Essence oil exceeds 3.6 billion! A 121% increase on Douyin? PMPM and LAN dominate? | 2023 Essence Oil Report

Category:

Keyword

language analysis information

Weight

Stock surplus

10000

隐藏域元素占位

- 详情概述

-

- Commodity name: Essence oil exceeds 3.6 billion! A 121% increase on Douyin? PMPM and LAN dominate? | 2023 Essence Oil Report

Overview

Total Word Count:5281words

Reading Time:5-8minutes

1.The overall volume of essential oils is far less than that of liquid serums, but its growth rate is significant, and it is expected to become a core category that rivals liquid serums.

2.50-100yuan and300yuan and aboveThe sales share of essential oils is showing positive growth.

3.2023.10MATDouyin Essential Oil CategoryGMVOver25100 million yuanDouyin has become the main battlefield for online sales of essential oils.

4.Dongbianye Beast Ganoderma Lucidum Essential Oil regular packaging price per milliliter is as high as31.2yuanThe price surpasses overseas Brands such as Clarins and Elizabeth Arden.

5.Supermolecular array penetration technology, sebum bionic technology and other penetration enhancing technologies help empower the efficacy of essential oil products.

6.Consumers' preferred essential oil ingredients arerose, herbal and camelliaAmong them, the demand for camellia has increased significantly.

Will the days of fearing oil be over?

Autumn is deepening, winter is approaching, and the cold is intensifying. As a high-frequency term in autumn and winter, the wave of oil-based skin care is coming as scheduled. With the continuous increase of consumers' attention and consumption enthusiasm for oil-based skin care, the track has now expanded toFacial essential oils, body essential oils, scalp care oils, bath oils, makeup remover oilsand other various oil categories. Facial essential oils, as the core oil-based skincare product, have gradually transitioned from niche to mainstream.

In recent years, whether it is first-line Brands or niche domestic products, they have all chosen to focus on facial essential oils.Taking domestic products as an example, in December 2022, the domestic giant Proya launched a sincere work that took two years to create—“Qishi Nourishing Essential Oil”to increase investment in the anti-aging track; Foerda's brand, Aier Boshi, chose to focus on night-owl skin, using its self-developed simulated regenerative skincare technology to launch an anti-oxidation new product——“Finely researched double extract rejuvenating essential oil”Niche domestic product March Lizhe seized the ingredient bonus of bakuchiol and launched the first domestic facial essential oil containing2% bakuchiol—“Taodundun Time Oil”。

It is not difficult to see that facial essential oil, asthe “biggest beneficiary” under the concept of “oil-based skin care”, is currently rapidly occupying a significant share of the beauty consumption market. In order to further understand the continuously high-growth facial essential oil market, Usersay launched《2023 Online Facial Essential Oil Consumption Trend Insight》report, analyzing the development and growth points of the current facial essential oil market from multiple dimensions such as market data, Brand analysis, marketing investment, user insights, and trend hotspots. By excavating the development potential points in the facial essential oil market, it provides more inspiration and ideas for category entrants.

Full Report89pages

Original Price¥899

(Contact customer service at the end of the article to receive coupons)

Year-on-Year Increase35%?

“Oil-based skincare” stimulates the vitality of the essential oil market

Data is a mirror of the market and one of the driving forces of market development.

