmall, JD.com, and Douyin, fromconsumer market insight, logic of creating best-selling products, Brand analysis research, marketing investment paths, user portrait demand trendsand other dimensions, comprehensively analyzes the needs and pain points of users in the cleansing product market, deeply explores the key points and strengths in the development of the cleansing market, and unlocks the market breakthrough points for cleansing products.

We hope to, by reviewing the rules and logic of explosive products in the cleansing market, insight into the trends and directions of online cleansing product consumption, help Brands seize the winning keys, stand firm in the ever-changing cleansing market, continuously release Brand potential, and thereby drive the volume increase of the cleansing industry and maintain a high level of prosperity.

Full report70page

Original price¥899

(Contact customer service at the end of the article to receive coupons)

Cleansing products exceeding 18.25 billion yuan

demonstrates strong market vitality and resilience

Enthusiasm for cleansing products remains high,

Douyin leads the cleansing product market?

「Data is not the answer, but it can point you in the right direction. 」

——American statistician W. Edwards Deming

Data is the basis of all major trends that are occurring, and this is especially true for the beauty industry. Recently, data released by the National Bureau of Statistics shows that in 2023, the total retail sales of above-limit cosmetics reached 414.2 billion yuan,setting a new high for cosmetics retail sales in the past 10 years。However, it is worth noting that the year-on-year growth rate of cosmetics retail sales in 2023 was5.1%,with a significant slowdown in growth, lagging behind the overall consumer market. It is clear that although the consumer level of the entire cosmetics market in 2023 did not meet expectations, it is undeniable that the cosmetics market is warming up, and the cleansing product category is also showing signs of warming up.

According to Usersay data tracking, in 2023, the total sales of cleansing products on Taobao, Douyin, and JD.com reached18.25 billion yuanyear-on-year growth6.4%year-on-year growth31%It is evident that facial cleansers, as a consumer necessity, still demonstrate strong market vitality and resilience. Consumer enthusiasm for facial cleanser products remains high and unwavering.

From a segmented platform perspective, Taobao remains the largest market for facial cleanser products, with platform sales reaching10.328 billionwith accumulated sales of 100 million. However, it is worth noting that thesales on the Taobao platform decreased by 7.1% year-on-yearwhile sales increased by 12.8%. The reasons for this include a decrease in the average order value of products, an increase in the market share of low-priced facial cleanser products, leading to an overall decline in sales, and the gradual shift of Taobao traffic to Douyin, an omni-channel interest e-commerce platform.

According to data tracking, in 2023, the sales of facial cleanser products on the Douyin platform increased year-on-year by118.9%year-on-year growth108.7%In terms of sales, the Douyin platform's facial cleanser products achieved annual sales of 4-5 billion. Although the volume is significantly lower than that of the Taobao platform, the year-on-year growth of Douyin sales reached 118.9% while sales on Taobao and JD.com both declined year-on-year.

This is sufficient to prove that“content + shelf”consumption model has gradually been accepted and sought after by consumers. With the support of short videos and live streaming e-commerce, it is foreseeable that Douyin will continue to seize market share in the facial cleanser market and extend the life cycle of facial cleanser products on the Douyin platform.

Are cleansing creams/lotions becoming saturated?

Cleansing gels may become a new trend

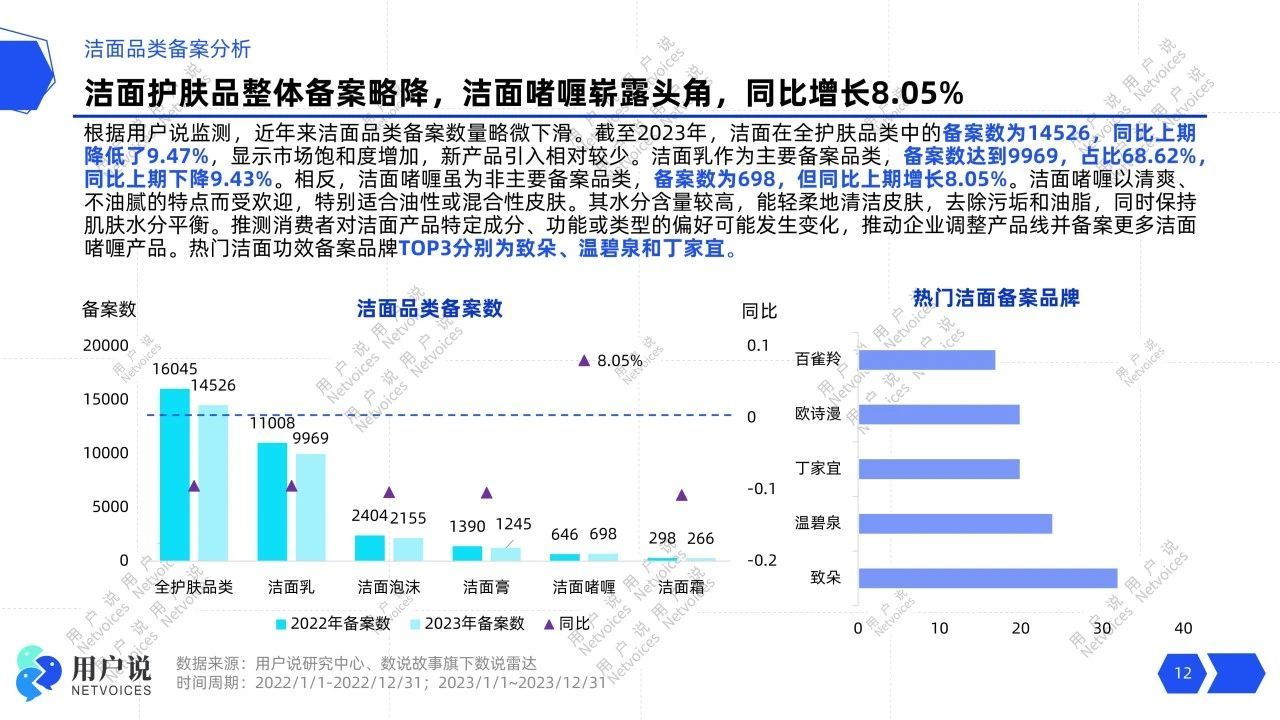

In recent years, with the segmentation of consumption scenarios and consumer demand, new forms and methods of facial cleansing have attracted much attention from consumers. From the perspective of registered products, in 2023, the number of registered facial cleansers in the entire skincare category was 14,526,a year-on-year decrease of 9.47%Among them, the number of registered products in core sub-categories such as cleansing milk/foam/cream/lotion has decreased to varying degrees. Only cleansing gels, a non-mainstream registered product category, achieved positive growth,with an annual registration number of only 698, but a year-on-year increase of 8.05%.

It can be seen that although cleansing milk/foam/cream/lotion dominate the facial cleanser market with high penetration rates, the market for basic products is gradually becoming saturated. Conversely, with cleansing gels leading the way,the number of registrations for non-mainstream facial cleanser product forms has increased.。

It can be seen that consumers' preferences for specific ingredients, functions, or types of facial cleanser products are changing, and facial cleanser product lines may become more diversified and scenario-based. At present, facial cleanser products are breaking through the traditional forms of creams, lotions, and gels, and Brands and consumers are beginning to focus oncleansing powder, cleansing beans, and cleansing honey, among other more diverse product forms.。

For example, the high-end niche skincare Brand TATCHA launched a Japanese geisha-stylerice cleansing powderusing a large amount of rice bran ingredients to achieve deep cleansing and brightening of the skin; the Hong Kong Brand M19Minus uses Oil-In-Powder technology to createa cleansing bean product that turns into milk when it meets water; and the brand Aier Boshi under Furide launched a best-sellingcleansing honeyusing a combination of triple amino acids and APG surfactants to achieve gentle cleansing.

The volume of facial cleanser products increased by 170.6%,

with a peak in popularity during spring and summer.

“Volume reflects consumers' attitudes towards a category and also reflects the market competitiveness of the category.”