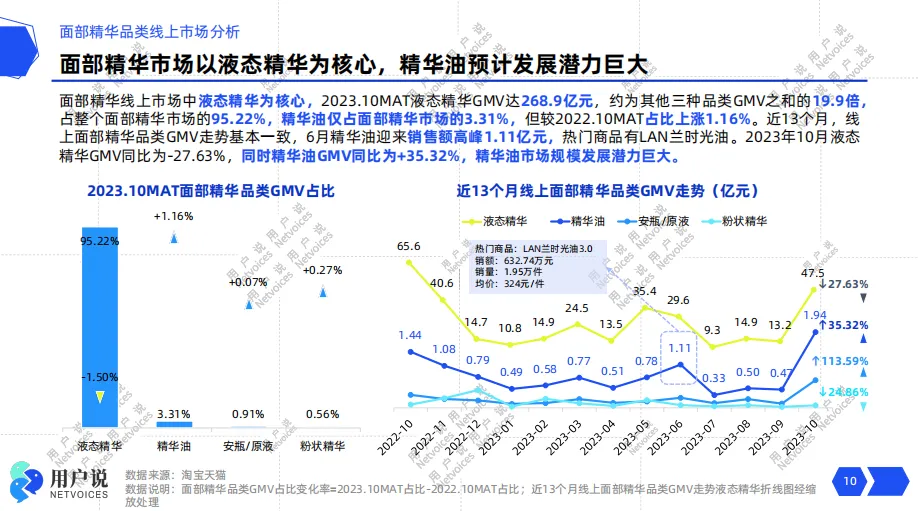

According to Usersay data monitoring,In 2023.10MAT, Taobao Tmall essential oil sales accounted for only3.31%of the facial essence market, but it increased by2022.10MAT increased by1.16%In addition, with the help of major promotions,In October, the year-on-year increase in essential oil GMV exceeded35.32%Meanwhile, the year-on-year decline in liquid serum GMV was27.63%. On the Douyin platform, the year-on-year increase in essential oil GMV in the past 11 months even reached121%It can be seen that essential oils, as a high-growth category, although their current overall volume is far less than that of liquid serums, their growth rate is significant, and they are expected to rise rapidly in the future, seize market share, and become a core category that rivals liquid serums.

In addition, according to Usersay《2023 Essential Oil Consumer Demand Questionnaire Survey》results show that the proportion of consumers who use essential oil products almost every day throughout the year is as high as16.6%In other words, essential oil products have already accumulated a certain user base. Under the impetus of the“oil-based skin care” environment, the essential oil market may unleash greater potential and vitality.

01

User said

300Demand for high-end essential oils (above a certain price) is expanding,

Is the essential oil market trending toward high-end products?

This yearIn September, Daisy's Sky launched a new anti-wrinkle essential oil, "White Sandalwood Ruyue," inspired by the natural anti-wrinkle power of East Indian sandalwood and Chinese ganoderma. The 30ml bottle is priced at 608 yuan, a high price comparable to leading international brands. In addition, the prices of essential oils from domestic brands such as Proya, PMPM, and Lin Qingxuan are allOver400 yuanor more, and the entire essential oil market continues torelease signals of high-end developmentBut will consumers be willing to pay for high-priced essential oils??

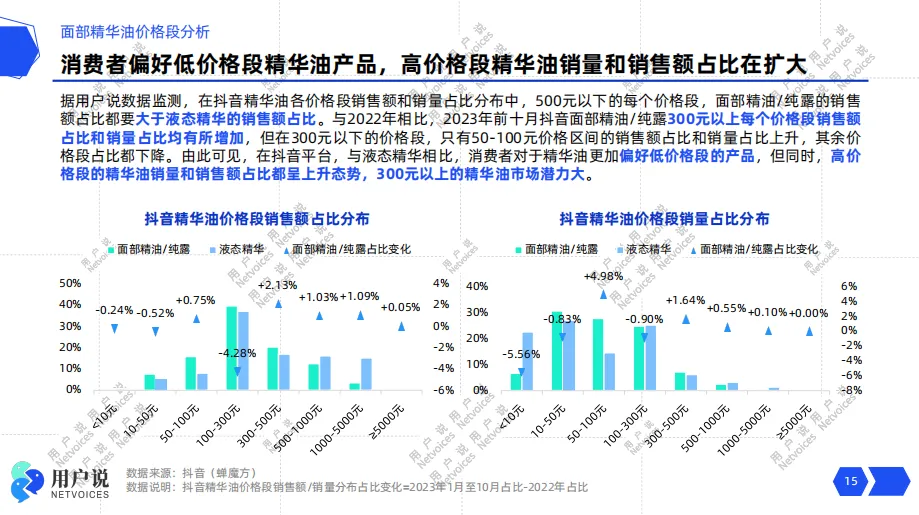

According to User Said data monitoring,From January to October 2023, the sales of essential oils in different price ranges on the Douyin platform were relatively dispersed. Among them,100-300 yuanrange essential oils were the best-selling, accounting for39.64%of the market share. Although it has the highest market share, the year-on-year decline in sales is particularly significant. On the contrary,the sales share of essential oils priced between 50-100 yuan and over 300 yuan showed positive growth.

It can be seen that although mid-range essential oils still control the absolute advantage, their dominant position is not consolidated,consumer preferences are beginning to tilt towards the low-end and high-end extremesIt is worth noting thatin each price segment below 500 yuan, the sales share of essential oils is greater than that of liquid serums. This shows that compared with liquid serums, essential oils within the 500 yuan price range are more attractive to the market and better meet consumer shopping needs.

In addition,in each price segment above 300 yuan, essential oils have shown an upward trend in both sales and volume year-on-year. This shows thatconsumers' acceptance of high-end essential oils is gradually increasingAccording to User Said research data, essential oil users' budgets are mainly concentrated in the100-400 yuanrange. In addition,22% of essential oil users are willing to purchase essential oil products above 600 yuan.

Looking at the best-selling essential oil products on the market, User Said found that the price of essential oil perml can reach as high as230 yuan/ml(La Prairie Caviar Night Essence Oil), while the lowest is3 yuan/ml(Ziben Shu Yan Essential Oil). That is to say, in the entire essential oil market, due to the different target customer groups, the prices of essential oil products from different brands vary greatly, which to some extent provides consumers with more consumption options. With the continuous advancement of consumption concepts, in the future, high-priced essential oil products are expected to become the backbone of the entire essential oil market.

02

User said

Voice Increase227%,

Douyin Becomes the Main Battlefield for Essential Oil Topics?

Douyin e-commerceThe transaction volume of goods from January to October 2023 was nearly 2 trillion yuan, with a year-on-year growth rate of nearly 60%.

In the era of live e-commerce, Douyin has rapidly risen to prominence with its refined track operation, high-quality content support policies, and official matching of high-quality goods. It has become an e-commerce platform comparable to Alibaba and JD.com. Currently,Douyin has become a new main battlefield for category share competition.。

According to User Said data monitoring,2023.10 MAT Alibaba essential oil category GMV was935 million yuanwhile the Douyin platform was2.5 to 5 billion yuanThe combined total of both platforms isGMVOver3.6 billion yuanAmong them, Douyin essential oilGMV accounts for13.71%of the total sales of facial essences on Douyin, while Alibaba's essential oil accounts for only3.31%It is sufficient to show that Douyin has become the core platform for online sales of essential oils.

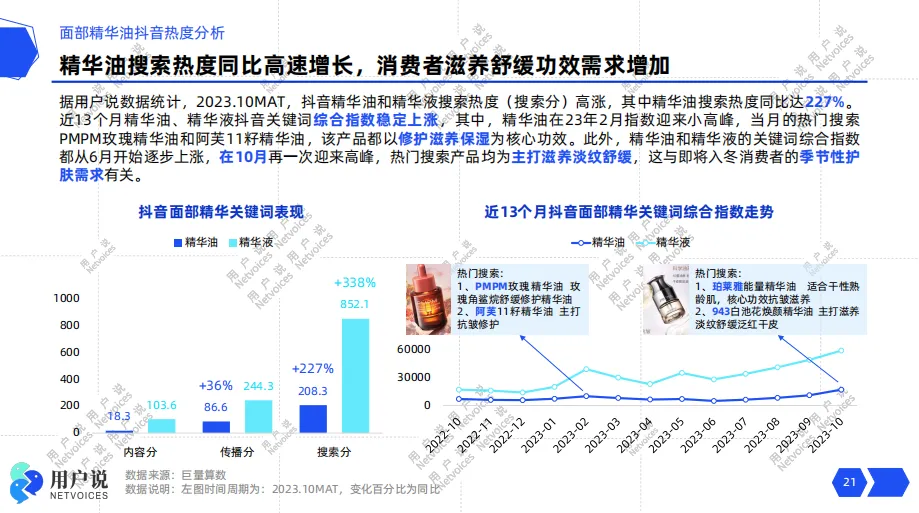

In most cases, sales and voice are complementary. Therefore, while sales are soaring, the increase in the voice of essential oils on the Douyin platform is also noteworthy. According to data tracking,2023.10 MAT Douyin essential oil search popularity increased year-on-year by227%The comprehensive index of Douyin keywords has steadily increased, withsmall peaks in February and October, and popular essential oil products from brands such as PMPM, Proya, and Afu contributed to the popularity.