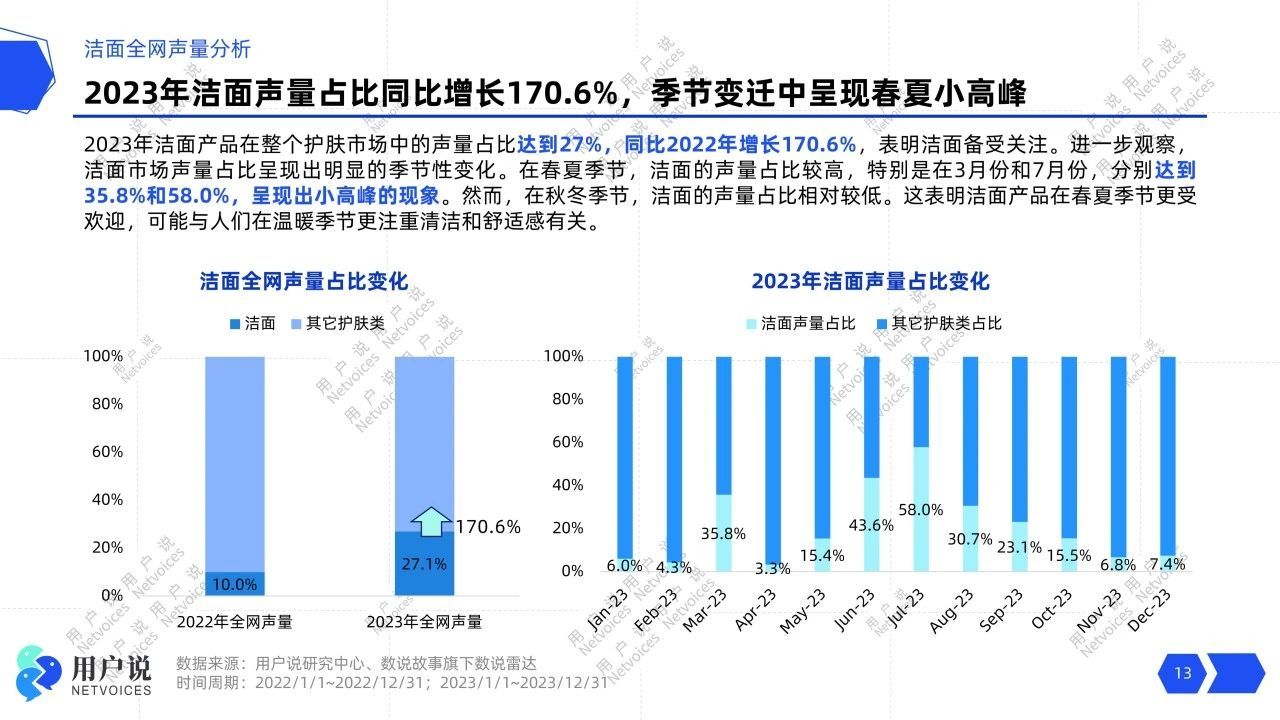

According to data tracking from Usersay, in 2022, the volume of facial cleanser products in the entire skincare market was only 10%, while in 2023, this figure soared to 27%,a year-on-year increase of 170.6%. This growth is partly due to the increase in consumer demand for the facial cleanser market, and partly due to the support of the fan economy behind celebrity endorsements. In 2023, many facial cleanser Brands formed a “bundling” relationship with traffic stars, and many Brands used the influence of stars to achieve“volume + sales”a double harvest.

For example, in May 2023, CeraVe collaborated with its brand ambassador Luo Yunxi for its cleansing product, launching various promotional activities. At that time, Luo Yunxi's hit drama "Long Moon Without End" was very popular, which to some extent helped CeraVe's facial cleanser products achieve efficient traffic diversion. Data shows that CeraVe's facial cleanser had a volume of 1.29 million that month,an increase of 301%.。

In addition, similar to sunscreen products, the volume share of the facial cleanser market also shows a significant seasonal change. According to the data, in 2023, thevolume of facial cleanser products was highly concentrated in the spring and summer seasonswith July accounting for 58% of the volume, the highest volume in nearly a year, followed by June and March.

It can be seen that consumers' enthusiasm for facial cleanser consumption is lower in autumn and winter, and the volume share is relatively low. However, during the spring and summer seasons, due to the increase in air humidity and temperature, the skin's perception of oil secretion ability is enhanced, and the amount of facial oil increases, so consumers' demand for facial cleansing and volume also increase. Therefore,consumers' demand for facial cleansers is high in summerBrands can seize this key time node, launch new products in a timely manner, or create momentum for existing products, and amplify the market competitiveness of Brands in the facial cleanser market.

The strong rise of facial cleanser Brands

Douyin Becomes a Major Sales Base for Cleansers

Freeplus Achieves 817 Million in Annual Sales,

Jiao Runquan Tops Douyin Charts

As a major category in skincare, cleansers are the first step for many brands entering the beauty industry. Whether it's a leading international brand or a niche domestic brand, many are keen on establishing themselves in the cleanser market, positioning cleansers as a major product for their brand. According to aggregated data, in 2023, the sales of the top 10 cleanser brands on Taobaocollectively contributed 3.206 billion yuan in achievements, accounting for 31.3% of the market shareamong which Freeplus817 million yuanin sales secured the top spot, followed by brands such as Zhiben, CPB, and Korres.

Usersay found that among the top 10 brands, domestic brands accounted for 4 seats, namelyZhiben, Ximu Yuan, Youshiyan, and Aier BoshiThese four brands, with an average unit price of less than 100 yuan, collectively contributed1.08 billion yuanin sales.

It is noteworthy that the overlap between the top 10 cleanser brands on the Douyin platform and Taobao is only 20%, which meansa major reshuffle of cleanser brands has occurred on the Douyin platform. In 2023, the top 10 cleanser brands on Douyin collectively contributed 1.55 billion yuan in achievements, approximately 50% of Taobao's total.

Among them, Jiao Runquan, established in 2023,ranked first with impressive achievements of over 500 million yuanclosely followed by C-咖, a new skincare brand established just two years ago. It is evident that new entrants are making strides in this lucrative platform, and Douyin is expected to become the main marketing base for many new domestic brands. Further observation reveals that Jiao Runquan's cleanser sales have surpassed Zhiben, the top domestic cleanser brand on Taobao. The status of leading brands in the cleanser market is precarious. How will emerging brands seize opportunities in the cleanser market?

Next, Usersay will focus on analyzing the three major brands, CeraVe, Fuyu Manpu, and Ocean Supreme, fromrepairing cleansers, aromatic cleansers, and men's cleansersthree dimensions to explore the growth path of cleanser brands.

CeraVe: Specializing in triple ceramides,

Douyin cleanser GMV increased by 273%

"The first step in skincare is to repair the skin barrier"

CeraVe was founded in 2005 by leading American dermatologists and is currently the largest brand under L'Oréal's dermatological beauty division. As a product recommended by professional dermatologists in the United States, CeraVe has two major differentiating highlights. The first is that all its products contain3 ceramides 1, 3, 6-IIwhich can effectively resist interference from external irritants and achieve the functions of strengthening the barrier structure, repairing dryness and damage, and deep hydration.