User Said found that essential oil search keywords are bundled with efficacy keywords such as nourishment, wrinkle reduction, and soothing. Among them, moisturizing and nourishing, as the primary efficacy requirement of essential oil users, is more prominent in autumn and winter. As we all know, in autumn and winter, the skin is often in a state of water shortage, and the sebaceous glands secrete less oil. The greatest significance of essential oil "oil-based skin care" lies insupplementing skin lipids and helping the skin surface form an oil film to lock in moistureTherefore, driven by seasonal skin care needs in autumn and winter, the demand for moisturizing and nourishing functions has also increased significantly.

Essential Oils Enter the Era of Involutive Competition

Domestic Brands Rise to the Top with Explosive Products

01

User said

Domestic brands contribute the main share,

PMPMDouyin Essence OilTOP1

The facial essence market has always been the main battlefield for the competition of leading brands. According to user data integration, in the past13 months, among the top ten brands of facial essence GMV in the Taobao Tmall market, Proya ranked first with2.602 billion yuanin transaction volume, while Kuadi squeezed into the top ten with893 million yuanachieving a market share of11.17%。

On the other hand, in the essence oil market, domestic brands have a strong reversal trend. Data shows that the sales of essence oilTOP 5 brands are all domestic brands, among which LAN and Lin Qingxuan contributed GMVover 100 millionIn addition,CR5 exceeded 50%, contributing nearly 473 million yuan in achievements. Compared with the entire facial essence market, domestic brands have performed more prominently in the essence oil segment, and have basically controlled the situation, and are expected to dominate the entire essence oil market in the future.

In addition to the Alibaba platform, as mentioned earlier, Douyin has become the main battlefield for essence oil products. User data tracking has found thatFrom January to November 2023, the top 10 brands of Douyin essence oil sales and the top 4 brands in sales volume are all domestic brands. Among them, PMPM's achievements are100 million to 250 million,GMV market share reached8.48%,Sales reached500,000 to 750,000achievingDouyin platform essence oil sales volume and sales double first。

As a young brand established less than four years ago, PMPM uses facial essence and lotion as its core product categories. Rose squalane essence oil, as PMPM's explosive product,during Double Eleven, won the top three rankings of Tmall essence oil praise list, hot selling list, and hot sales listTOP1。

However, it is worth noting thatPMPM essence oil's performance on Alibaba platform and Douyin platform is inconsistent. In the past 13 months, PMPM's Taobao Tmall essence oil sales were only53 millionwith a total of223,800 single products sold. However, on the Douyin platform, PMPM essence oil category's GMV in the past 11 months has exceeded200 millionamong whichOctober 2023 alone achieved37.28 millionin achievements.

Recently,PMPM won the "Douin the top 100 beauty products gold list" self-care skincare 2023 gold list productThe "Douin the top 100 beauty products gold list", as Douyin's official list, uses the most direct and transparent data to show consumers' satisfaction with product effects, experience, and emotional needs. PMPM essence oil's listing this time also reflects to some extent that the product isreputation, quality, and voice have achieved certain resultsIt is reported that。

PMPM will usehigh trafficKOL live streaming combined withself-live streamingand has now formed a high-frequency, long-term normalized live streaming system. It can be predicted that in the futurePMPM will continue to exert its efforts in the Douyin essence oil track to consolidate its top position in the Douyin essence oil market.High-speed growth in sales of multiple brands,

02

User said

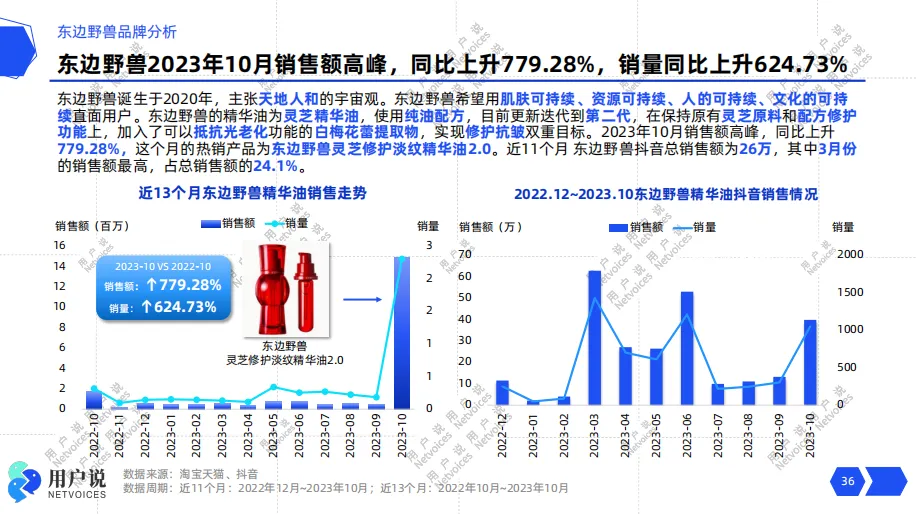

Dongbianye Shou also increased

In order to explore the779%

potential brands in the essence oil market, user data tracking has found that in October 2023, the year-on-year growth of sales of several essence oil brands on the Alibaba platform was astonishing. Dongbianye Shou, PMPM, and Afu's sales increased by more than 300% year-on-year, among which Dongbianye Shou's sales increased dramatically by779.28%The growth momentum is quite optimistic.and

LikePMPM, Dongbianye Shou was established in 2020. It is a sustainable beauty and lifestyle brand that uses oriental herbs as its main raw materials. It is committed to combining oriental classic pharmacology with modern biopharmaceutical concepts in a modern way to unleash the dual value of oriental herbal medicine's efficacy and aesthetics. Currently, Dongbianye Shou has covered multiple categories such as essence oil, face cream, cleansing honey, and hand cream.

Unlike ordinary essence oils, Dongbianye Shou specializes in unique plant-extracted essence oils and has become a representative brand of Ganoderma lucidum essence oil. Ganoderma lucidum essence oil, as Dongbianye Shou's major single product, has been updated to the second generation. While maintaining the original Ganoderma lucidum raw materials and formula repair functions, it has addedwhite plum blossom bud extractThe brand usessuperfluid high-pressure cell-breaking extraction technologySABEXGanoderma lucidum cell oil and white plum blossoms are extracted using a low-temperature, high-pressure method without harmful solvents, effectively regulating the skin's immune barrier and inhibiting inflammation. This achieves multi-dimensional goals, including wrinkle reduction, photodamage repair, redness reduction, and barrier repair.

It is worth noting that the regular version of this best-selling essence oil from Dongbianye shou is priced at15ml/468 yuan, with a unit price of 31.2 yuan per milliliter, surpassing brands like Clarins and Elizabeth Arden. This shows that low price is no longer the inherent label of domestic products; expensive but effective domestic products may become a new path to success.

Understanding User Needs

Innovative Technology Empowers Product Updates and Iteration

01

User said

Penetration-enhancing technology empowers product efficacy,

Refining products to seize market share

In 1983, Peter Elias first proposed the stratum corneum brick wall structure theory in the SCI journal. That is, the skin's natural barrier consists of a "brick wall structure" composed of corneocytes and the lipids and natural moisturizing factors between the cells. Oil-based skin care uses oils to mimic skin barrier components to promote penetration, replenish skin fatty acids, enhance skin's water retention and moisturizing, and further strengthen the stability of the "brick wall structure." This is inseparable frompenetration-enhancing technologysupport.

With the continuous attention of the market and consumers to the essence oil market, the current biological technology of essence oils on the market has become increasingly mature through marketrefinement, includingsupramolecular array penetration technology, microcapsule technology, and sebum biomimetic technology,etc. Microcapsule technology refers to the technology of encapsulating solid or liquid substances into microcapsules using natural or polymer materials. It uses unstable and easily inactivated active ingredients to extend the shelf life and reduce the addition of preservatives in the formula. At the same time, as a carrier that promotes absorption, microcapsules can further maintain the freshness and activity of oil-soluble ingredients and promote skin absorption.

Many popular essence oil products currently available, such asJapaneseepisteme Yuanbi Zhi essence oil, Lin Qingxuan Camellia bursting pearl essence oil, LAN LAN Time bubble essence oil,etc., all use microcapsule technology for deep penetration and effective freshness retention. TakingEpisteme's essence oil small p bottle as an example, this product uses 120 years of professional microcapsule technology from Rohto Pharmaceutical Co., Ltd. in Japan to maximize the activity of fibroblasts and improve elasticity from the base.

Smallp bottle usesPQQ encapsulation technology with pure oil baseto enable high-activity, unstablePQQ to penetrate deep into the skin stably, promoting the absorption and penetration of subsequent skin care products, effectively targeting aging problems such as glycation, photoaging, oxidation, and natural aging.