The second is that in order to achieve 24-hour long-lasting hydration, the CeraVe R&D team has developedpatented MVE TechnologyThis technology is a multiphase water-in-oil multi-microvesicle emulsion system that can gradually release moisturizing ingredients such as ceramides and hyaluronic acid, helping the skin better lock in moisture and achieve long-lasting moisturizing effects.

According to Usersay data tracking, in 2023, CeraVe's total sales of cleansers on Taobao Tmall were163 million,a year-on-year increase of 52.07%Although sales on Douyin were slightly lower than on Alibaba, the year-on-year growth rate was as high as273.29%。

Currently, Alibaba remains the major sales base for CeraVe cleansers. However, Usersay found that CeraVe has recently started to increase its efforts on Douyin, with increasingly diversified and refined platform layout and investment. For example, CeraVe collaborated with cleanser spokespersonsYang Yang, Zhang Linghe, and Zhao Lusito create multiple popular short videos, driving growth through content. In the future, CeraVe's cleanser market share may continue to shift from Alibaba to Douyin.

In 2023, CeraVe had three cleanser products, namely salicylic acid cleanser, amino acid cleanser, and green amino bubble cleanser, to suit various skin conditions such as oily and dry/sensitive skin. This year, CeraVe collaborated with spokesperson Zhao Lusi to launch a new cleanser product"Amino Cleanser"This cleanser, reportedly developed based on the characteristics of Chinese skin, is CeraVe's first product specifically developed for Chinese consumers.

Unlike the brand's previous cleansers, this Amino Cleanser usesdual-state liquid crystal amino acid-type surfactantscompounded withtriple ceramides and centella asiatica extractto achieve maximum gentle deep cleansing. Its excellent cleaning power can even help remove light makeup and sunscreen, truly achieving "gentle" skin care.

AromeManpo: Aromatherapy + Bio-fermentation,

New Cleansing Honey Crystal Sparks Controversy?

"Exploring the peak of ingredients and efficacy with full-bodied products"AromeManpo has nearly ten years of aromatherapy genes and is the first brand in Chinato use aromatherapy + microecological skincare system as its coreThe brand has created a tuberose luminous fermentation series around the tuberose ingredient, which currently covers multiple categories such as essence water, face cream, essence oil, and eye oil.

In 2023, Furong Manpu officially entered the facial cleanser market, launching its first facial cleanser product - Tuberose Luminous Fermentation Essence Cleansing Honey. According to data, from May 2023 to December 2023, Furong Manpu's total sales of facial cleansers on Taobao and Tmall reached5.677 millionWith sales exceeding one million in October alone during the big promotion, market expectations are quite high.

This cleansing honey is based on the concept of"Aromatic Therapy + Bio-Fermentation"using 50% fermented essence composed of fermented centella asiatica essence, self-developed tuberose "Fu Yu Xing" fermentation group, and purslane patented fermentation essence to replace water, increasing the content of effective ingredients to achieve gentle hydration and gentle exfoliation.

In addition, in order to achieve"Return to basics, moderate cleansing"vision for facial cleansing, Furong Manpu uses a combination of triple amino acids and APG surfactants in its cleaning system to achieve high-purity and gentle synergistic effects. To test the product's gentle cleaning ability, Furong Manpu commissioned a third-party authoritative institution to conduct human skin patch tests. The results showed that none of the 30 subjects experienced any adverse skin reactions, further validating the product's efficacy and safety.

However, earlier this year, Furong Manpu released a statement on its official account regarding the crystallization problem of the Tuberose Luminous Fermentation Cleansing Honey. The statement indicated that since the end of November 2023, the brand has received reports about the crystallization of the cleansing honey. Therefore, the brand recalled the problematic products for internal testing and institutional testing. The test results showed that the crystallization problem was caused by sudden temperature changes, leading to"Cocoyl Glycinate/Cocoyl Glutamate"crystallization of the amino acid cleanser surfactant, with no other microbial exceeding standards.

Currently, the brand has replaced the relevant amino acid cleanser surfactant in the newly produced cleansing honey and has recalled the crystallized products. The crystallization issue has precedents before Furong Manpu, such asbobbi brown's popular cleansing oil, john jeff's salicylic acid cleanseretc. Although Furong Manpu has replaced the relevant ingredients, the crystallization issue has caused some consumers to question the product, therefore, the brand must rebuild trust with consumers.

Enthusiasm for cleansing products remains high,

Douyin leads the cleansing product market?

Unlike CeraVe and Furong Manpu,Ocean Supreme is a green brand focusing on men's skincareFounded in 2020, the brand has been committed to improving men's skin problems and providing comprehensive solutions for men's overall appearance.

Facial cleansing has always been the most basic and widely accepted category in men's skincare. Therefore, many men's skincare brands, such as Liran and Dear Boyfriend, which have emerged in recent years,have chosen facial cleansing as their entry point into the marketAs a rising force in the new consumer era,Ocean Supreme uses facial cleansing as its core category to create a complete skincare system for male consumers.