In addition to microcapsule technology, biomimetic technology is also expected to become the next hot spot in the essence oil market. For example, Lin Qingxuan's camellia essence oil uses sebum biomimetic technology to further amplifyskin-friendly, easy to penetrate, easy to absorbadvantages. Guy's snow velvet truffle essence oil usesthree biomimetic sebum elements to replenish human sebum-like components and accelerate the repair of barrier defects. In addition, brands such as L'Oreal, Clarins, and Filorga have also adopted the structure mimicking biological organisms in their essence oil products to achieve skin anti-aging, firming, and repair effects.

The development of biotechnology is often an important indicator of industry trends. For essence oil products, products are still in a process of continuous updating and innovation, and consumers and products are also in arunning-in phase. Continuous polishing of R&D technology is expected to inject continuous driving force into the essence oil market and drive the development of the category.

02

User said

Targeting oily skin groups,

Specialized research on water-oil two-phase

“The structure of human skin is lipophilic, and oily components are more easily accepted by the skin than water-based components.”

In order to break the inertia of consumers' thinking that "oily skin cannot use essence oil," most essence oils are now increasingly becoming water-oil two-phase and water-oil replenishing. The oily feeling hasbeen significantly reduced, allowing oily skin to use essence oil products without burden. Currently popular essence oils usually use a dual-chamber design and focus the water-oil ratio on2:1, 4:1and other golden ratios. For example, Clarins' Double Serum uses a unique double-tube design to control the water-oil ratio at the golden ratio of2:1, effectively locking in the freshness of plant extracts while amplifying the efficacy of the ingredients; Freeplus uses a precise 8:2 water-oil formula to build a skin source sebum film, achieving the core efficacy of homologous repair and two-way nourishment.

It can be seen that although products use different water-oil ratios, their goals are consistent, that is, to create a moisturizing but not greasy, refreshing and easily absorbed skin feel, constantly improving users' experience using essence oils, and continuously expanding the consumer group.

Younger Target Users

Essence Oil Market Bursts with Demand

01

User said

Users are becoming increasingly younger,

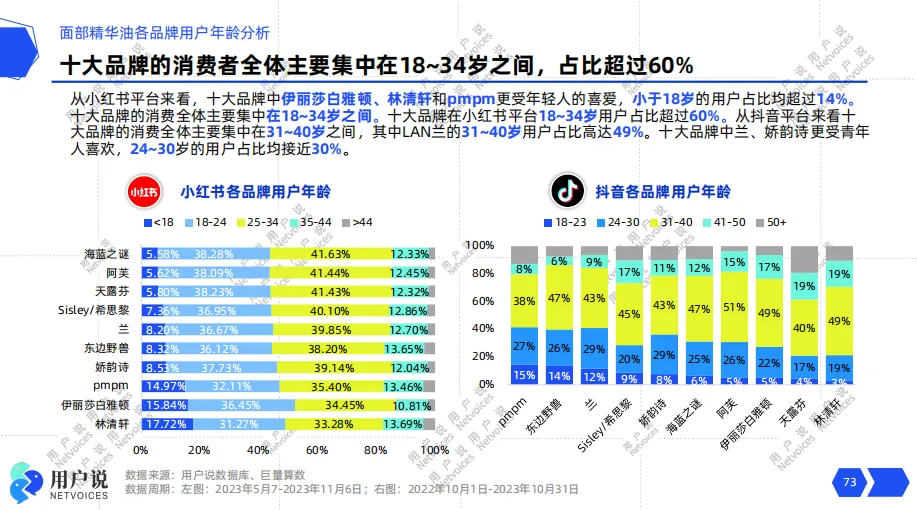

18-34years old are the main consumer group

Under the general environment of anti-aging users becoming younger, the essence oil market is no exception. From the Xiaohongshu platform, users of many popular brands, such as La Mer, Aofei,PMPM, etc., are mainly concentrated in the age range of18-34 years oldwith a high percentage of80%. Furthermore, data shows that Elizabeth Arden, Lin Qingxuan, and PMPM are more favored by young consumers, with nearly 50% of their users under 24 years old.