Currently, Ocean Supreme's facial cleanser product matrix mainly includes two categories: cleansing milk and cleansing mousse. Among them, the brand's popular Prism Cleansing Milkbreaks through the traditional blind spots of men's facial cleansers, achieving the three effects of oil control, acne removal, and cleansing.The product uses the blue algae Annoin patented ingredient to provide moisturizing, anti-inflammatory, and repairing effects for men's skin. To effectively reduce oiliness, the brand adds a patented supramolecular salicylic acid to the product, using a unique anti-gravity suspension process to quantitatively and effectively reduce facial oiliness, achieving 8 hours of refreshing and non-greasy skin.

According to user data tracking, in 2023, Ocean Supreme's total sales of facial cleansers on Taobao and Tmall were 325,500, a year-on-year increase of 92.19%, with relatively stable sales throughout the year, not significantly affected by the peak sales months. In addition, it was found thatStarting from August 2023, the brand's sales of facial cleanser products have shown a monthly declinewith December sales dropping to 13,600, the lowest value for the year.

At the same time, Ocean Supreme's facial cleanser products have seen steady sales growth on the Douyin platform since August, with nearly 70,000 sales in November, surpassing the sales on the Alibaba platform. It's clear thatSince the second half of the year, Ocean Supreme's facial cleanser sales platform has shifted from Taobao and Tmall to the Douyin platformand overall sales have surpassed those on Alibaba. In the future, Ocean Supreme's focus on the facial cleanser market may shift to the Douyin e-commerce platform.

Market Continues to Roll Low Price

Amino Acid Compound Brings New Growth

And the initial average transaction Price is high,

Furong Manpu's Price per unit exceeds 1 yuan

Because facial cleanser products are necessities and easily consumed, most consumers tend to choose cost-effective products with lower unit Prices when selecting them. From the analysis of Taobao's facial cleanser Price category,Facial cleansers in the 50-100 yuan range dominatefollowed by facial cleansers in the 200-500 yuan and 100-200 yuan ranges. In addition, facial cleansers priced under 10 yuan showed the most significant increase, reaching137.63%。

In terms of specific brands, the average transaction Price of facial cleansers from Qu Chu is the highest among those analyzed in this report, reaching 265 yuan, and also has the lowest Price per unit (ml)at only 0.36 yuan per mlThis is mainly because Qu Chu sells its products primarily as combination sets, which increases the average transaction Price of facial cleansers.

In addition, in terms of price per unit (ml), Furui Manpu's amino acid cleansing honey has the highest price per unit (ml), at1.19 yuan/ml,and is also the only brand among the top ten brands analyzed in this report with a price per unit exceeding 1 yuan. It is evident that from the price environment of cleansing products, inexpensive cleansing products are still the core products of the market, deeply loved by consumers, and the future cleansing market may continue to focus on low prices.

Amino acids dominate the cleansing market,

Jiao Runquan, and Qichu's specialized patented ingredients

Currently, consumers' most basic needs for cleansing productsare cleaning, followed by derivative functions such as anti-oxidation, soothing, and whitening.And for cleansing products to achieve cleaning, surfactants are indispensable. Currently, the mainstream surfactants in cleansing products are divided into three categories: soap-based surfactants, amino acid surfactants, and APG surfactants. Among them,amino acid surfactants have the highest market acceptance and category penetration rate.

According to data integration from user feedback, in 2023, the TOP 1 ingredient demand for cleansing milk, cleansing honey, and cleansing foam is all amino acids. Currently, the leading products in the cleansing market are almost all amino acid cleansers, includingFreeplus cleansing milk, Zhiben's soothing and repairing cleansing milk, and HBN's amino acid cleansing milketc. However, user feedback shows that although the volume of amino acid ingredients has increased, it has decreased year-on-year compared to 2022, with the volume of amino acid ingredients in cleansing foam decreasing by 55.3% year-on-year.

It is foreseeable that after the cleansing market enters the 3.0 era, APG surfactants are expected to become the new favorite of cleansing surfactants, and the future development path of amino acids maybe mainly based on APG compounding,a strong combination. For example, DDG's cleansing jelly uses a triple APG glucoside compound plant amino acid advanced two-way cleaning system to achieve deep cleansing of the skin while gently cleansing the face.

In addition to amino acids, many brands have begun to compound patented ingredients to further improve the cleansing power, gentleness, and skin feel of cleansing products. For example, Jiao Runquan, based on the amino acid formula, uses dual patented ingredientsβ-glucan + Yuefuningto enhance skin tolerance while repairing, achieving the two core needs of deep skin cleansing and soothing. Qichu uses dual-patented high-purity amino acid compound specialized oil-removing ingredients, usingmandelic acid and butyl avocado oilto achieve efficient pore unclogging and oil removal, further regulating the skin's oil-water balance.