Unlike the Xiaohongshu platform, users of essential oils on the Douyin platform are more concentrated inthe 31-40 age group, with the highest proportion reaching 51%. Taking Lin Qingxuan as an example, the Brand's users under 18 years old on the Xiaohongshu platform account for17.72%,Users aged 18-24 account for31.27%,but on the Brand's Douyin platform,users under 18-23 years old only account for3%,It can be seen that the distribution of core user groups for Lin Qingxuan on different platforms is different. While this is related to the platform's attributes, it also fully reflects the large age elasticity and span of essential oil users, and young consumers are expected to become the core potential force in the essential oil market in the future.

02

User said

The demand for anti-aging, anti-wrinkle, and eye wrinkle reduction is increasing,

Camellia essential oil may become a new trend

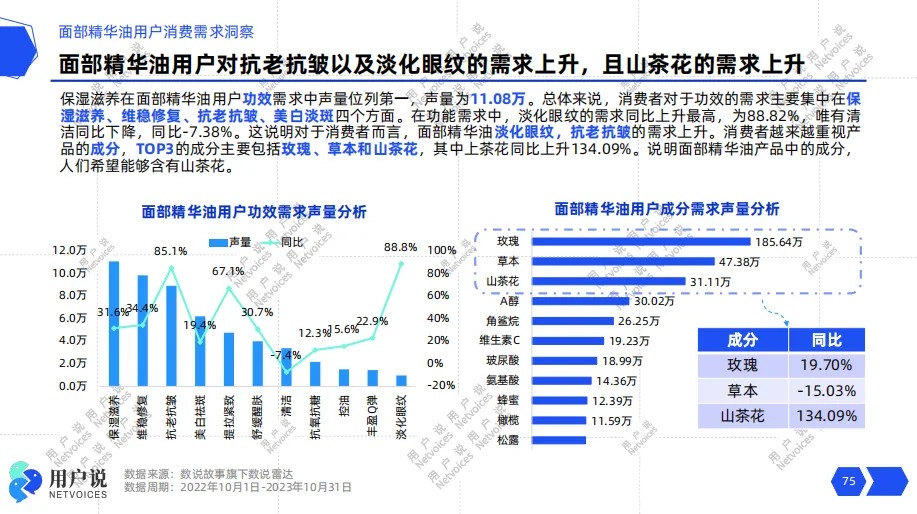

As mentioned earlier, essential oil search keywords are bundled with efficacy hot words such as nourishment, wrinkle reduction, and soothing. According to user data tracking, user needs for essential oils mainly focus on moisturizing and nourishing, stabilizing and repairing, anti-aging and anti-wrinkle, and whitening and lightening. In addition, it is worth noting that although the demand for reducing eye wrinkles is not as high as moisturizing and nourishing10%, its demand has increased by88.8%year-on-year. Obviously, user demand for essential oils is beginning to expand to additional functions such as reducing eye wrinkles. In the future, consumer demand for essential oils will become more refined, scenario-based, and diversified.

In addition to efficacy, ingredients have also become an important factor for consumers to choose essential oils. Data shows thatthe top 3 preferred ingredients for essential oils among consumers in 2023.10MAT arerose, herbal and camellia,among which camellia oil has increased by more than134.09%year-on-year, with a significant increase in demand.

At present, a number of essential oil best-selling products with camellia as the core selling point have emerged on the market, such as Lin Qingxuan's camellia anti-aging essential oil and Ximu Yuan's repairing camellia essential oil. Taking Ximu Yuan as an example, the Brand has established its own camellia planting base, from which it selects high-quality camellia seed oil and extractsCeramideNP,to maximize the strengthening of the barrier structure, repair damaged barriers, soothe sensitive skin, and amplify the efficacy advantages of essential oils.

For a long time, consumers have been trapped in a fixed pattern of fearing oil. With market education and the upgrading of consumption concepts, oil products have begun to transition from niche to mass market, becoming one of the market's focal points. In the future, more Brands are expected to enter the market to share the category cake. The newly launched "User Says" report, "2023 Online Facial Essential Oil Consumption Trend Insight," analyzes the market insights andClarins, La Mer, Elizabeth Arden, Sisley, Tianlufen, Lin Qingxuan,LAN, East Beast, PMPM, and AfuTen Brands' in-depth analysis, essential oil user needs, and other dimensions, summarizing the development trends of the essential oil market and helping Brands upgrade.十个品牌的深度剖析、精华油用户需求等维度,梳理了精华油市场的发展趋势,助力品牌升级。