Mass-market products dominate the cleansing market

Douyin live streaming achieves a combination of effectiveness and efficiency

Cleansing marketing presents mass-market and homogeneous characteristics

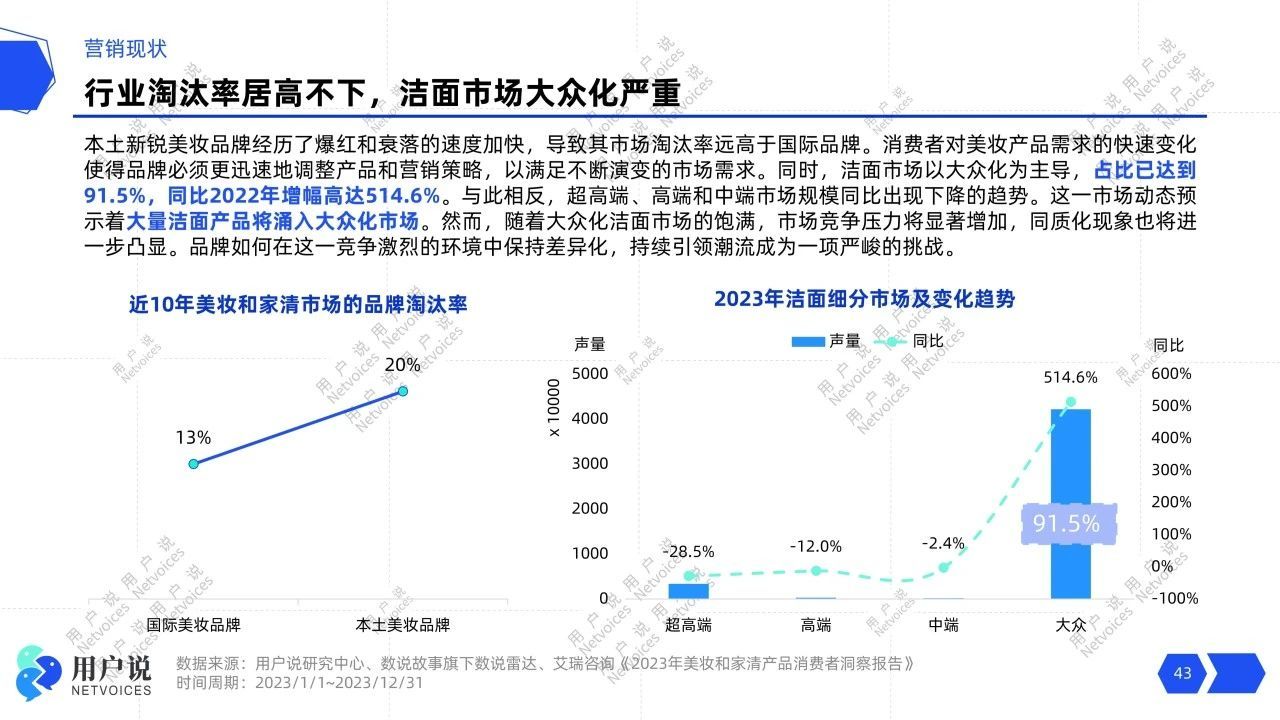

At present, China's cosmetics consumption market is dominated by mass-market products, and the cleansing product category basically follows this law. In 2023, the mass market in the cleansing marketaccounted for as high as 91.5%,with a year-on-year increase of more than 514.6% compared to 2022. At the same time, the ultra-high-end, high-end, and mid-end markets have shown a downward trend year-on-year. This market dynamic also indicates that the mass-market cleansing market is rapidly expanding, with an increase in the market base and size.

To a certain extent, this phenomenon will lead to the saturation of the mass-market cleansing market, and products will gradually become homogeneous. At that time, homogeneity will become a situation that brands and products cannot avoid. For brands, the more serious the market homogeneity, the more intense the competition. Therefore, if they want to win in the competition among brands in the mass market, they must start from theingredients, technology, and R&Dlevels to create the brand's differentiated advantages, so as to ensure that the brand will not be drowned in the "vast ocean" of homogeneity.

High return on investment and error tolerance,

Beginner KOLs become the first choice for cleansing brands

According to industry data, the number of daily active users of Xiaohongshu has exceeded 100 million, making Xiaohongshu a "Baidu Encyclopedia" for a large number of people. Under this circumstance, cleansing brands arepenetrating into the Xiaohongshu Community through text, images, and video formats. According to data integration from user feedback, the KOLs that cleansing brands mainly cooperate with on Xiaohongshu are beginner KOLs and mid-tier KOLs, with a combined share of over 90%.

Taking Banmu Huatian as an example, the brand's cooperation with beginner KOLs accounts for 92.6%, with an ROI as high as 41.13. That is to say,Banmu Huatian has maximized its income with relatively low cooperation costs, and the overall return on investment is high.For most cleansing brands, choosing mid-tier and beginner KOLs offers high returns and high error tolerance, making it easier to achieve widespread product exposure, resonate with consumers, and achieve the expected effects of their investment.

Furui Manpu's Douyin live streaming accounts for 96%,

Product card live streaming may become a new hotspot

From the perspective of Douyin, the current main ways for cleansing brands to conduct live streaming on Douyin arelive streaming, video, and product cards. Among them, Furui Manpu mainly relies on live streaming to carry out market layout on Douyin, and the brand's live streaming sales account for as high as96.1%。

In addition, user feedback shows that the sales of product cards for many brands have exceeded the sales of videos. As a card that displays product information in a shelf scenario, product cards allow merchants to directly expose their products after publishing product cards fromDouyin Mall, shop windows, and Douyin search pagesetc., achieving higher conversion rates and monetization rates. In the future, product card sales are expected to exceed the original video sales, becoming a popular live streaming method on Douyin for both brands and consumers.

In terms of the number of brand-affiliated KOLs on Douyin, Jiao Runquan has the most advertising, followed by brands such as Banmu Huatian and C-ka. A common characteristic of these brands is that their number of video KOLs exceeds their number of livestreaming KOLs. Clearly, for cleansing brands,brand-owned livestreaming has become a trendandbrand collaborations with KOLs are increasingly video-orientedto better achieve synergy between product and effect.

Female cleanser users are the mainstream

Fragrant cleanser concepts attract attention

Female users account for 95%,

Male users prefer cleansing milk

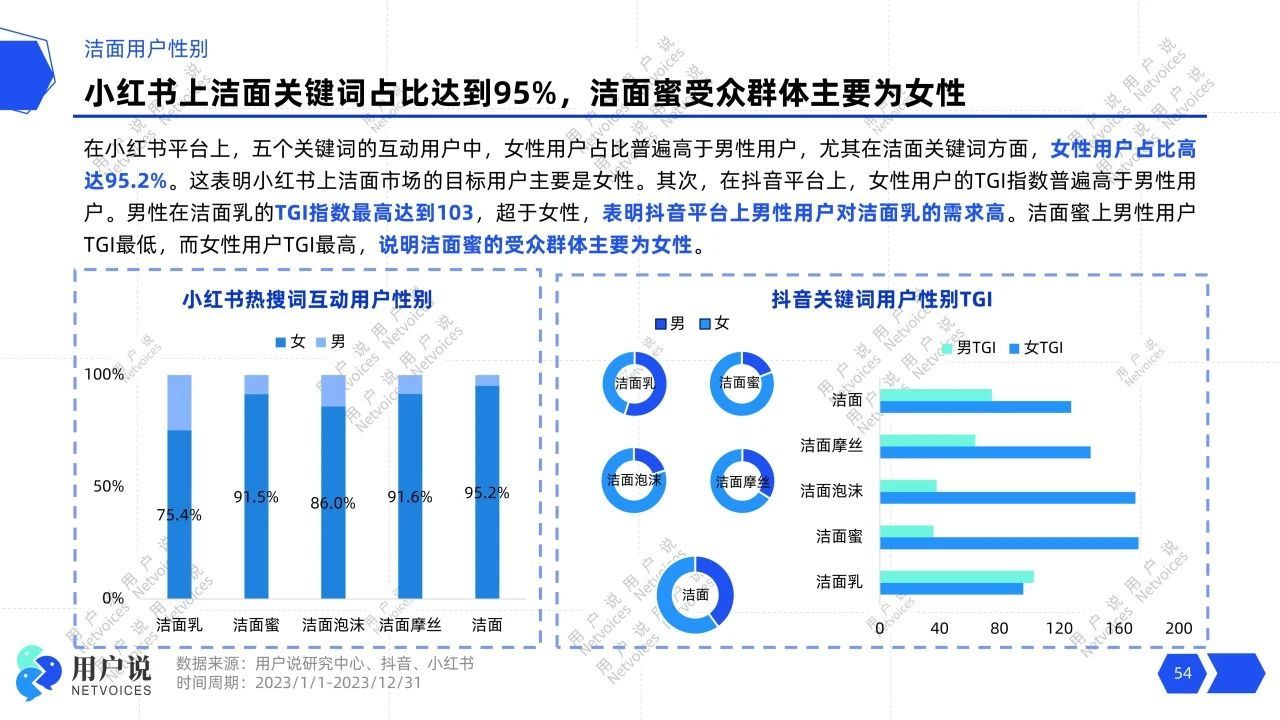

On the Xiaohongshu platform, female users account for a staggering95.2%of searches for cleanser keywords. The female user percentage is higher than male users for other sub-category keywords. The gender gap is smallest for cleansing milk, with men accounting for 24.6%. This indicates that the target user group for the Xiaohongshu cleanser market is women, whilemen show greater attention and consumer enthusiasm for this sub-category of cleansing milk.

This pattern also applies to the Douyin platform. In the Douyin cleanser market,the TGI index for female users is generally higher than that for male usersandMen's TGI index for cleansing milk surpasses that of women, reaching 103. Because cleansing milk has rich foam, strong cleaning ability, and a refreshing, non-greasy texture, and is the most conventional and traditional type of cleanser, it naturally becomes the preferred choice for male consumers.

High attention to efficacy dimensions,

Demand for scent increased by 46.4%

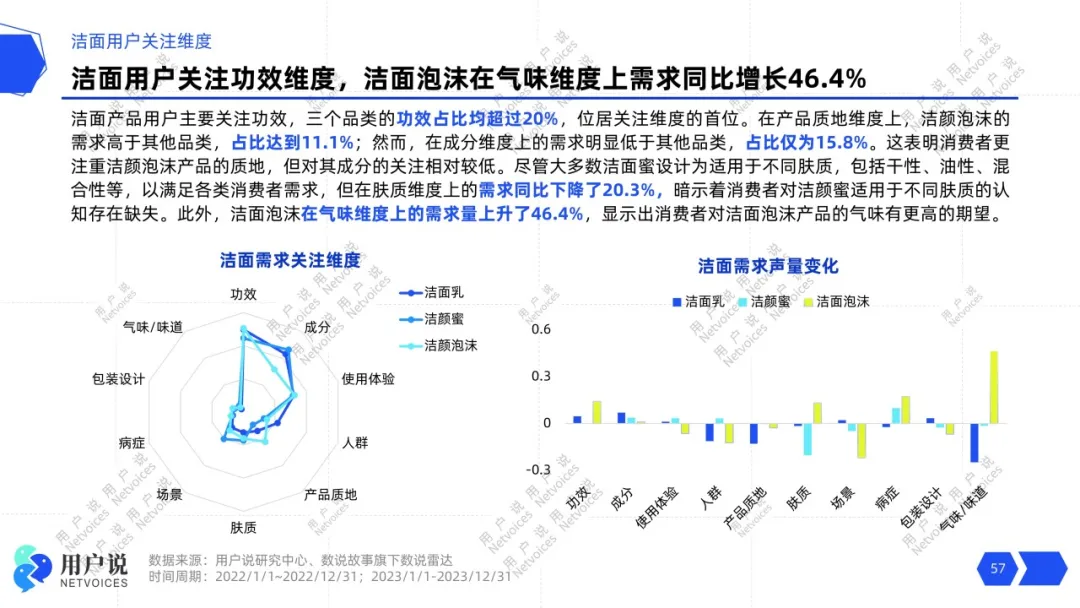

Consumer demand for cleansing products mainly focuses on efficacy, ingredients, and user experience. Efficacy accounts for over 20%, ranking first in terms of attention. Taking cleansing foam as an example, theefficacy, skin type, diseases, scent/flavordemand volume has increased year-on-year, with the scent dimension increasing by 46.4%. This means that consumers pay more attention to the scent of cleansing foam when choosing it and have higher expectations for the product's scent.

Currently,the olfactory economy is booming, and consumers are willing to pay for scents, including cleansing products.Users have found that many cleanser brands are introducing the concept of fragrant cleansers,organically combining fragrance with cleansing to create an emotional cleansing experience.For example, the aromatherapy brand Zhuben adds schisandra berry essential oil, honeysuckle essential oil, and grapefruit essential oil to its essential oil cleansing milk, allowing users to immerse themselves in a refreshing and pleasant citrus fragrance while cleansing their skin, enjoying a moment of tranquility, and turning cleansing into a calming experience.

The popularity of skin microbiome care is rising

Prebiotic cleansers may be the next trend

According to industry data, the global prebiotic market reached $5.4 billion in 2022, and the projected compound annual growth rate from 2022 to 2030 will beas high as 10.6%. Prebiotics, as organic substances that selectively promote the metabolism and reproduction of beneficial bacteria in the body, can effectively improve the diversity of skin flora, maintain the balance of the skin microbiome, reduce the proliferation and growth of harmful bacteria, enhance skin barrier function, and achieve anti-inflammatory and soothing effects. Popular products such as Mi Bei'er powder water and Lancome Little Black Bottle contain prebiotic ingredients.

As people's attention to skin microbiome balance continues to rise, the popularity of prebiotic ingredients in the cleanser market is also increasing.Many brands are using prebiotics as a starting point to enter the microbiome-focused skincare market.Taking AOSO's amino acid balancing cleansing cream as an example, AOSO uses inulin and α-glucan oligosaccharide, two natural prebiotic ingredients, to regulate the balance of facial flora. It also combines triple amino acids and six plant extracts for deep cleansing of surface oils to achieve water-oil balance. The brand usesflora balance + water-oil balanceformula to achieve skin microbiome balance.

Cleansing has always been an indispensable part of skincare routines. To meet consumers' core cleansing needs, cleanser brands remain committed to gentle cleansing as their main focus and scientific cleansing as their foundation. They cultivate popular products to provide consumers with gentle, safe, and comfortable cleansing products. User said“2024 Online Cleanser Product Consumption Trend Insight Report”will also conduct an in-depth analysis of mainstream cleanser brands including Defei, Banmu Huatian, Zhuben, Qiechu, Hongzhi, C-ka, and Jiao Runquan.

The cleanser market never lacks entrants or strong players. How to discover new hot spots and highlights in a saturated market and stimulate consumer desire is a question that all cleanser players need to consider. We hope that with the industry's promotion and brand innovation, the cleanser market will remain vibrant and prosperous.